This is priceless, even for salesforce.com, inc. (NYSE:CRM). Fresh off announcing they have no plans to earn a GAAP profit anytime soon (neat trick for a company valued at 25B) comes this latest slight of hand. CRM announces a 4 for 1 stock split and this is the line of crap, I mean, reason they give: Here is the section from the 14A

Stock Split The trading price of our common stock has risen significantly over the past several years. The Board regularly evaluates the effect of the trading price of our common stock on the liquidity and marketability of our common stock and believes the considerable price appreciation has made our common stock less affordable and, therefore, attractive to fewer investors. The Board believes that this considerable price appreciation, and the associated reduction in number of shares of stock covered by equity awards we issue to newly hired and existing employees, has reduced the perceived attractiveness of our employee equity awards. The closing market price of our common stock on January 24, 2013 was $172.29 as reported on the New York Stock Exchange (the “NYSE”).

The Board believes that effecting the Stock Split would make our shares more affordable and attractive to a broader group of potential investors, increase liquidity in the trading of our common stock and increase the attractiveness of our employee equity awards. The Board believes it is in our best interests to increase the number of authorized shares of common stock to accommodate the Stock Split. If the Amendment is approved by the stockholders, the Stock Split would become effective at a time to be designated by the Board. While the Board currently intends to effectuate the Stock Split shortly after the approval of the Amendment, the Board’s decision as to whether and when to effect the Stock Split will be based on a number of factors, including market conditions and existing and expected trading prices for our common stock on the NYSE. Even if the stockholders approve the Amendment, the Company reserves the right not to effect the Stock Split if the Board does not deem it to be in the best interests of the Company and its stockholders to effect the Stock Split.

Now, we all know how high stock prices have been a detriment to attracting employees at Apple Inc. (NASDAQ:AAPL), International Business Machines Corp. (NYSE:IBM) and Google Inc (NASDAQ:GOOG). I mean, those places have to scrape leftover employees from Asian Plantations Limited (LON:PALM) and Research In Motion Limited (NASDAQ:RIMM) (TSE:RIM) for programmers and hire laid off postal workers just to staff the mailroom they are so desperate. What it is about then? It is simply a continuation of the games they have been playing with earnings for going on 4 years now. I have detailed scores of them on the blog, just follow this link and read away.

This latest “maneuver” is simply about one thing, attempting to diminish EPS losses. That’s it. The rest of the reasons they give are pure unadulterated garbage. The stock option reason? Really? If Joe the new employee is going to get 100k in stock options, does it matter if he gets that is 10k shares ($10 each) or 2k shares ($50 each)? Are we really to believe that is going to be a dealbreaker? Liquidity? This would be the time to point out that the aforementioned Apple Inc. (NASDAQ:AAPL) ($430), Google Inc (NASDAQ:GOOG) ($750) and IBM ($205), all with MUCH higher stock prices all trade 2X to 3X as many shares a day as salesforce.com, inc. (NYSE:CRM) does. Apparently profitable companies stock prices are not “illiquid” due to high share prices? Maybe just those who show GAAP losses for three years running?

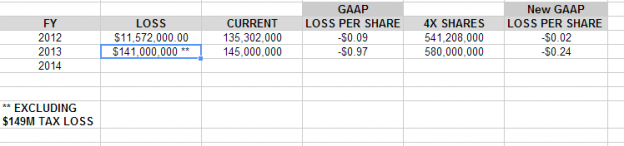

Lets get back to EPS. Real quick, salesforce.com, inc. (NYSE:CRM) is posting increasing GAAP losses in FY 2012,2013 and based on what they told us, 2014 and probably even 2015. So, how do companies increase EPS, they buyback shares and reduce the outstanding total. How do we diminish them? We increase the total. Right? Nothing changes. The company’s ultimate valuation won’t change, each current shareholder has the same stake in the company etc etc etc. Here is how it looks. I have even been so generous as to take out the 149M deferred tax write down the company took in Q3 when they admitted GAAP earnings are not forthcoming anytime soon. One has to be impressed by the fact the company, even after excluding the deferred tax asset loss managed to go from losing 11M to 141M in a year’s time….and the stock rose!!

Dramatic, right? A cute little ($.24) loss vs what will be over ($2) on a GAAP basis or the ($.97) I have above excluding the tax loss. This is a sham…..plain and simple.

Fools will take this stock split as a sign something good is happening with the company…there isn’t. Yes, they are increasing revenues 30% annually but they are also increasing losses at a faster rate. Think about it, increasing losses at a faster rate than revenues. But the stock will rally because of the split. Yes, it will also increase the inevitable pain down the road……

By: valueplays

The post Salesforce Pulls Another Quick One appeared first on ValueWalk.