We have an economy built around what Monetary Realism calls “inside money” or bank money. That is, most of the money in our economy is deposits that exist as a result of bank loans (loans create deposits). So it makes sense that the price of this money can have an enormous influence on the economy. Outside of natural market forces and the demand for credit (which helps banks set the price of loans) the government can influence the cost of this money via monetary policy. This is why the Fed’s operations are often seen as being so important. When the Fed changes interest rates they are essentially changing the spread or the price at which banks can make their loans. The Fed does this using “outside money” (money created outside the private sector) by changing the amount of reserves in the banking system or via alternative policies like QE.

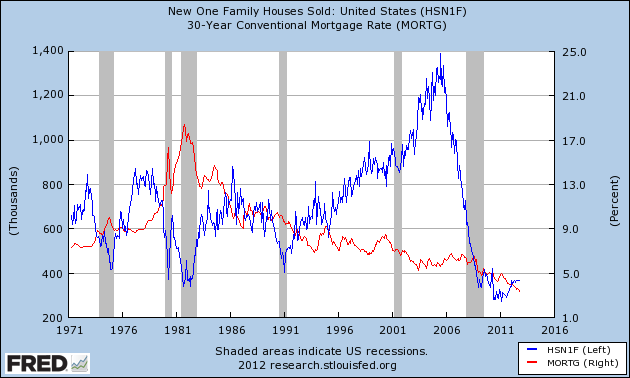

I was rummaging through this morning’s data and noticed the depressed state of new home sales. Now, I know there’s a supposed “housing recovery” going on at present, but the fact of the matter is that the data doesn’t actually support this view at all. If anything, housing is still deeply depressed although it is coming off these very depressed lows.

But the more interesting thing to note is the broken credit transmission mechanism. If you look at the 30 year mortgage rate closely you’ll notice a relatively steady inverse correlation between rates and new home sales. That is, all the way up until about 2007. Then, rates remain low and new home sales stay depressed. The low rate transmission mechanism breaks.

Why does it matter? This is exactly what we’d expect to see given the state of the balance sheet recession. You see, demand for credit is very low because households are still recovering from the implosion in their balance sheets. Instead of taking on more debt, households are paring back debt. This is clear from yesterday’s NY Fed report on household credit trends. And this is why monetary policy has been so broken in recent years. The Fed can’t gain traction because their primary transmission mechanism is busted. And the economy won’t feel quite right until this part of the monetary system starts working normally again….