I was having a discussion with someone on Twitter about Monetary Realism (this person was not sympathetic to MR’s views) who asked if there was “even one insight” that was unique about MR that separated it from MMT or Post-Keynsian economics. I think that’s an important question since MR has developed into something fairly unique and outside of any “school” of economics.

I think it’s important to note that MR is not entirely unique and doesn’t claim to be. Instead, it’s built on many understandings from many different schools of thought. But most importantly, the MR approach is unique in that MR just provides a set of understandings for others to analyze and build into their world view. They might not be perfect or applicable to all systems (who could do that in a world where monetary systems are non-linear dynamical systems?), but it is a very unique way of thinking about the monetary system and trying to understand it.

Anyhow, here goes:

1. MR is designed to eliminate politics from economics using the Da Vinci Methodology.

We probably can’t completely eliminate politics from economics, but MR is based on attempting to understand the monetary system and the economy at its operational level as opposed to focusing on providing policy solutions like so many other economic schools. So we focus on things that are verifiable. For instance, how certain institutions are structured in specific monetary systems, how modern banking works, etc. It’s all based on the view that a superior understanding of the money system comes from building an understanding of how the monetary “machine” works from the ground up.

We try, as best we can, not to provide prescriptive ideas and instead try to provide a set of understandings so that users of MR’s understandings can then decide on their own how best to implement policy. We are not Keynesians, Monetarists, Austrians or any specific school at all. MR is simply a set of understandings designed to describe the money system.

Economics tends to focus on how certain policies can solve problems. I believe economists should adhere to a Da Vinci method. That is, when Da Vinci studied the human body he did not focus so much on how to fix the body, but how it worked. Economists focus too much time trying to fix the economy and not enough time building a set of principles that define how it works. If more economists adhered to a Da Vinci method I think better solutions would necessarily arrive.

This is the primary strength of MR. We don’t treat economics like it’s a religion. Instead, we treat it like an evolving and changing science that requires flexibility and an open-minded approach. As far as I know, there are few if any approaches to economics that provide this sort of approach.

2. MR’s unique understanding of money and banking.

MR uses a unique approach to understanding modern money. As money is a central component of the monetary system it’s crucial to build a solid understanding of precisely what money is. MR uses a specific description of money using a “scale of moneyness” with the focus on money as a medium of exchange. This brings us to a central component of MR which is the banking system and what MR calls “inside money” (money that comes from inside the money system).

See the following for more:

3. Quantity Value vs Acceptance Value.

Understanding why fiat money has any value at all is paramount to understanding the monetary system. We break this down into two specific and clear definitions:

Acceptance value represents the public’s willingness to accept something as the nation’s unit of account and medium of exchange. This is largely the result of government laws and infrastructures.

Quantity value describes the medium of exchange’s value in terms of purchasing power, inflation, exchange rates, production value, etc. This is primarily the result of the quality of output produced by the total economy.

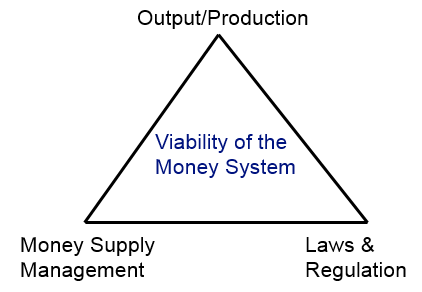

4. Understanding fiat money’s linkages to viability

We build our understanding of fiat money’s viability based on the understanding that a monetary system exists primarily for the purpose of exchanging goods and services. So the money system is inherently as good as the quality of its output. We form the linkages of fiat money’s viability using that the value of any form of fiat money is ultimately derived from three key linkages:

1. Output/Production

2. Money Supply Management

3. Laws & Regulation

All of these linkages play key roles in maintaining a stable money system.

4. MR is entirely open to other schools and their views of the money system.

Because we focus primarily on operational realities we are very open to other schools of thought and their policy ideas and thoughts. You’ll notice that MR appears as though it’s a mixture of many different schools and understandings. That’s because it is! This is the power of the unbiased operational view. There is no such thing as a set of MR policy ideas or ideologies that must always be adhered to. MRists understand that the monetary system is evolving and changing and that requires a flexible and open-minded approach to viewing the system. You’ll often notice us agreeing with Austrian economists, Keynesians, Market Monetarists, etc. One of the keys of the approach is to maintain an open-mind and open arms to other schools and their ideas. No one has all the right answers and any school that sells you their message as though they do is likely peddling something more like an ideology and not an unbiased view of the world.

5. S=I+(S-I) & The lead role of the private sector .

We break down Wynne Godley’s sectoral balances approach to provide a clearer understanding of the balance in the monetary system. Through the equation S=I+(S-I) one can clearly begin to see why private investment plays such an important role in the economy. A big part of MR is understanding the balance between agents in the economy. The monetary system exists primarily so private agents can transact business in the pursuit of better living standards. This is most often achieved when private agents are productive and providing goods and services that improve overall living standards.

Historically, we know that the economy has relied primarily on private investment for the expansion of this process. So we try to present that reality in mathematical form by showing that private saving is driven by two pieces – private investment and government. When you understand the balance of the equation you can begin to see how the private sector’s balance sheet is made up primarily of claims it has against itself in the form of things like common stocks, corporate bonds, loans, etc. All of these assets and liabilities comprise parts of a massive balance sheet that expands and contracts primarily based on how productive the private sector is. So the focus and balance should always emphasize the private sector and its lead role.

6. The government plays a facilitating role in the economy.

Although we focus on the private sector we also understand the important role that the government plays in our lives. MR is NOT an anti-government view of the world, but instead focuses on describe its current structure and role by understanding how it exists and how it has historically operated in our lives.

Unlike many other approaches, we don’t design a government centric view of the world. You’ll notice that most other economic schools like the Keynesians, post-Keynesians and Monetarists all focus on the ways the government can implement policy. We understand that the government plays an important policy role, but also like to emphasize that the government is primarily a facilitating agent in the monetary system. If we think of the monetary system as a soccer field we might say that the private sector includes most of the players trying to score goals while the governments serves a role like a referee. They determine laws, help support stability and integrity of the game, regulate the players and can have an enormous influence on the outcome of the game. Government is an extremely powerful tool that can be leveraged by the private sector to help generate growth and sustain stable growth. But it must be understood and harnessed correctly.

7. The MR Law.

A big part of understanding the money system is about understanding living standards. Most economists focus their policy ideas on full employment and price stability, but there is no guarantee that full employment and price stability are consistent with improving living standards. You could easily determine full employment and price stability through a command economy approach where the government simply implements price controls and hires all the unemployed. Of course, there’s no guarantee that would lead to improved living standards. Therefore, we focus on the component of living standards that is consistent across almost all of human life – time. The MR Law states:

“We generate improving living standards through the efficient use of resources resulting in the optimization of time”

This is not to imply that price stability and full employment are not important, but when one considers the monetary system we must consider the broader scope of all the factors that can impact overall living standards. The MR Law helps bring a concise understanding to the role of output with respects to overall living standards.

8. No two monetary systems are exactly the same.

MR treats specific economic environments and monetary systems as their own unique situations. You won’t find vague generalizations in MR implying that what’s true in one monetary system MUST be true in another monetary system. This again highlights the flexibility of the MR approach to economics. In order to understand the monetary system in a specific country or its economy you must start by understanding its specific institutional structures and environment.

Most of economics is a cookie cutter approach. Schools too often imply that what works in one economy will automatically work in another. A recent example is the Reinhart and Rogoff work on sovereign debt or the ECRI’s recession call. MRists said both of these concepts were incorrect because they were not applied with the appropriate specifics necessary to understand the environment and the potential economic outcomes.

For more info, please see the following:

To obtain a better understanding of Modern Monetary Realism we recommend the following reading (some of which is quite advanced):

1. Understanding The Modern Monetary System2. If You Learn Better by Reading in sections I Would Recommend Reading the Understanding The Modern Monetary System Paper in Parts:

- Part 1 – Introduction to Monetary Realism

- Part 2a – Understanding Modern Money

- Part 2b – What Gives Fiat Money Its “Value”?

- Part 3 – The Basic Institutional Structure of Fiat Monetary Systems

- Part 4 – The Lead Role of the Private Sector & “Inside Money”

- Part 5 – A Fiat System Where Everyone Still Thinks Government Has a Solvency Constraint

- Part 6 – Understanding Sectoral Balance Economics & S = I + (S-I)

3. The “Dismal Science” and Getting Back to Da Vinci’s Methodology

4. Understanding Inside & Outside Money

6. The Disaggregation of Credit

8. The Human Body, The Economy & The System of Flows

9. Understanding the Fed’s Primary Purpose

10. JKH on Saving, Investment and S=I+(S-I)

11. The Treasury and Central Bank: A Contingent Institutional Approach