From Matthew Graham at Mortgage News Daily: Mortgage Rates Back to 7%

From Matthew Graham at Mortgage News Daily: Mortgage Rates Back to 7%

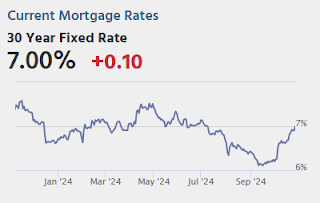

It’s no mystery that mortgage rates have had a terrible October. As of last Friday, the average lender’s top tier 30yr fixed rates were up to 6.90–an increase of more than 0.625% this month. Today’s 0.10% increase brings the rate index up to 7.0% exactly which is the highest we’ve seen since July 10th.

…

This week sees the return of highly relevant economic data with Friday’s jobs report being the most important, by far. Each of the past two jobs reports has had a huge impact on rates due to wide deviations from expectations. If Friday’s report is anywhere nearly as surprising, the impact on rates should play out on a similar scale. [30 year fixed 7.00%]

emphasis added

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for August. The consensus is for the Composite 20 index to be up 6.0% year-over-year.

• Also at 9:00 AM, FHFA House Price Index for August. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Job Openings and Labor Turnover Survey for September from the BLS.

• Also at 10:00 AM, The Q3 Housing Vacancies and Homeownership report from the Census Bureau.