The cat is out of the bag. Everyone knows that AAPL prices are no longer linked to iPhone, iPad or other iGadget sales. To the frustration of Wall Street, AAPL has developed a mind of its own. Here’s one simple trick that foreshadowed all turns since November 2012.

Is Apple’s decline over? Much has been written about Apple’s quick demise from darling of the masses to giant under achiever.

The good news is that AAPL shares recovered a bit recently. The bad news is that further gains are a must to break the down trend. Here’s why:

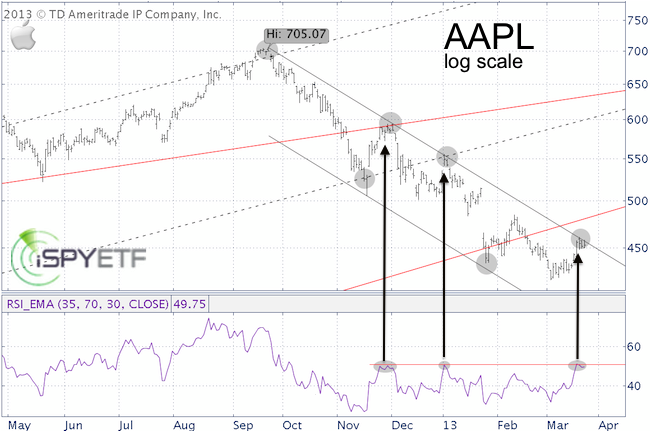

Charted below is AAPL on a log scale along with RSI (Relative Strength Index) and some powerful support/resistance levels.

Apple’s decline from the September high has been confined to a well-defined parallel trend channel.

Every instance Apple hit that channel is marked with a gray circle. There are six circles, so AAPL must consider this channel to be important.

This week AAPL touched the upper channel line for three consecutive days but has so far failed to break above it.

At the same time, RSI has come back to test resistance at 51, a level that rebuffed all prior rallies since October.

There is a silver lining for AAPL bulls. On the regular (non log scale) chart, AAPL already moved above its parallel channel. Nevertheless, the down trend deserves the benefit of the doubt as long as AAPL fails to bust through price and RSI resistance.

Regardless of your bias, what AAPL reaction to current resistance will likely set the directional trend for the coming weeks. The trend channel can be used to find low-risk entry points and to manage risk.

The other shown support/resistance levels may come into play if AAPL is able to break out if its current ‘resistance prison.’

The lower ascending red trend line goes back to the year 2000. The dashed gray channel goes back to May 2010 and the upper ascending red trend line originates in 2003.

All those long-term support resistance levels have been helpful in anticipating important turns, particularly the all-time high above 700.

The September 12, 2012 Profit Radar Report featured this (at the time outrageous) trade recommendation: “Aggressive investors may short Apple (or buy puts or sell calls) above 700 or with a close below 660.”

Do you want to profit from future issues of the Weekly ETF SPY (that’s what you just read). >> sign up for the FREE Newsletter