Is this a turning point or a dead cat bounce? I’d say it’s signs of positive improvement and I am infinitely more bullish on housing than I was over the last few years, but I still don’t think we’re off to the races here…

More via Zillow:

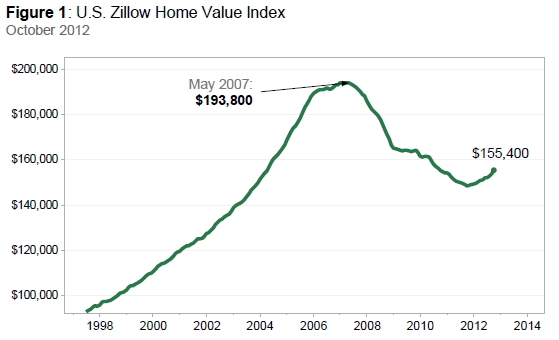

Zillow’s October Real Estate Market Reports, released today, show that national home values rose 1.1% from September to October to $155,400 (Figure 1). This is the largest monthly increase since August 2005 when home values rose 1.2% month-over-month. October 2012 marks the 12th consecutive month of home value appreciation, further evidence of a durable housing market recovery. On a year-over-year basis, home values were up by 4.7% (Figure 2) in October 2012 – a rate of annual appreciation we haven’t seen since September of 2006, before the peak of the housing bubble. Rents declined in October, depreciating by 0.1% from September to October. On an annual basis, rents across the nation were up by 5.4% (Figure 3). The Zillow Home Value Forecast, which is now available on a monthly basis, calls for 1.5% appreciation nationally from October 2012 to October 2013. Most markets have already hit a bottom and 40 out of the 256 markets covered are forecasted to experience home value appreciation of 3% or higher.