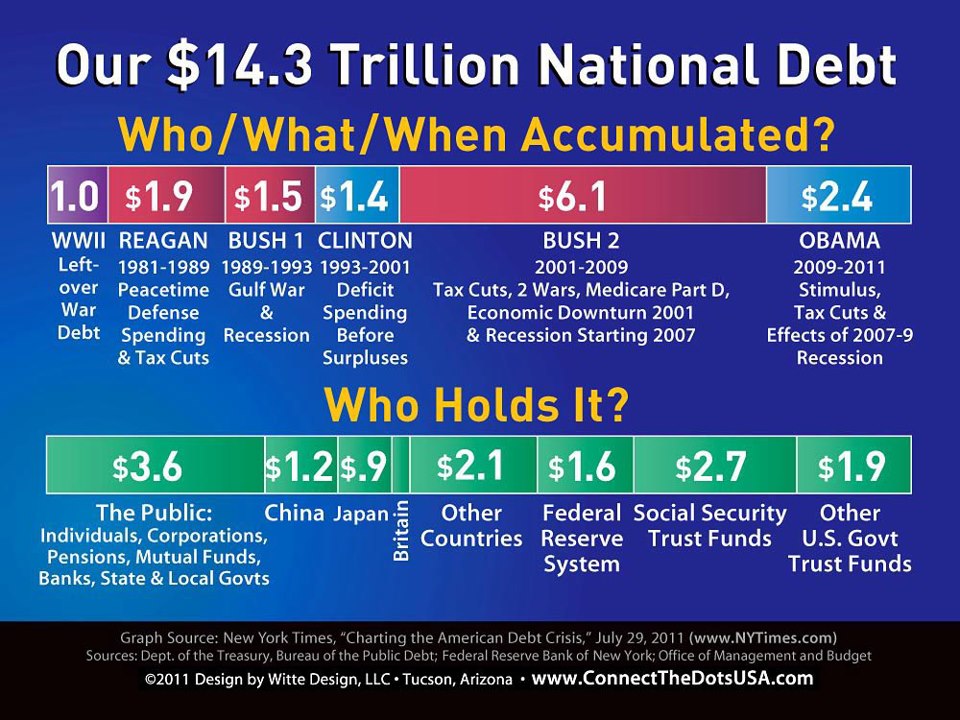

A friend of mine posted this on Facebook:

I started to explain it, but realized that the standard usage is wildly screwy and confusing for any normal human, and decided to explain it here instead.

The problem is that even in standard economists’ usage, “public” is used in two different ways:

1. “Public” debt: debt owed by the government. In this usage, “public” means “government.” It’s sort of metaphorical: the government r us. As in “the public [versus the private] sector.” “Public debt” is often called “gross public debt.” That includes money “owed” to Social Security, etc.

Note that these debts to trust funds don’t in any way represent the liabilities of those programs; they’re pretty much arbitrary numbers, accidents of the moment, bookkeeping artifacts of a political/ideological construct, that are best ignored if true understanding is the goal. “Gross public debt” a.k.a. “public debt” — the $14.3 trillion shown in this graphic — is not an even vaguely useful figure in understanding the fiscal position of the country or the federal government.

2. “Debt held by the public” (not the public as described in this graphic): in this usage, the public is exactly not the government. It refers to debt held by non government — including other governments, and private holders in other countries. This is often called “net public debt.”

Watch: two (contradictory) usages of the same word, in one equation!

Net public [government] debt = debt held by the public [non government]

You can see this if you search for “public debt” on Fred. Or, read this wikipedia graph caption:

Red lines indicate the debt held by the public (net public debt) and black lines indicate the total public debt outstanding (gross public debt), the difference being that the gross debt includes that held by the federal government itself.

It’s no wonder people are confused.

This graphic makes it even more confusing, because “the public” here is the domestic private sector plus state and local governments. And it excludes foreign-held debt, which is included in the normal definition of “debt held by the public.”

This is the fault of the New York Times, which uses the term in the infographic from which this graphic is prepared. Not only they start with the gross figure rather than the more useful net figure, but they use “the public” in a completely idiosyncratic way.

A further complication: in standard usage, “debt held by the public” includes Fed holdings, even though the Fed is part of the government. The interest it is paid (by the Treasury) on government bonds is paid right back to the Treasury. (The presumption is that those bonds will eventually be sold back to the private sector.) This is not usually such a big deal, but these days the Fed is holding 17% of the Debt Held By The Public.

I suggest the word “public” should be eradicated from all these usages, in favor of more descriptive and precise terms. “Public” does nothing but confuse if you don’t know exactly what it means. Instead, say things like:

Net federal debt.

Net federal debt minus Fed holdings.

Federal debt held by the domestic private sector.

Government debt [including state and local]

And etc. The bookkeeping at this high level is not actually very complicated, so hopefully careful usage will help people better understand and discuss fiscal issues.

Cross-posted at Asymptosis.