Inventory declines every year in December and January as potential sellers take their homes off the market for the holidays. That is why it helps to look at the year-over-year change in inventory.

According to the deptofnumbers.com for (54 metro areas), overall inventory is down 23.9% year-over-year and probably at the lowest level since the early ’00s.

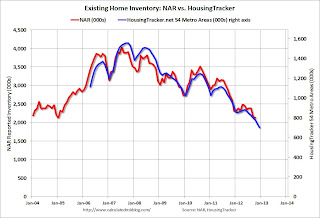

This graph shows the NAR estimate of existing home inventory through October (left axis) and the HousingTracker data for the 54 metro areas through mid-December.

Click on graph for larger image.

Click on graph for larger image.

Since the NAR released their revisions for sales and inventory last year, the NAR and HousingTracker inventory numbers have tracked pretty well.

On a seasonal basis, housing inventory usually bottoms in December and January and then increases through the summer. So inventory will probably decline a little further over the next month before increasing again next year.

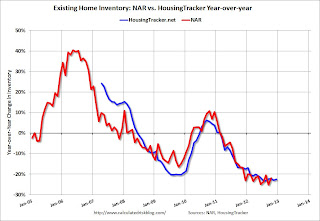

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the mid-December listings, for the 54 metro areas, declined 23.9% from the same period last year.

HousingTracker reported that the mid-December listings, for the 54 metro areas, declined 23.9% from the same period last year.

My guess is inventory will bottom in January (both seasonally and for the current cycle). I think the recent increase in prices will entice a few more people to list their homes (some people will no longer have negative equity too and can finally sell). Also there may be a few more foreclosure listings in some judicial states.

Nick Timiraos at the WSJ writes: 2013: How Rising Prices Could Boost Housing Demand

Rising prices could eventually encourage more sellers to put their homes on the market, which would help boost demand even further. Glenn Kelman, chief executive of Redfin, says he is looking to increase the company’s workforce of 400 agents nationally by 50% by the end of January. “I’m going across the country meeting with managers, and the only topic we’re talking about is hiring,” he said.

At the least the year-over-year declines should still start to get smaller since inventory is already very low. It seems very unlikely we will see 20%+ year-over-year declines next summer!