A crowd follower does the opposite of a contrarian. Like a red light camera, contrarian indicators are effective because most people aren’t aware of them. But what happens when – as is the case right now – contrarian indicators go mainstream?

In the first week of January investors shoveled $22 billion back into equity funds around the world. This is the second highest inflow on record reports Bloomberg.

Bullish sentiment of investment advisor and newsletter writing colleagues (polled by Investors Intelligence – II) jumped to the highest level since September 18, 2012 (the S&P 500 declined 9% thereafter).

Retail investors polled by the American Association for Individual Investors (AAII) are the most bullish they’ve been since February 9, 2012.

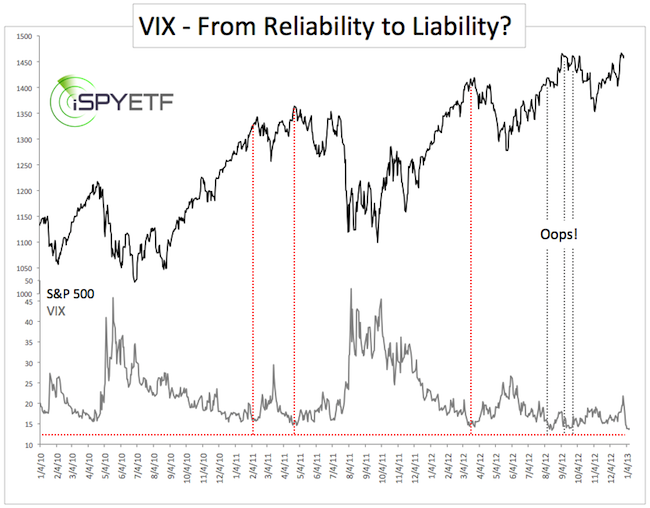

Am I forgetting something? Oh yeah, the VIX just hit the lowest reading in 72 months.

Investors are so bullish, it must be bearish for stocks, right?

Contrarian Gone Mainstream

It normally pays to fear the cheer. But a trap is only a trap as long as it remains hidden and extreme sentiment is only a contrarian indicator as long as it remains contrarian. Contrarian indicators gone mainstream don’t work (remember the much publicized, ultra-bearish Hindenburg Omen in August 2010?).

Extreme optimism alerts or “fear the cheer” headlines have just gone mainstream. A small sampling of Friday’s headlines is listed below:

“Where’s the wall of worry?”

“Why VIX’s recent plunge may be bad for stocks”

“Earnings disappointments ahead”

“Is the crowds cheery mood reason to fear the rally’s end?”

For the first time in quite a while the VIX, II, and AAII polls are delivering a generally bearish signal. However, the media skepticism caused by investor optimism may well negate the bearish contrarian implications (is there such a thing as an inverse contrarian signal?).

Even though the VIX is unusually low, the chart below shows that as of late a low VIX alone doesn’t automatically translate into lower stock prices.

How the Market May Trick “Inverse Contrarianism”

The media can change its tune on a dime and the market usually takes the route least expected. One way the market may shake out or convert the pessimistic optimists is simply by grinding higher. Nothing is as persuasive as rising prices.

Or, the market may decline a bit – make the bears feel safe – and then deliver another rally leg.

Whatever route the market chooses, I wouldn’t make any buy/sell decisions purely based on sentiment at this time.

Key Inflection Point Ahead

More gains in the form of a final push higher would harmonize well with my technical indicators and technical model, which sees a key inflection point just ahead.

This key resistance (I call it inflection point because the S&P 500’s reaction there should set the stage for weeks to come) is the same type of resistance level that pinpointed the 2011 market top and subsequent 20% waterfall decline.

Key inflection points like this always provide low-risk trade opportunities. Why? The potential for gains is so much larger than the risk of losses because you know exactly when you are wrong. You can go short with a stop-loss just above resistance or long once resistance is broken with a stop-loss just below.

The latest Profit Radar Report highlights this key inflection point along with actual trade recommendations.