By Walter Kurtz, Sober Look

In spite of ongoing stream of positive economic news out of China, a number of economists have been ringing alarm bells with respect to the nation’s economic trajectory. China clearly faces some major challenges, but the question remains if the country is still at risk of a “hard landing”. Here are some of the issues that keep China-focused economists and portfolio managers awake at night.

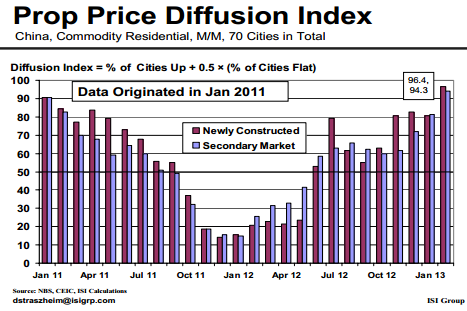

1. After a slowdown, China’s property prices resumed their climb. The ISI Price Diffusion Index has risen sharply over the past year, indicating that liquidity continues to flood these markets (see figure 1 below). This trend can persist for quite some time (as we’ve seen in the US), but it certainly introduces the risk of further inflating China’s property bubble. Economists at the ISI Group are definitely concerned.

2. Related to the issue above, economists from Nomura are pointing to the dependence of local governments on land sales. Severe problems with local governments could also easily spill into the banking system.

WSJ: – Local governments, which rely on land sales as their main source of revenue, could be hit as hard as property developers by a real estate crash. The problems would quickly find their way into the banking system – 14.1% of outstanding bank loans are to local government financing vehicles, and 6.2% are to property developers, Nomura’s economists say.

Moody’s analysts are just as concerned about China’s local government indebtedness. According to them, escalating debt levels and rising default risks at the local government levels – particularly pertaining to local government financing vehicles (LGFVs) – represent a major risk to China’s growth.

Bloomberg: – Moody’s Investor Services said China’s local-government financing vehicles face greater risk of default, as regulators warn 20 percent of their loans are risky.

3. The risk of China’s “shadow banking” keeps resurfacing. It’s been a topic widely discussed in the media and the blogosphere, and even chastised by high-level Chinese officials. Nevertheless the issue remains unresolved.

MoneyNews: – The World Bank warned recently that the Chinese economy could overheat from an influx of capital, resulting in excessive credit growth.

The International Business Times reported that the shadow banking system in China is “growing at an alarming rate.”

In fact, nearly half of all new credit is supplied by non-banks or through off-balance-sheet vehicles of regular banks, International Business Times said, up from 10 percent a decade ago.

Of particular concern to some regulators are so-called wealth management plans (WMPs), which are yield-bearing instruments sold by banks that do not have guaranteed principal.

Xiao Gang, chairman of the board of Bank of China, wrote an op-ed in the English language China Daily in which he said the quality and transparency of WMPs are “worrisome.”

“To some extent, this is fundamentally a Ponzi scheme,” Xiao said, according to the International Business Times.

One would expect that after a statement such as this by Xiao, WMPs sales would decline sharply. Apparently they haven’t.

4. As the saying goes, “a rising tide lifts all boats”. And rapid economic growth solves or masks a great number of structural issues. However, China is facing a slowdown simply due to its demographics (see post), which could over time expose these structural problems. Furthermore, limited growth will restrict how much stimulus could be deployed without sparking inflation. And if the authorities don’t play this slowdown correctly, it could even spark widespread political unrest.

WSJ: – … adding to the likelihood of a crisis is China’s declining potential growth rate. It is not easy to calculate this number, which represents the maximum speed the economy can grow without generating excess inflation, but even analysts more optimistic than Nomura’s agree that it’s falling, driven by factors such as a shrinking working-age population. That gives China’s policymakers a lot less leeway to stimulate the economy than they have enjoyed in the past.

The post The Key Risks to China’s Economic Growth appeared first on PRAGMATIC CAPITALISM.