Interesting commentary from David Rosenberg here regarding negative real rates and the tendency for excess to occur. I’d say this time is slightly different in that the low real rates of the past tend to coincide with better credit conditions, but this time might find a different enabler in QE’s supposed “wealth effect”. Here’s Fed Governor Jeremy Stein first:

“For example, a prolonged period of low interest rates, of the sort we are experiencing today, can create incentives for agents to take on greater duration or credit risks, or to employ additional financial leverage, in an effort to “reach for yield.” An insurance company that has offered guaranteed minimum rates of return on some of its products might find its solvency threatened by a long stretch of low rates and feel compelled to take on added risk. A similar logic applies to a bank whose net interest margins are under pressure because low rates erode the profitability of its deposit-taking franchise.

Moreover, these three factors may interact with one another. For example, if low interest rates increase the demand by agents to engage in below-the-radar forms of risk-taking, this demand may prompt innovations that facilitate this sort of risk-taking.”

And then Rosie:

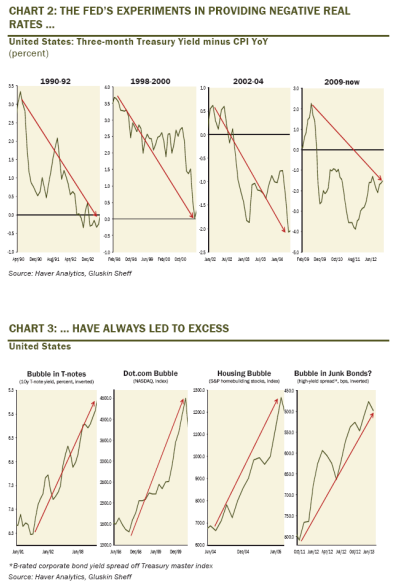

“as the charts below illustrate, it may take time to fester, but each period of real zero or sub-zero real interest rates ushered in by the Fed in recent cycles generated bubbles somewhere. And they don’t tend to end very well. Store that in your pocket for future reference.”

Hard to argue with this one. The Fed has been on a strategy of boom/bust cycles for the last 25 years that tends to target some form of nominal wealth with the presumption that this will help generate real sustained wealth. It might accomplish that to some degree, but it appears to come with a price that includes a huge amount of economic volatility….

The post Experiments in Negative Real Rates Tend to Lead to Excess…. appeared first on PRAGMATIC CAPITALISM.