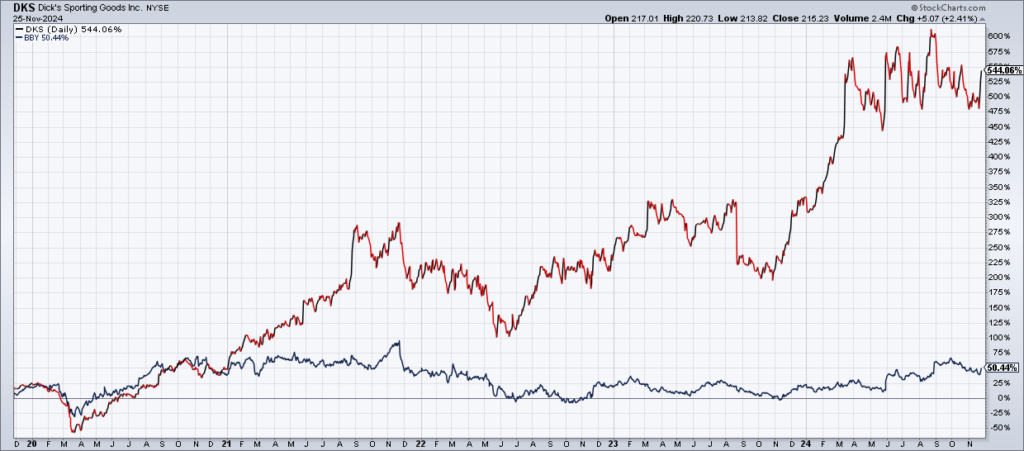

Two well known national chain retailers – Best Buy (BBY) and Dick’s Sporting Goods (DKS) – both reported earnings Tuesday morning. BBY shares are off 7% in reaction to their report while DKS is up 8% in reaction to its – continuing a trend of outperformance for the latter and underperformance for the former over the last five years which can be seen in the chart above.

BBY comps were -2.9% on top of -6.9% a year ago as the leading consumer electronics retailers continues to struggle. I’m not entirely sure what’s going on here but it could be that BBY continues to be Amazon’s storeroom. That is, people figure out what they want to buy at BBY and then buy it on AMZN. BBY had a $20 billion market cap at Monday’s close, trades for 15x current year guidance and pays a 4% dividend. But the stock just isn’t working.

The story at DKS is just the opposite. Comps were 4.2% on top of 1.9% a year ago. DKS had a market cap of $18 billion at Monday’s close, trades at less than 16x current year guidance and pays a 2% dividend. With a return of 550% over the last 5 years, this is a stock worth holding onto if you own it and worth giving a look if you don’t.