I was reading this report from Zillow on the future of home prices and it got me thinking about some of the macro trends in real estate. I’ve turned much more constructive on housing in the last year than I had been for the past 5-6 years. Before about 12 months ago I wouldn’t have told anyone to purchase a home in the USA, but about a year ago I started saying:

“If you’re planning on living in a house (as in, 10 years of actually living in a home) then you should have no great fears about buying today.”

Admittedly, the year over year surge in home prices has been greater than I expected, but the halt in price declines doesn’t surprise me at all. After all, we’ve fallen 30%+ from the peak in many areas so the risk/reward structure of the real estate market has shifted favourably for buyers. But I do worry that the misconceptions regarding housing persist as this quote from the Zillow report implies:

“We’ve just finished compiling our Q1 2013 Zillow Home Price Expectations Survey (ZHPES), where professional forecasters provide predictions for housing market growth in the near term. This survey marks a break with the past in that the survey benchmark is now the national Zillow Home Value Index rather than the Case-Shiller index. The prediction for appreciation in 2013 is 4.6 percent, with the lowest projection at 3.5 percent depreciation and the highest at 8.5 percent appreciation. This edition of the survey was compiled from 118 responses, including the projections of economists, market and investment researchers and real estate experts.

It’s also interesting to break up the market by growth periods to compare historical annual average rates to expectations, as done in Figure 2 above. Covering expectations for annual average growth to the end of 2017, the average of all respondents, at 4.1 percent, is above the pre-bubble average of 3.6 percent. Indeed, the optimists, on average, seem to expect the recovery to continue modestly picking up speed. And while on average the pessimists expect things to slow, it would not be too far below the pre-bubble average.”

Real estate returns are not rocket science. Because they’re such a huge portion of the consumer balance sheet they tend to be tied very closely to wage growth. Wage growth, by definition, is very closely tied to the rate of inflation. That explains why the long-term historical return of real estate is roughly in-line with the rate of inflation. But this survey from Zillow shows that real estate “investors” are probably still too optimistic.

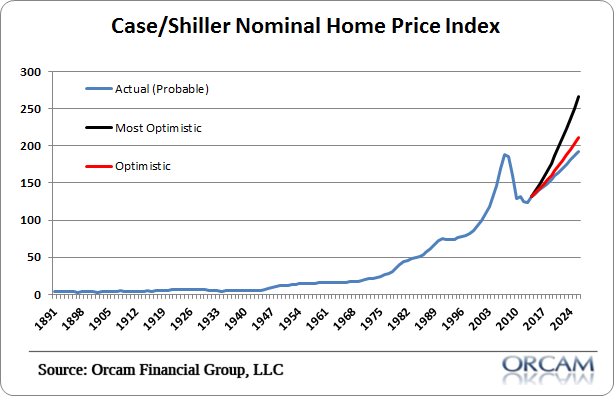

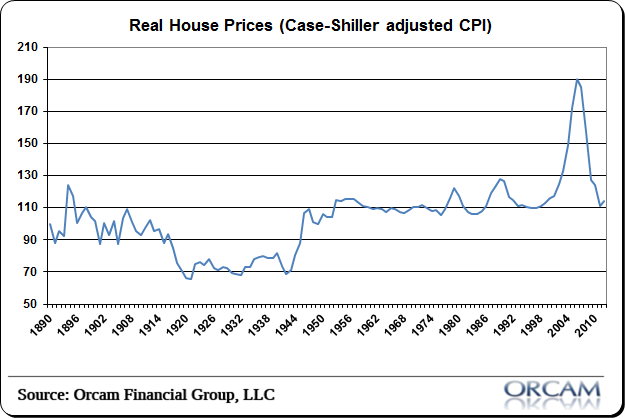

I’ve compiled the same data using the Case Shiller nominal price index in figure 1 below. US real estate has averaged about 3.7% since 1890. That’s just a tad above the average historical inflation rate of 3.2% in the USA. When I started calling housing a bubble back in 2005 it was largely due to this one simple mathematical reality – house prices cannot deviate from wage growth in perpetuity. So when Robert Shiller started posting his famous inflation adjusted house price chart (figure 2) all over the place it should have sent us all into a worried frenzy. But it didn’t for some reason. Instead, most people shrugged it off and it directly contributed to one of the worst economic calamities in US history.

Looking forward, I wouldn’t expect house prices to break their bubble peak until about 2025. Figure 1 shows the historical Case/Shiller data with Zillow survey results. The most probable scenario (historical average) assumes a real return of about 0%. But the average respondent to the Zillow survey expects 4% nominal growth. That sends us back to new highs by 2022. That’s not terribly unreasonable. But the most optimistic real estate investors are expecting something closer to bubble-era nominal growth of 6% per year. That gets us back to the bubble peak by 2019 and sends us shooting 41% over that level by 2025. That’s just not realistic and not sustainable in any way.

Of course, the future won’t play perfectly to the averages or even my practical assumptions. It’s entirely possible that the Fed’s implicit asset targeting approach will veer us closer to something like the “most optimistic” scenario. Combine that with the broadly held myth that housing is a good “investment” (it’s actually a crappy investment in terms of real, real returns) and we might have all the ingredients for the highly unusual post-bubble bubble. I for one, hope prices stagnate with inflation rates and basically move sideways per the Case-Shiller chart, but I’d be lying if I didn’t say I am getting at least moderately worried about the impacts of the Fed’s policies at present. It’s way too early to start declaring this an environment consistent with a disequilibrium like 2005, but we should be proactive thinkers, not reactive like our friends at the Fed.

(Figure 1 – Housing Scenarios via Orcam Research)

(Figure 2 – Real House Prices via Orcam Research)

The post Some Thoughts on the Future of Home Prices appeared first on PRAGMATIC CAPITALISM.