Medtronic PLC investors have been content with receiving dividends on their holdings for a few years now. The stock has hardly gone anywhere except for a post-covid rally that saw the stock price reach as high as $131. Lately, there has been some renewed optimism in the stock’s performance, fueled by its medium-term growth prospects.

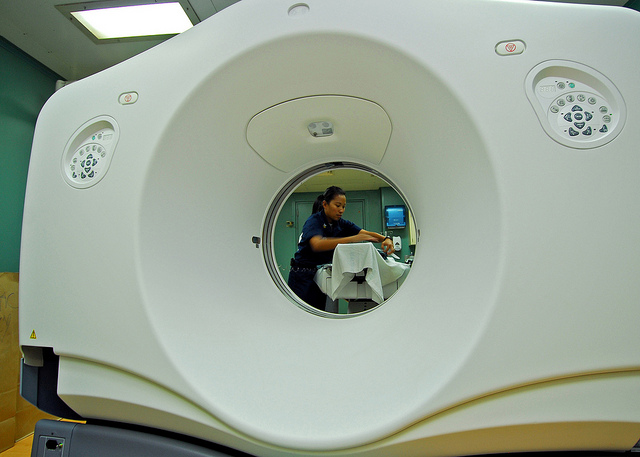

Medtronic (MDT) is a global medical technology leader specializing in designing, developing, and manufacturing medical devices. Founded in 1975 and with operational headquarters in Minneapolis, the company integrates advanced technologies like data analytics and artificial intelligence to improve healthcare for patients with more than 70 health conditions.

The company’s key products include cardiac devices like pacemakers and defibrillators, tools for diabetes management including insulin pumps and continuous glucose monitors, neuromodulation devices for chronic pain and movement disorders, and robotic surgical systems. It also provides biological solutions for the dental market.

The company caters to various end markets in more than 150 countries from Asia, Europe, the Americas, the Middle East, and Africa. It primarily targets patients undergoing treatment for chronic conditions such as heart disease, diabetes, and neurological disorders, while its top clients are hospitals, healthcare providers, and government healthcare programs.

The most recent quarter saw Medtronic increase its total revenue by 5.3% YoY. With its revenue sources spread relatively evenly among the Surgical, Neuroscience, and Cardiovascular segments with a little bit of Diabetes care, the company has achieved this growth across all segments. Moreover, the company generates 48% of its revenue from its international operations.

It was this international operations segment that attracted investor attraction, partly causing its short rally so far. The international business grew at 6.5% while the US portion grew at 4.1%.

What’s even better is that the company didn’t have to sacrifice its margins to achieve this topline growth. Its gross margins grew by 0.3% while the operating margins grew by 0.6% in the most recent quarter. The cost efficiencies have finally resulted in improved profitability, which wasn’t bad at all to begin with.

Investors are bracing for a bull rally as all the pieces start to fall into place. If the next earnings report on the 19th of November confirms the international growth and strong margins, it could spur a new rally. Conservative investors will find their beloved downside safety in the fact that the company is sitting on $7.8 billion in cash and short-term investments. At a 53% payout ratio and 47 consecutive years of dividend raises, there is no question mark on the management’s willingness to keep paying dividends.

Medtronic is not on our latest list of the 31 Most Popular Stocks Among Hedge Funds. As per our database, 52 hedge fund portfolios held MDT at the end of the second quarter which was 54 in the previous quarter. While we acknowledge the potential of MDT as a leading AI investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as MDT but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: $30 Trillion Opportunity: 15 Best Humanoid Robot Stocks to Buy According to Morgan Stanley and Jim Cramer Says NVIDIA ‘Has Become A Wasteland’.

Disclosure: None. This article was originally published at Insider Monkey.