By Lance Roberts, StreetTalk Advisors

Since the end of last year the bullish optimism for 2013 has risen to an almost fevered pitch. Concerns of any further disruption from the Eurozone have faded into the mist. With the“fiscal cliff” issue resolved, and little concern that the “debt ceiling” will not be raised, the worries of a domestic drag have been all but alleviated. Furthermore, despite slowing earnings and revenue growth, the outlook for 2013 earnings growth is remarkably ebullient. According to the vast majority of the media, analysts and portfolio managers there is absolutely nothing to be worried about, particularly given the fact that every major central bank is now engaged in some sort of financial easing campaign, and the markets should surge to record highs by year end.

However, maybe it is in this very optimistic outlook that we should find at least the smallest grain of concern. Bob Farrell once stated: “When all experts and forecasts agree – something else is going to happen.” As a portfolio manager I am not paid to garner portfolio returns but rather manage the risk of loss. It is in the risk management, as we discussed previously, that long term returns are achieved. It isn’t as fun, or as sexy, as driving a Ferrari at top speed but the crashes won’t kill you either.

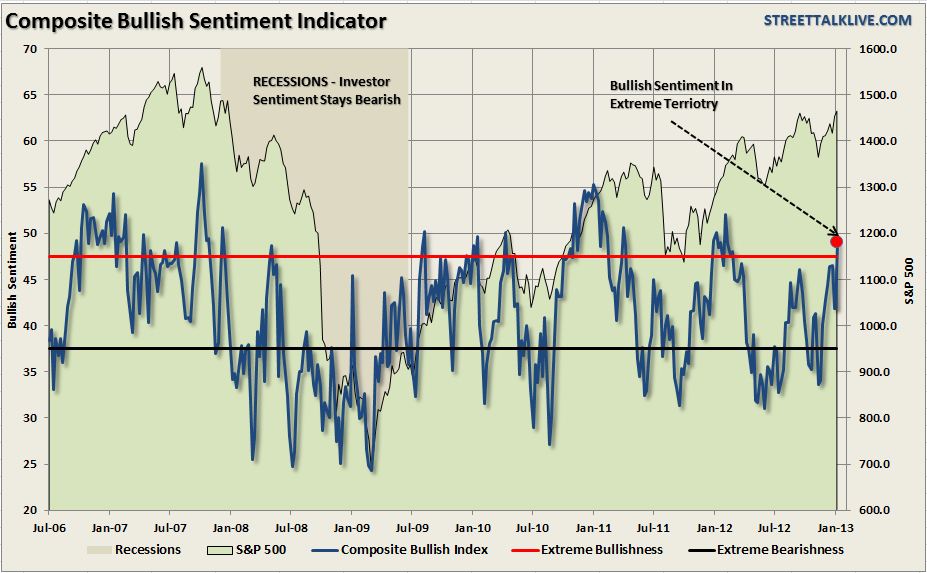

There are many ways to measure investor optimism. The chart below is the composite index of bullish sentiment of both individual and institutional investors. As you can see the index is now at levels normally associated with the beginnings of market peaks.

The next chart is of the Volatility Index. The volatility index, which is used as a gauge of investor fear, is currently at levels normally associated with extreme complacency. What is important to note is that the level of complacency is not the concern but rather how quickly such complacency can turn to fear.

The last chart is my composite indicator which combines bullish versus bearish sentiment, highs versus lows, volatility, and the index’s rate of change into a single measure of risk. When looking at a variety of different measures combined into one indicator we can clearly see that optimism has begun to reach extreme levels. I have identified the previous times that the market has pushed up into these more extreme reading which have all equated to more intermediate tops.

This all very much aligns with our recent discussion on the current state of this rally:

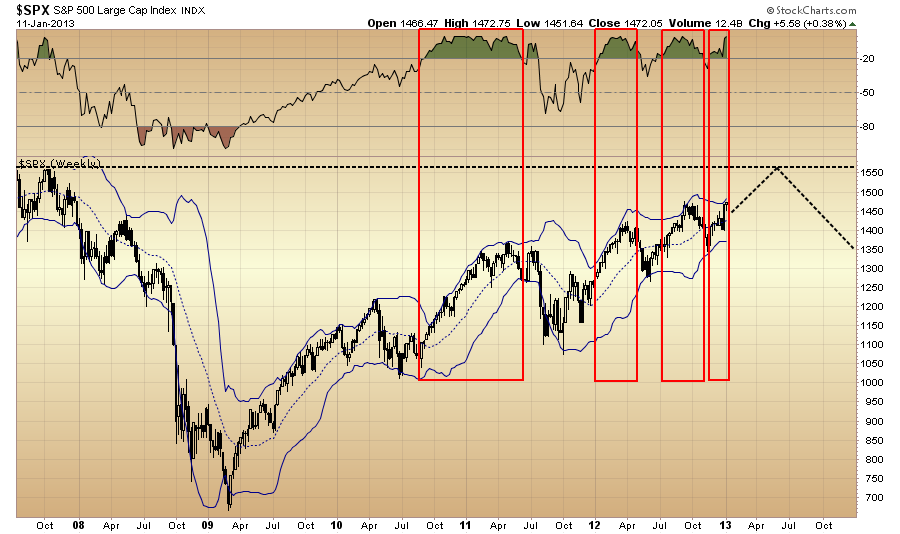

“The question of how far the rally will likely go is shear speculation. Using past history as a guide I currently think that the market could reach our intra-year target of 1560 as shown in the first chart above within the next three to four months. After that, however, I suspect that a resurgence of economic weakness caused by increased taxes, potential spending cuts and a continued drag from emerging markets and the Eurozone will begin to negatively impact the markets. The chart below shows the likely trajectory in the months ahead.”

As with all forecasts and projections it is simply just my best guess. However, what is clear is that the markets are once again very overbought and extremely optimistic. This doesn’t mean that the market will not rally further but, historically speaking, it has not been wise to assume that the advance will continue indefinitely. The reality is that we are very long in the tooth in this current rally and we are now seeing a multiple expansion based on rising prices and deteriorating earnings. Such an event has never ended well – although it can last far longer than is generally imagined.

Ben Bernanke’s fingerprint is clearly present in the current rally. The trend is currently positive and internal dynamics are relatively stable as money rotates from safety into risk. However, as stated above, the markets are overbought, overly bullish in terms of sentiment and complacency, and fundamentals are showing signs of weakness. While 2012 made a very strong advance in the face of rather substantial headwinds it is unlikely that 2013 will repeat such a showing.

One of my favorite quotes is by Howard Marks who said:

“Resisting – and thereby achieving success as a contrarian – isn’t easy. Things combine to make it difficult; including natural herd tendencies and the pain imposed by being out of step, since momentum invariably makes pro-cyclical actions look correct for a while. (That’s why it’s essential to remember that “being too far ahead of your time is indistinguishable from being wrong.”)

Given the uncertain nature of the future, and thus the difficulty of being confident your position is the right one – especially as price moves against you – it’s challenging to be a lonely contrarian.”

The problem with being a contrarian investor is that it is grossly unpopular. People would rather hear all the reasons why a market will advance rather than the reasons that something might go wrong. Being a contrarian gets you quickly labeled as a “bear” and you are definitely no fun to invite to parties. However, it is the understanding of the inherent risks, when investing your savings, which separate success from failure.

What matters most to me is not a label of “bullish” or “bearish” but the understanding of the risks that can destroy large amounts of capital in a relatively short period of time. The economic data is far from strong and most of the bullish expectations are built around a premise that the world has achieved a financial equilibrium. That is not a bet that I am willing to take – are you?

The post Bullish Optimism is Beginning to Reach Extremes appeared first on PRAGMATIC CAPITALISM.