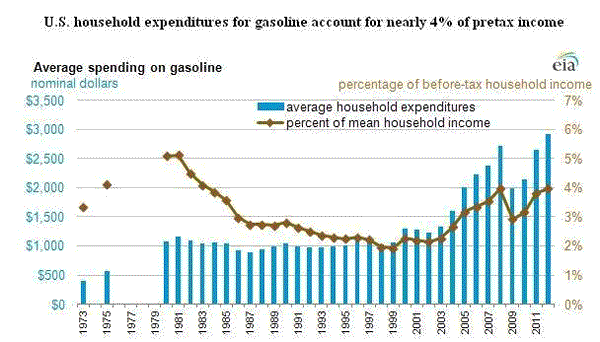

I couldn’t help but notice today’s note from the EIA that if you exclude the 2008 spike in oil prices (to be fair, seemingly a unique anomaly and unsustained) Americans are paying the highest portion of paychecks toward gasoline prices in the past 3 decades. 30 years. This chart tells the story, but consider the implications:

Often times, gas prices spike even further in the summer, chalking it up to the “summer driving season” so we may have more increases in store. So a few musings on how we got here and implications:

•Not Due to Robust Economic Activity – Historically, rising gasoline prices are a function of either inflation, a supply shortage, or robust economic growth (fears that demand will outstrip supply, hence pushing up the price until such time that demand and higher prices slow down the economy). Well, the government claims we have very low inflation (if you use their index) and nobody with any self-respect will call our current “recovery” robust. It’s been fueled by stimulus, back-door stimulus (like the recent call to increase the minimum wage which is a basic tax on businesses to redistribute to the lower end on the income curve) and continued $Trillion deficits.

•Should We Really Complain? One consideration that can’t be taken lightly is that Americans pay a heck of a lot more than European markets and many others, where refineries are scarce or government taxation is much higher. For instance, this week, gas prices in France breached $8/gallon in many areas, whereas Americans start really complaining at half that – the $4 we’re at now.

•Other Unintended Consequences of QE and Low Interest Rates – So, if we don’t attribute these prices to robust economic activity, inflation, or a refinery shortage, is it just that there’s too much cash awash in the financial system and this is an inevitable byproduct? To be clear, there have been many benefits to the global easing if you look at the variety of loans available which have put cash back in the pockets of borrowers while spurring economic growth around the globe. Conversely though, savers have been slaughtered, pension funds are finding it difficult to meet their historical return targets (8% returns may be a thing of the past) and we may be setting ourselves up for another spectacular crash in both bonds and equities.

From a trading standpoint, I’ve always been a proponent of hedging my own family’s gas prices by selling puts on UGA, the gas ETF. I roll this position about twice per year and currently have a July 55 option out there, which I have little doubt will expire worthless so I can rinse and repeat the cycle.