A few months ago, I talked about how a financial transactions tax can have significant unintended consequences. Using Hungary as an example, I said that when the government implemented a levy of 0.5 percent on banks’ assets, bank credit growth rates plummeted. As a result, Hungary’s household and corporate sector credit growth rates became anemic compared to other Eastern European countries.

Now it appears that Italy is going “Hungary” by introducing a financial transaction tax that became effective in March. For shares of Italian companies, investors are taxed an additional 0.12 percent of the value of the shares purchased in a regulated market or trading platform. For over-the-counter transactions, the tax is even more costly, at 0.22 percent, according to Reuters.

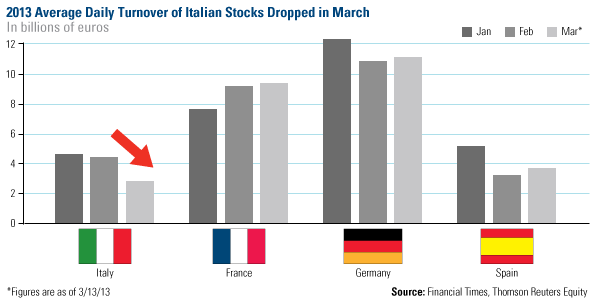

Since going into effect on March 1, trading in Italian stocks through desks of major banks has plummeted. According to the Financial Times, average daily trading volumes in March have dropped about 40 percent compared to the previous month. “This is the biggest fall in volumes on any major European exchange so far this year,” says the FT.

I believe this is a great example of how government policies are precursors to change. With a reduction in trading volumes, fewer buyers and sellers participate in the bid-and-ask process, and less competition can cause prices to languish.

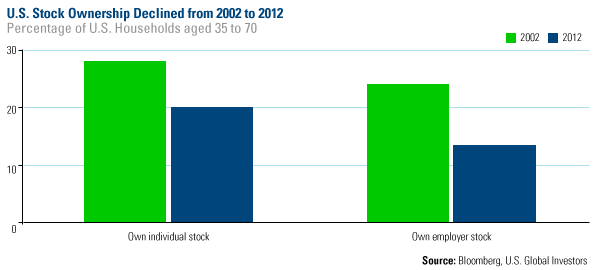

With fewer buyers owning shares of public companies, investors’ portfolios are likely going to be deficient in growth assets. Take a look at Investment Company Institute data showing a decline in the percentage of households in the U.S. holding individual stocks in 2012 compared to 2002. In addition, Americans are less likely to own shares of their companies’ stock today compared to 10 years ago.

With less stock ownership, many of these U.S. investors likely missed out on the market’s tremendous rise over the last few years.

In March 2013, ICI issued a response to the financial transaction tax that’s been introduced in the U.S., saying, “A financial transaction tax is bad policy that substantially reduces the investment returns of fund investors and retirement savers. Whether introduced in the United States, Europe, or elsewhere, financial transaction taxes slow economic growth, drive away financial activity, and make markets less efficient.”

I believe leaders in Washington D.C. and around the world should be focused on policies that encourage individuals to invest rather than making it more onerous. I hope those considering similar financial transactions are taking note.