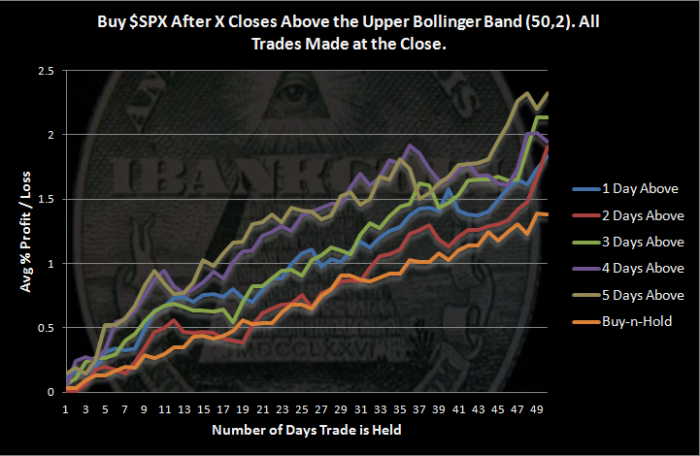

Today, despite closing slightly lower, the S&P 500 closed for the 5th day above its upper Bollinger Band (50,2). I have written previously how closes above the the upper band are typically bullish and may signal an abnormal market. This evening we’ll examine what happens after 5 consecutive closes above upper Bollinger Band.

The Rules:

- Buy $SPX at the close after it has made X consecutive closes above its upper Bollinger Band

- Sell Y days later

- $SPX history starts in 1928

- No commissions or slippage included

The Results:

The results are more bullish than I expected, and they improve as the number of closes above the upper band increases.

- This setup was not nearly as rare as I had imagined.

- There were 126 occurrences of 5 closes above the upper band with 110 trades held the full 50 days.

- After 5 closes above the upper band, $SPX has closed higher 50 days later 67.27% of the time.

- Buy-n-Hold results are calculated by cutting $SPX history into 50 day segments and then averaging the segments.

The number of samples should be sufficient to lend reliability to the results, but I am honestly a little disappointed because I suspected the results would be either extremely bullish or extremely bearish. I was looking for some drama and didn’t find it. Instead, this study just presents another reason to lean bullish.