Warren Buffett has often discussed his two rules of investing. 1) Don’t lose money. 2) Don’t forget rule #1. That seems basic enough, right? Well, it’s often easier said than done…

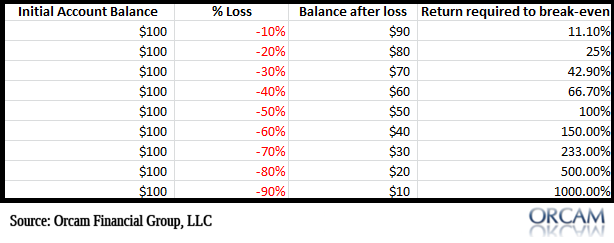

To elaborate on this point, there’s some rather simple and unfortunate arithmetic behind this thinking. See the graphic below for a basic outline of the gains required to overcome investment losses. As you can see, the deeper the losses the less likely you are to recover those losses as they require ever increasing gains just to break-even.

I got to thinking about this as I read this article at CNBC about John Paulson’s Advantage Fund and its -62% return over the last two years. A -62% loss requires a 165% just to break-even.

Good lucking planning for retirement with that kind of volatility in your savings portfolio….