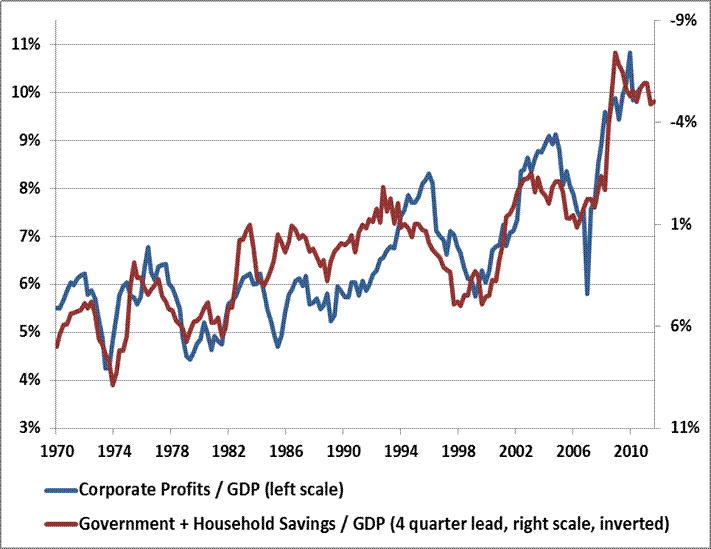

Pretty interesting commentary here from John Hussman’s weekly letter in which he points out that one sector’s deficit is obviously another sector’s surplus. In the case of the government’s deficits, it’s not surprising that corporations, to a large degree, have been the beneficiaries of the surplus. After all, when the US government places an order to purchase $50MM in jets from Lockheed Martin who do you think gets to book the profit? The fact that government deficits can boost corporate profits is not even remotely controversial (although some might actually argue it despite the hard math – the thought of government spending generating profits for private corporations upsets some people – get over it, it happens), but I found Dr. Hussman’s comments pertinent going forward. He says:

“The deficit of one sector must be the surplus of another.

This is not a theory. It’s actually an accounting identity. But the effect of that identity is beyond question. Elevated corporate profits can be directly traced to the massive government deficit and depressed household savings that we presently observe.

I should note that this result is the outcome of hundreds of millions of individual transactions, so it’s tempting to focus on those transactions as if they are alternate explanations. For example, one might argue that corporate profits are high because people are unemployed, many workers have been outsourced, and government transfer payments are allowing corporations to maintain revenues from consumers despite low wage payments. That’s a perfectly reasonable of saying the same thing – but the transaction detail does not change the basic equilibrium that profits are elevated because government and household savings are dismal. One will not be permanent without the other being permanent.

To see this, notice that corporate profit margins have always moved inversely to the sum of government and household savings.”

That’s a pretty important chart. What it’s essentially showing is that government deficits have been a big driver of corporate profits. This won’t come as a surprise to anyone reading this website as I’ve been pointing that out for years, but it’s important to keep in mind going forward as the USA moves to what looks like an increasingly more austere position. I am not hugely worried about collapsing corporate profit margins at this point because I see private investment recovering AND I still see big budget deficits, but it’s an important risk to keep on the radar…

The post Profit Margins and the Government’s Deficit appeared first on PRAGMATIC CAPITALISM.