By Tiho, Short Side of Long

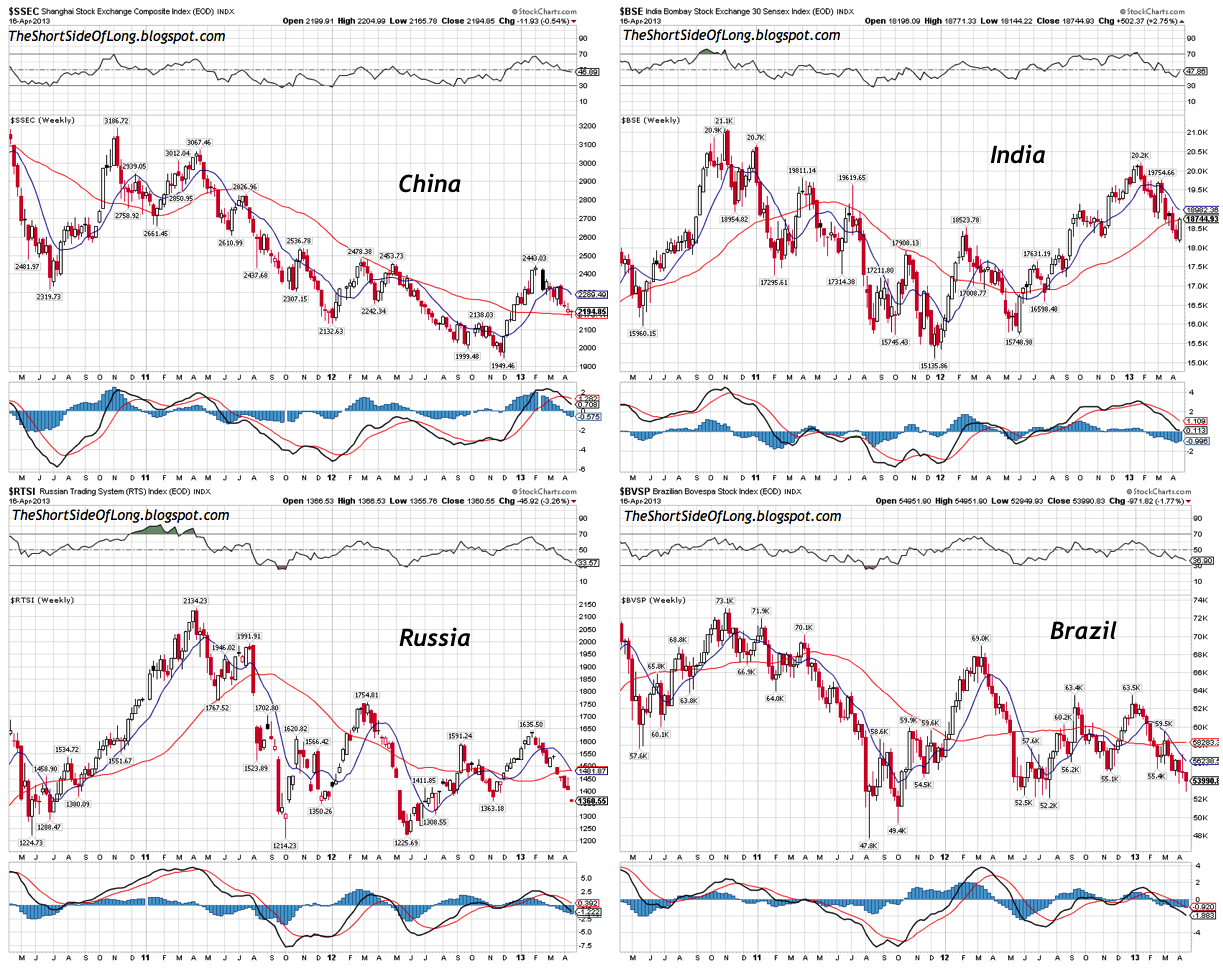

The grid of charts shown below perfectly illustrates the under performance of emerging markets in recent years. Let us quickly cover some of the more important details for the four main BRICs:

- Chinese Shanghai Composite has been in a downtrend since late 2007, despite a powerful bear market rally in early parts of 2009. The index is 63% below its all time highs and 35% below its peak in late 2009. On the other hand, the index is still up 27% from the November 2008 lows. China’s official debt to GDP ratio stands at 22% (unofficial might be a lot higher just like in the US & EU), equity market P/E at 9.4 and price to book at 1.44.

- Indian Bombay Sensex recently re-tested the 2008 and 2010 highs around 20,000 – 21000 point range. The index is 10% below its all time highs and about 6% below its peak recent peak at the begging of the year. Indian equities have experienced a tremendous gain of 125% from the March 2009 lows. India’s official debt to GDP ratio stands at 68% (unofficial might be a lot higher just like in the US & EU), equity market P/E at 16.2 and price to book at 1.9.

- Russian Trading System remains in a downtrend since its 2011 highs around 2,123 points. Russian being one of the world’s largest commodity exporters, the index hold a close correlation with the CRB as well as Crude Oil prices. The RTSI is 45% below its all time highs in 2008 and about3 6% below its last major peak in April 2011 (same time Crude Oil peaked). Russia’s official debt to GDP ratio stands at only 11% (unofficial might be a lot higher just like in the US & EU), equity market P/E at 5.2 and price to book at 0.7.

- Brazilian Bovespa is currently re-testeing its support level from 2011 and 2012 corrections around 52,000 point range. Similar to the Russian equity story, the index hold a close correlation with the CRB prices, as Brazil exports large amount of commodities to the world. The Bovespa is 27% below its all time highs in 2008 and about 26% below its peak recent major peak in 2011 (just like the CRB Index). Brazil’s official debt to GDP ratio stands at 65% (unofficial might be a lot higher just like in the US & EU), equity market P/E at 13.2 and price to book at 1.6.

S&P 500 has been outperforming the Emerging Markets since late 2010 and might continue to do so for awhile longer (even though short term metrics suggest a technical mean reversion for the oversold GEMs). Investors keen to allocate funds to emerging markets in the future will have to also be believers in the commodity story (far and few commodity bull left these days). Finally, China is the most depressed of all the BRICs when looking at the price, while Russia is the cheapest on valuations (and incredibly low debt levels).

(Click for full size image)

The post Chart of the Day: BRICs Markets are Struggling appeared first on PRAGMATIC CAPITALISM.