It has long seemed to me that redistribution is, for some reason, necessary for the emergence, continuance, and growth of large, prosperous, modern, high-productivity monetary economies. No such economy has ever emerged absent large quantities of ongoing redistribution. There are no exceptions; every such economy on earth engages in it on a large scale. The Economist recently devoted a whole special section to the need for Asian countries — notably China — to develop such systems of social redistribution in order to make the move from “developing” to “advanced.”

That’s the big-picture empirics. What I’ve been missing, have been unable to find, and have been struggling to conceive, is a straightforward, intuitively convincing economic model (mathematical or at least arithmetic) to explain this fact theoretically.

Paul Krugman says that thinking in terms of models will make you a better person. I want to be a better person.

I think I may have finally created such a model. (I’m feeling better already.) It’s a very simple dynamic simulation model (set it up, plug in parameters, and watch it run over the years), and it’s purely monetary. It makes no attempt to model the real economy of production and trade in real goods. It makes no distinction between consumption and investment spending; there’s just spending. It doesn’t require a theory of value, or of capital, or of profits. It simply assumes that production and trade happen, and that they yield a surplus. You can imagine that surplus as consisting of new real assets, or being embodied in new financial assets that are representative of those real assets. It doesn’t really matter.

The model is based on one and only one behavioral assumption: declining marginal propensity to spend out of wealth. (Something I fiddled with previously, here.) That in turn is based on the declining marginal utility of consumption (the millionth dollar spent yields less utility than the first). The assumption, which seems safe both empirically and theoretically:

Rich people spend a smaller portion of their wealth each year than poorer people.

In this model each person’s spending is replaced each year by income (with a surplus), but the spending is determined by the person’s wealth. It assumes that people expect the income to replace the spent wealth, but they’re not certain that it will, always. So they (especially those with low income/wealth) are facing a tradeoff between present spending and long-term economic security. Different wealth/income levels have different propensities to substitute one for the other.

This is basically looking at spending and income from the opposite direction of most such models. Here, spending drives aggregate income (all spending is income, when received), rather than spending being determined by income (which is how we tend to think about individuals).

The rest is just arithmetic.

Here’s the basic setup, with a population of 11 people. The spreadsheet is here (Google Doc version here); you can change of the numbers and see the results.

I’m assuming 0% inflation for simplicity.

One person has $1 million.

Ten people have $100K each: $1 million total.

The rich person spends 30% of their wealth annually ($300K to start).

The ten poorer people spend 80% of their wealth annually ($80K each, $800K total, to start).

Through work/production and gains from trade, each person gets 5% more income annually than they spend. I’ve black-boxed that whole surplus-creation process; it just happens. I’ve set it up so that income (including the surplus) is distributed to the population proportionally based on how much they spend. It’s a somewhat arbitrary choice (I had to make some choice), but since people’s incomes and expenditures do tend to correlate fairly closely, it doesn’t seem like a nutty one.

The additional money for this annual +5% would come from new bank lending and/or government deficit spending and/or Fed money printing and/or trade surpluses with other countries. Choose your monetary model/paradigm; in any case the surplus is monetized via trade and the financial system.

So no, Income ≠ Expenditure (or vice versa), unless you include purchases of new financial assets in “Expenditures.” Absent those purchases/receipts, Income is 5% greater than Expenditures. That’s what surplus from production/trade is all about, how it plays out in an economy that includes monetary savings.

Now add this: Some percentage of the rich person’s wealth is transferred to the poorer people every year (by the ebil gubmint man).

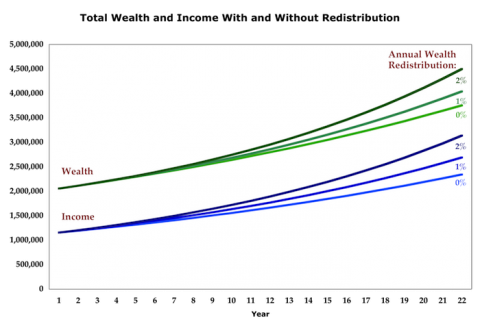

Does that wealth transfer make everyone wealthier, or poorer? Here’s the result with the numbers I set out above:

In this model, taking money from the rich and giving it to the poor make us more prosperous in aggregate, raises all boats, makes the pie bigger…you’ve heard all the metaphors.

Explanation below the fold.

The arithmetic, and the theory, is simple:

The arithmetic, and the theory, is simple:

1. Redistribution results in more spending (because of declining marginal propensity to spend from wealth)

2. More spending spurs more production

3. More production (and trade) produces more surplus

4. Surplus (monetized) is the source of monetary savings

5. Bonus: More savings (wealth) results in more spending. (Note the exponential curves.)

6. Repeat loop.

The result seems to be an apparently counterintuitive, but on consideration very obvious, conclusion:

Saving doesn’t cause saving. Spending causes saving.

The preceding is halfway tongue in cheek. It points out how problematic the word “saving” is in a monetary context. Saving some of this year’s corn crop is straightforward enough — eat less of it. Money makes it into a far more complicated concept, cause you can’t eat money.

I would say instead:

Spending causes accumulation, because it spurs production and trade, resulting in a surplus. That surplus is what allows for accumulation.

So we want more spending, and less so-called “saving.” Some people call it money hoarding, but that’s confusing too. The best synonym for monetary saving is “not spending.”

I’m with Nick: we should stop using the word saving.

More monetary saving by individuals (the word works fine for individuals) — spending a smaller proportion of their wealth on real goods each year — results in less accumulation in aggregate.

Faithful readers will recognize that this purely monetary model sidesteps and obviates the need for the conceptual quagmire associated with S = I = Y – C — a construct which, in its effort to go in the opposite direction from mine and model a barter, real economy devoid of monetary savings, arguably makes it impossible or at least very difficult to think cogently about how monetary economies (i.e. all economies) work.

But how about sharesies? Is it fair? Here’s how it plays out:

| 20 Year Change in Income/Wealth | |||

| Redistribution | Rich Person |

Poorer People | All |

| 0% | 35% | 119% | 96% |

| 1 | 10 | 165 | 123 |

| 1.5 | 0 | 192 | 139 |

| 2 | -10 | 221 | 158 |

At 1.5% redistribution in this model, the rich person’s income, spending, and wealth all stay the same over time (remember: no inflation here), while the poorer people’s income and wealth almost triple, and overall wealth and income more than doubles. Seem fair to you? Pareto devotees please comment.

I know exactly where everyone’s going with this: incentives and behavioral responses. And I have to admit that I did make one other behavioral assumption here: that there are no other behavioral responses.

Giving a bit less money to the rich person will give slightly less incentive to work. But at the same time it’s giving ten poorer people far more incentive to work. You do the math. (This all before we get into issues of substitution vs. income effects at different wealth and income levels, something I won’t even begin to address here.)

Whatever combination of behavioral effects one might posit, I would suggest that the burden of proof lies with the positor to demonstrate, empirically, that those effects are sufficient to overwhelm (or supplement?) the inexorable arithmetic of compounding that’s at play here.

Finally, note that this model doesn’t even touch on aggregate utility delivered under each regime. Since the spending of the poorer people is split among ten — each spending $80K/year to start — a larger proportion of that spending is on necessities like food, clothing, shelter, health care, and education. I think all economists will stipulate to the proposition that those purchases yield higher utility per dollar than a family’s purchase of a third car or a fourth TV. So the graph above greatly understates the higher aggregate utility provided by redistribution, and the table either understates the utility gains by the poorer people, or overstates the gains by the rich one. (It would be easy to add a somewhat arbitrary formula to represent that effect graphically, but I’ll leave it to your imagination.)

And: this utility effect would serve to multiply the incentive for poorer people discussed in the previous paragraph, giving the ten people even more incentive to work.

I’m rather taken with this spending + surplus = income dynamic approach to modeling. (But I would be, wouldn’t I?) I’d be delighted to see how others might analyze and display results using various parameters, and how they might adjust, improve, or dismantle the model. In particular: are there obvious, gaping flaws here?

Cross-posted at Asymptosis.