I see some evidence that higher domestic energy production and improved competitiveness of US manufacturing is having a positive impact on the US trade balance and US industrial production. But I still expects the impact to be limited. In particular, the real non-petroleum trade balance continues to deteriorate. Increased supplies of cheap natural gas helps the petrol-chemical industry, but its impact on other industries appear limited. If their is any segment of the economy where the rule of one world price holds, it is energy. Cheap energy prices in the US will only last until the industry can remove the bottle-necks and open those markets to competition. Firms do not build new plants to exploit temporary advantages. Work is already underway to reverse a pipeline from the Gulf Coast to Cushing, Oklahoma so the surplus oil in the Midwest can be exported. The Boston Globe reported that an application was just filed to reverse the oil pipeline from the Maine Coast to Montreal to facilitate exports of Canadian tar sands oil.

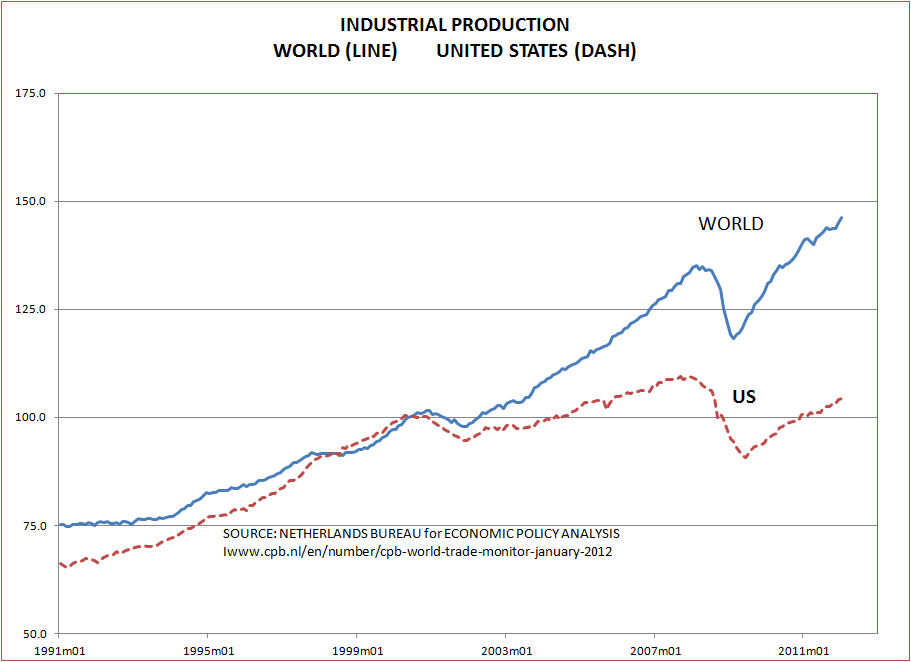

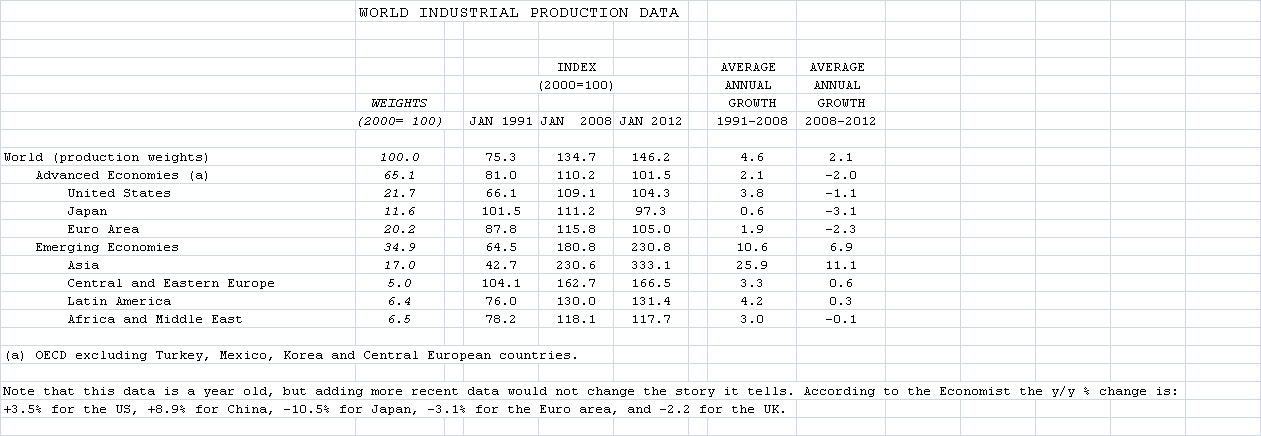

If you compare US industrial production to the rest of the world there does not seem to be much of a change that can not be traced to recent world economic growth rather than structural changes in US production.

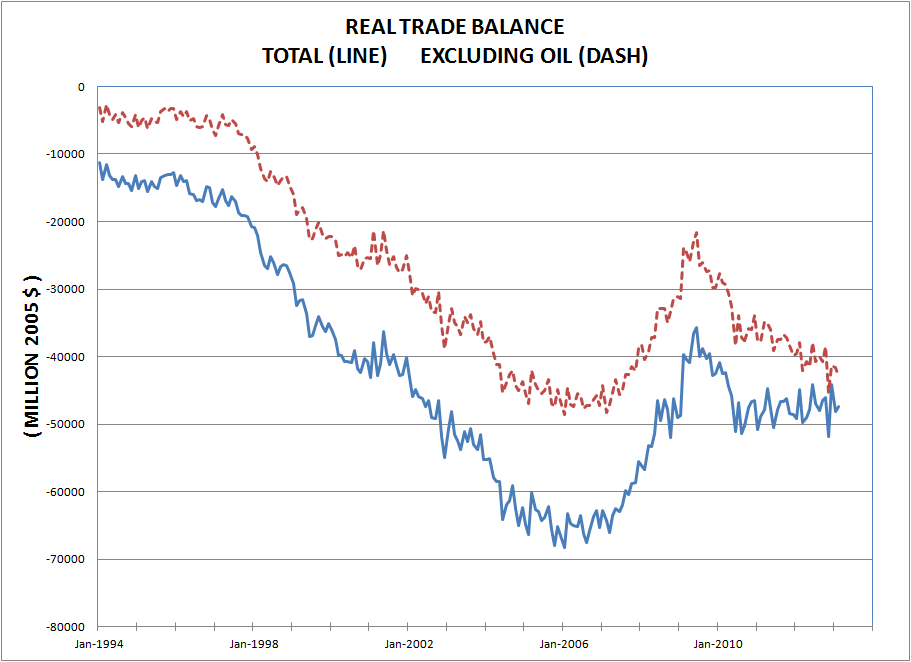

In real terms the total trade balance is improving because of reduced oil imports and expanded oil exports.

But, excluding oil, the real trade balance is still growing. The rate of growth may be slowing, but that seems to stem more from weak world growth rather than structural changes in the US.

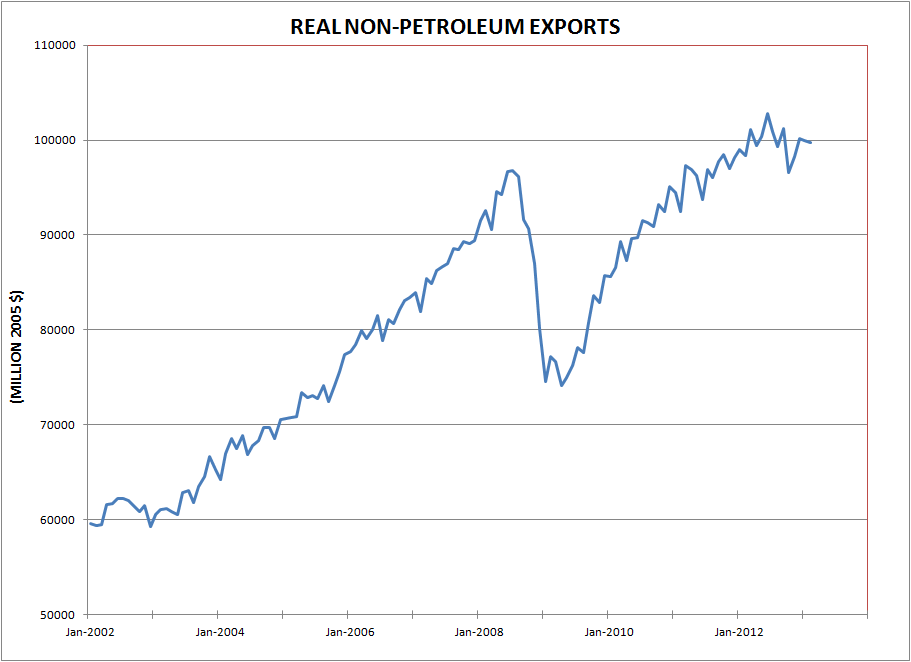

Moreover, real non-petroleum exports are clearly peaking and may be rolling over.