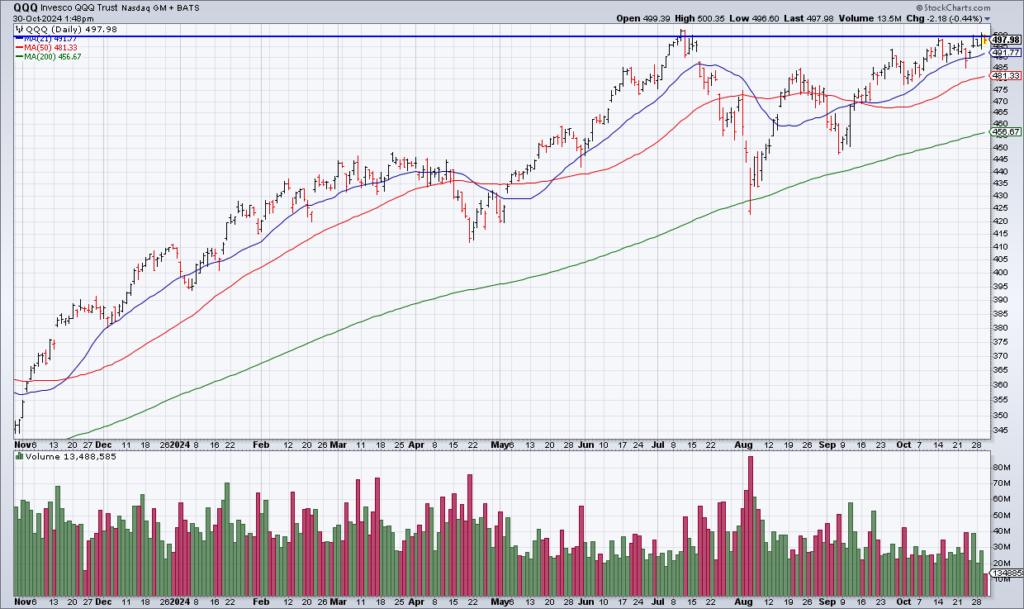

In analyzing the markets we must always keep in mind that the Mag 7 make up approximately 30% of the market capitalization of the S&P 500. As a result, so go the Mag 7, so goes the major market indexes. And the QQQ – which is dominated by the Mag 7 and is the most important ETF in the world – hasn’t been able to get and stay above $500. Unless it can, the market just won’t have the juice to go much higher.

Which makes this week especially important because five of the Mag 7 are reporting earnings. Google (GOOG/GOOGL) reported Tuesday afternoon. Microsoft (MSFT) and Facebook (META) report this afternoon (Wednesday). And Apple (AAPL) and Amazon (AMZN) report Thursday afternoon.

Let’s start with GOOG’s stellar report yesterday (Tuesday) afternoon. I have to say that I was impressed by this report and if I had to be long one Mag 7 stock – which I am not – it would be GOOG. Revenue increased 15% which is fine. But what was truly excellent about the quarter was a 4.5% increase in operating margin to 32.3%. That means that 4.5 cents more out of every dollar went to GOOG’s bottom line compared to a year ago. That’s tight. The result was a 37% increase in EPS. GOOG stock is up 4% today – though it has been fading all day which is worth taking note of. You can see that in today’s candle in the chart above with the stock opening at $182.50, rising even higher in the opening hour, but since losing more than $6.

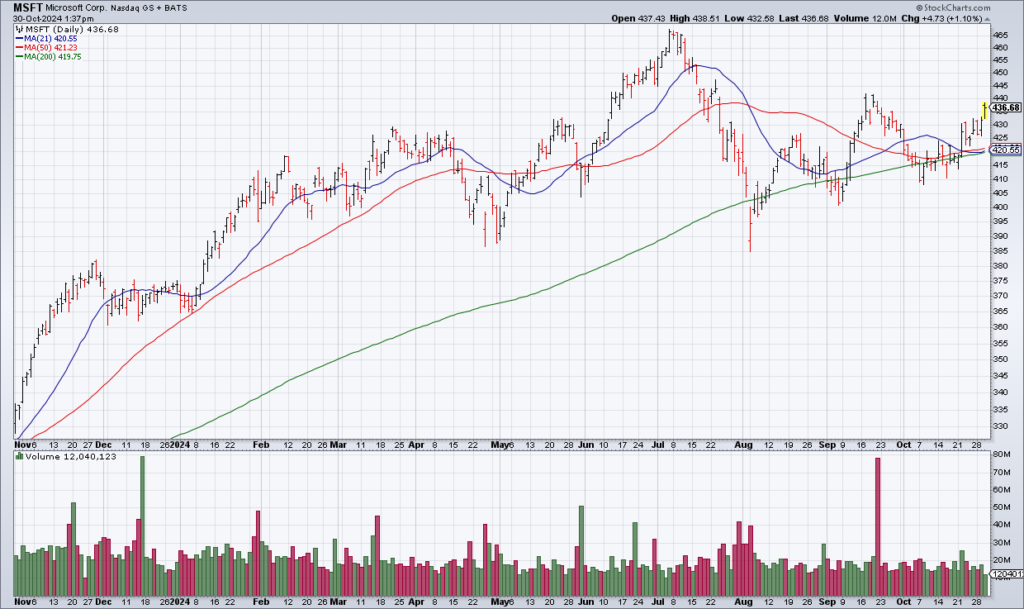

Now let’s turn to Microsoft (MSFT) – one of three $3+ trillion behemoths. I fail to see any reason why the quarter won’t be stellar. The problem is valuation or how much is priced in. MSFT earned $11.80/share in FY24 ended June 30, 2024. Let’s say they earn $13.12 in the current FY25. At its current price of $437, that’s 33x forward earnings. That for a stock with top line growth in the mid-teens. IMO it’s hard to justify a further increase in price without an acceleration in growth – which I don’t see either.

What about Facebook (META)? (I refuse to call it Meta Platforms until the Metaverse starts to meaningfully contribute to its business). Once again, I expect a stellar quarter this afternoon but I wonder how much is already priced in. META earned $9.86/share in the first half of 2024. Let’s say they earn $20/share for the full year. At its current price of just below $600, the stock is trading at nearly 30x current year earnings. META has more growth than MSFT with revenue +25% YTD – but it’s also more cyclical with its dependence on advertising on Facebook and Instagram. It’s hard for me to justify a further increase in price without some unexpected improvement in fundamentals here as well.

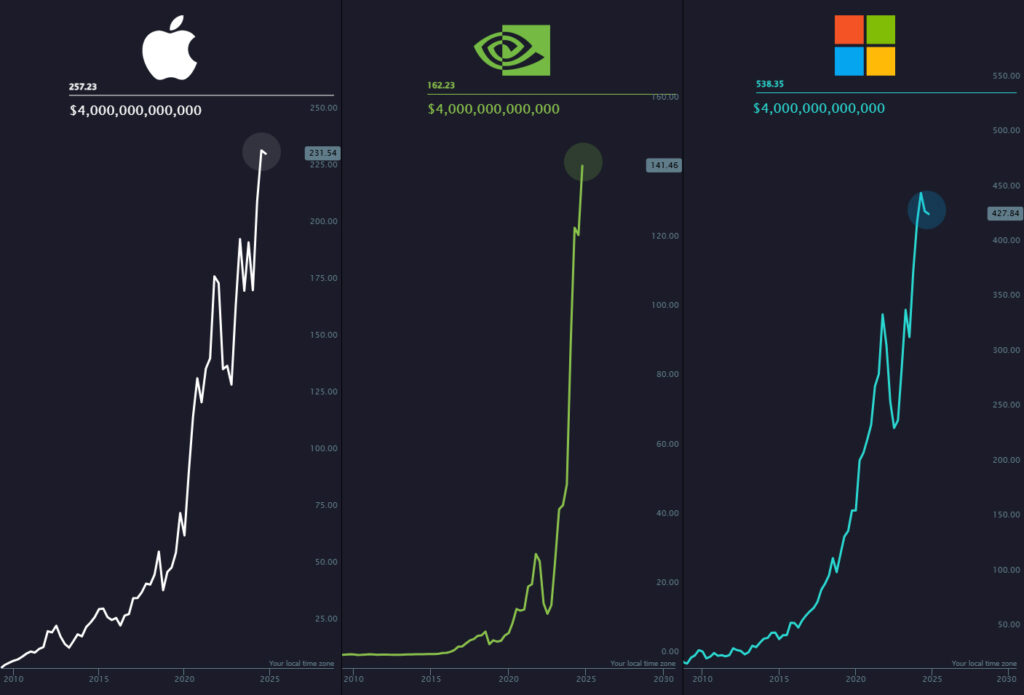

Let me be clear: These are the greatest companies in history. There’s never been anything like these stocks. All you had to do the last 15 years was own them and you would have made a killing. But I suspect we are nearing the end of an epic run. Nothing gold can stay….