I’m doing a pre-emptive Q&A this week covering a macro view of 2013. I generally don’t believe in forecasting a full year out because I think it’s impossible, but that doesn’t mean we can’t provide some general guide posts for the year given what we currently know. I usually update these views on a quarterly basis (more frequently through the research with specific market views) so this is probably more like a Q1 outlook with some vague 2013 commentary. And unfortunately, because the fiscal cliff remains unresolved a lot of this is just pure speculation….But I hope this helps frame the big picture for you.

1) What Will Happen With US Fiscal Policy?

With the fiscal cliff still entirely unresolved this one remains a bit hard to decipher. A worst case scenario of $500B+ in cuts to the 2013 budget would drive us down from 2012′s $1.1T budget to something in the $600B range. With a private sector that is still de-leveraging and unable to run with the baton since the damage of the credit crisis has been inflicted this would obviously have very damaging effects on the economy. Recession is a near certainty in a worst case scenario.

The more likely scenario is moderate cuts and another year of economic muddle through as the budget deficit remains large enough to offset a healing private sector.

Downside risk: The obvious risk is Washington. A poor outcome on the fiscal cliff means an already fragile economy will be driven into recession. I am substantially more concerned about recession in 2013 than I was in 2012 as the risk of austerity is higher.

2) What Will Happen with US Monetary Policy?

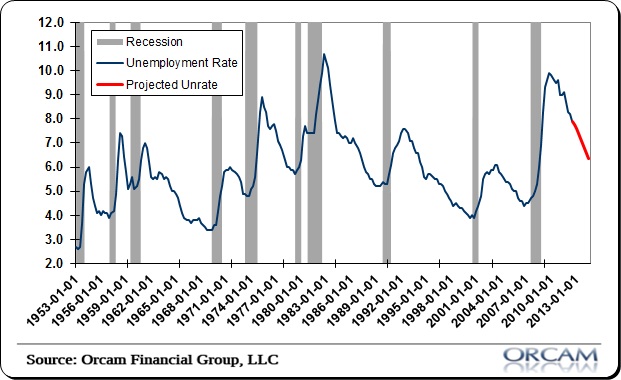

This one looks like a no-brainer. The Fed has been pretty clear that they’ll remain accommodative through 2015. The recent change in communication and timing made it clear that they’ll be on hold until the unemployment rate drops below 6.5%. Even in a best case scenario the unemployment rate likely won’t hit 6.5% until the middle of 2014 so it looks like we’re in accommodation mode for the duration of 2014.

Downside risk: Ben Bernanke is likely to step down in 2014. Could he become less accommodative later in the year in order to create flexibility for a smoother transition? Or could policy take an unexpected turn due to the uncertainty that is likely to develop in the market surrounding this event?

3) Is the US Economy Headed into a Recession?

I’ve been pretty vocal over the last 18 months since the ECRI came out with their recession call. I said the US economy would not enter a new recession in late 2011 or 2012. The thinking was relatively simple. Because the US economy remained in a balance sheet recession you had to throw all the past historical data out. None of the models applied to what we are going through. What did apply was understanding how the US economy was de-leveraging and that meant the private sector was too weak to sustain growth on its own. That meant we needed the public sector to pick up the slack. You’ve probably seen this chart (or some version of it) a million times here:

What happened to the US economy was an unprecedented collapse in private investment. Normally, the private sector alone can bring us out of a recession. But this was no ordinary recession. Private investment cratered over 20%. This was beyond unusual. It meant the private sector was flat on its back. And more importantly it meant that the huge public deficit was supporting incomes, driving revenues, and generating an economic “flow” where there wasn’t one.

It’s kind of like the office building called the US economy was burning down and the indoor sprinkler system stopped working. A balance sheet recession isn’t merely a contained one office fire. It has the potential to wreck the building. So, what was needed was an outside flow. That arrived in the form of government spending. It not only put the fire out, but saved the building from collapsing.

Anyhow, it’s hard to tell whether there will be a recession in 2013 due to the fiscal cliff circus, but if we get a relatively sane response then the budget deficit should remain large enough to support the private recovery in 2013. On the other hand, in a negative cliff outcome the US economy almost certainly suffers the European fate of austerity in a BSR and enters recession. I am going to make the insane call of assuming politicians will do the sane thing in the next few weeks and avoid a major budget catastrophe in 2013. Therefore, I still don’t see the recession in the USA this year, but the odds are substantially higher than they were in 2012.

Downside risk: It’s all about the cliff.

4) Is Global Growth Going to Slow?

Global growth appears to be stabilizing. The USA has maintained a muddle through environment, Europe has been mired in recession and Asia has stumbled a bit in late 2012. But that third leg of the stool (Asia) appears to be turning a corner. This has been apparent in global PMI data where the GDP weighted PMI is turning positive for the first time since early 2012. I think global GDP should stabilize further in 2012 largely on the back of a stabilizing Chinese economy.

Downside risk: The Chinese government fails to act in front of a still very fragile economic environment.

5) Is the Euro Crisis Over?

The Euro crisis never ended. As I’ve explained before, this remains a currency crisis and not a banking crisis. The problem in Europe is that the Euro remains unworkable. The single currency system has locked its users into a fixed exchange rate regime without a fiscal rebalancing mechanisms. In other words, unlike the USA (which is almost perfectly analogous to Europe’s union) there is no central treasury to rebalance any imbalances. Most people aren’t aware of the fact that the USA is actually a huge fiscal transfer union. The wealthy states pay more into a system that redistributes funds to weaker states. This helps eliminate the solvency concerns and trade imbalances that naturally develop in any fixed exchange rate system.

Europe has no such arrangement so the only rebalancing mechanism is through painful austerity and time. The result is depression in many regions. Unfortunately, there hasn’t been any permanent fix to this problem. Instead, the ECB has implemented a series of measures that help reduce the solvency risk at the national level which brings private bond buyers back to the market, but this is far from a permanent fix to the underlying economic problems in the region. The Euro crisis remains one of the primary risks to the global economy.

Downside risk: The big risk is civil unrest which leads to potential defections and defaults. The citizens of Europe are unlikely to put up with depressionary economics forever.

6) Where is US Employment Headed?

Last year I said we were making “baby steps” in the right direction on the employment front. Understanding the balance sheet recession has been all about understanding the growth of private credit. As the lifeblood of our monetary system private credit tends to correlate with the unemployment rate and rate of hiring. The one positive trend we’ve seen on the employment front is the beginning of gains in private credit accumulation. As you can see in the chart below, private credit (inverted) is beginning to turn the corner. The process is slow and remains incredibly fragile, but it’s moving in the right direction. I don’t think it’s unreasonable to assume that the unemployment rate will drop below 7% this year for the first time since the crisis flared up.

Downside risk: Again, it’s all about the cliff and austerity. Austerity would hurt private balance sheets and likely cause a freeze in credit accumulation and hiring.

7) Will High Inflation Finally Arrive in 2013?

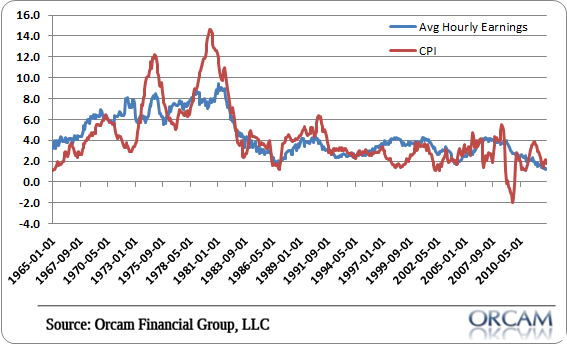

In 2012 I expected disinflation leading to a level where the Fed would feel comfortable intervening with QE3 around the middle of the year. I’ve been lucky predicting inflation in recent years. Looking forward, we’re likely to see many competing forces on the inflation front in 2013. Oil prices are still very high, credit trends are improving, government spending remains high and yet hourly earnings are still near rock bottom. Ultimately, I think the two primary drivers will be credit trends and hourly earnings. Continuing weak demand for credit and virtually zero earnings power on the labor front will continue to suppress inflation. Contrary to popular opinion, I am not a deflationist and haven’t been for many years. So, I see positive inflation, but low inflation in 2013.

Downside risk: Or should I say “upside risk”? It is definitely oil prices. A repeat of something like 2008 cannot be ruled out. Particularly with the volatility in the Middle East.

8) Will hyperinflation finally come in 2013?

I’ve had a lot of fun over the years at the expense of the hyperinflationists. But that was mostly in trying to create a teachable moment about the way our monetary system works (see here for more). As I’ve long predicted, hyperinflation is not a serious risk in the USA because hyperinflation is far more than a monetary phenomenon and none of the conditions that precede hyperinflationsts are present in the USA. I would place the risk of hyperinflation in the USA in 2013 at approximately 0%. I’d go negative if I could.

Downside risk: None. I honestly don’t think there is any risk of hyperinflation in 2013.

9) Should You Buy a House in 2013?

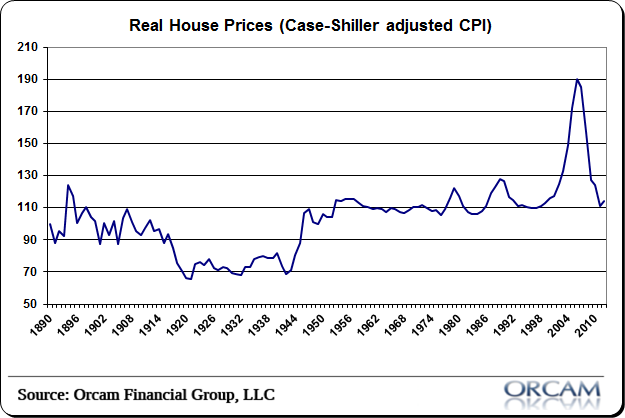

5 years ago I was a big housing bear. I wouldn’t say that I’ve done a 180 here, but I’ve definitely become much more constructive on housing in recent years (see here and here). The keys in the housing market has been sizable declines in inventory, vast improvements in affordability, improving price to rent ratios and substantial price declines across the nation. I still think we’re in the midst of a post-bubble “workout”. Like most bubbles, it’s highly unusual for prices to bounce back quickly. Instead, we’re likely to see a flat-lining in prices.

Despite the many calls for recovery this year, I still don’t see a big recovery in housing. That said, I also don’t see great downside in prices. We’ve already had a massive decline in real house prices so I think we’re most likely to see moderate gains at best in 2013. If you’re looking to buy a home in 2013 and you’re looking to live in that house then I think the downside risk are fairly limited.

Downside risk: I hate to be a broken record, but the risk here is in the fiscal cliff and the potential that incomes from government spending decline substantially which puts downside pressure on the economy.

10) What Will Happen to Corporate Profits in 2013?

Last year I predicted that corporate profits were likely to come under pressure for the first time since 2009. As Q3 operating earnings come in at just 1% I think that has become a reality. There are a lot of moving parts here, but the likelihood of slow corporate profit growth is likely to continue into 2013. Revenues are slowing into the low single digits, corporate profit margins are high and profits have soared on the back of the large budget deficit. I think the risk to all of this is to the downside. I am much more concerned about a profits recession in 2013 than an economic recession.

Downside risk: Again, understanding the Kalecki equation shows us that corporate profits have benefited enormously from the large budget deficit. If the fiscal cliff results in a substantial decline in the budget in 2013 we should expect a profits recession.