Mark Dow had a great post the other day:

There is zero correlation between the Fed printing and the money supply. Deal with it.

He points out (emphasis mine):

From 1981 to 2006 total credit assets held by US financial institutions grew by $32.3 trillion (744%). How much do you think bank reserves at the Federal Reserve grew by over that same period? They fell by $6.5 billion.

As he says:

if you are an investor, trader or economist, understanding—and I mean really understanding, not just recycling things you overheard on a trading desk or recall from econ 101—the mechanics of monetary policy should be at the top of your checklist. With the US, Japan, the UK and maybe soon Europe all with their pedals to the monetary metal, more hinges on understanding this now than ever before.

And, as we saw this week, even many of the Titans of finance and economics have it wrong.

He’s obviously been reading Manmohan Singh and Peter Stella (S&S) over at Vox EU, who cite the very same numbers and add:

In fact, total commercial bank reserves at the Federal Reserve amounted to only $18.7 billion in 2006, less than the corresponding amount, in nominal terms, held by banks in 1951.

S&S also point out (Table 1 and Figure 1) what we’ve known for decades but many seem unwilling to admit: since WWII, reserve levels have had approximately zero correlation with inflation/price levels.

They continue:

This suggests either that there is something wrong with:

- the theory of money neutrality;

- the theory of the money multiplier; or

- how money is measured.

Or, I would say, all of the above. I’d actually replace all three: there is something wrong with the (nonexistent) definition of “money.” But that’s another post.

I’m going to go even farther than Dow and say: the Fed is not printing money. (It can do that, but the result is stuff you can hold in your hand.) That’s a confusing and actually incoherent misconception. The Fed is issuing new reserves and exchanging them for bonds. Those bonds are effectively retired from the stock of assets circulating in the financial system (though perhaps only temporarily), as if they’d expired.

Reserves are not “money” in any useful sense. Or, they’re only money (whatever you mean by that word) within the Federal Reserve system. We probably just shouldn’t use the word at all here. It’s only confusing.

The key to understanding (and to avoid misunderstanding) this is to think about the banking system, not individual banks. The dynamics are totally different, because individual banks can affect their reserve positions (though under various market and regulatory constraints). The banking system can’t.

Because: Reserves only exist (can only exist) in banks’ accounts at the Federal Reserve Banks (and only members — banks plus GSEs and other large institutions like the IMF — can have accounts there). The banking system can’t remove reserves from the system by transferring them to the nonbank sector in exchange for bonds, drill presses, or toothpaste futures.

One bank can transfer reserves to the account of another entity with a Fed account, in exchange for bonds or whatever, but total reserves are (obviously) unchanged. And that exchange has no direct effect outside the Fed system. (That exchange can, does, have second-order, indirect, portfolio-rebalancing effects on the rest of the market. More below.)

And here’s the key thing: the banking system can’t lend reserves to nonbank customers by somehow transferring them to those customers’ deposit accounts (thereby reducing total reserves). They can’t “lend down” total reserves. The banking system doesn’t “take money” out of total reserves, or reduce those reserves, to fund loans.

This is why it’s so crazy to worry about those reserves eventually “flooding out into the real sector” in the form of new loans (and resultant spending), with all the hyperinflationary hysteria attached to that notion. (Equally: those reserves are not “unused cash” on the “sidelines” that the banks are “sitting on.” See Cullen Roche on this.) Reserves can’t leave the system, whether in a flood or a trickle. The banking system will lend (creating new deposits in its customers’ accounts out of thin air), if bankers think it will be profitable. But increased lending if anything forces the Fed to increase total reserves. Viz:

A bank issues a billion dollars in new loans, creating a billion dollars in deposits in its customers’ accounts. The borrowers spend the money by transferring it to sellers’ banks. When all the transactions net out at night at the Fed, the issuing bank is short on reserves that need to be transferred to the sellers’ banks (or sees that it will be short). So it borrows reserves from other banks. If reserves are tight, this pushes up the interbank lending rate. The Fed doesn’t want the interbank rate to increase, because it thinks interest rates are where they should be to fulfill its mandates. So it issues new reserves and trades them for banks’ bonds (which it retires, at least for the time being).

Short story: more lending increases total reserves. Slightly longer story: more lending forces the Fed to increase total reserves (or abandon its mandates).

In the current situation, of course, there’s no shortage of reserves. Banks are holding extraordinary quantities in excess of regulatory requirements. So the Fed instead controls the interbank lending rate within a corridor by setting the rate it pays on reserves (bottom) and the rate at which it will lend to banks (top). Read it all here from the FRBNY.

So how can the banking system reduce total reserves? Only in one significant way: by buying bonds from the Fed. Send some reserves over, and the Fed retires those, (re)issuing bonds in exchange. But of course the Fed isn’t selling these days; it’s buying.

Fed asset moves just issue and retire reserves and bonds. And those moves are purely at the discretion of the Fed (the Fed “enforces” this on the system by buying/selling at prices that individual banks will take up). So the Fed is in complete control of the level of total reserves. Again: there is no way for the banking system to turn existing reserves into deposits in its customers’ accounts. It can’t “lend down” total reserves.

When the Fed issues and retires bonds and reserves, it’s not “printing money,” so it’s not playing some kind of simplistic MV=PY game. It’s adjusting the balance of the banking system’s portfolio (“forcing” it to change exchange bonds for reserves) — and by extension, affecting the mutually interacting portfolio preferences of all market players (via interest-rate/yield-curve effects, and also, more psychologically, by imparting the optimistic notion that there’s adult supervision — that this frat party won’t turn into Animal House).

In other words, it’s a much deeper game than many monetarists would have you believe. It’s especially deep because neither the Fed nor the markets understand it properly. Certainly the Fed governors have strong disagreements about how it works. (Arguably, nobody understands, very much including me. There are many interacting understandings and reaction functions out there, many based on complete misunderstandings of the system dynamics. But I think we’re getting closer these days, with the slow but increasingly widespread and accelerating dismissal of silly notions like the money multiplier.)

Dow explains these portfolio effects and reaction functions very nicely:

…why is the Fed doing QE in the first place?

By keeping rates low well out the yield curve and providing comfort that the Fed will be there to fight the risk of recession and deflation…we start feeling better about putting our getting our money back out of the mattress and putting it back to work.

…it is the indirect psychological effects from Fed support and the low cost of capital—not the popularly imagined injection of Fed liquidity into stock markets—that have gotten investors to mobilize their idle cash from money market accounts, increase margin, and take financial risk. It is our money, not the Fed’s, that’s driving this rally. Ironically, if we all understood monetary policy better, the Fed’s policies would be working far less well. Thank God for small favors.

…

The other, more mechanical, implication is that financial sector lending is neither nourished nor constrained by base money growth. … The main determinant of credit growth, therefore, really just boils down to risk appetite: whether banks and shadow banks want to lend and whether others want to borrow. Do they feel secure in their wealth and their jobs? Do they see others around them making money? Do they see other banks gaining market share?

These questions drive money growth more than the interest rate and base money. And the fact that it is less about the price of money and more about the mental state of borrowers and lenders is something many people have a hard time wrapping their heads around—in large part because of what Econ 101 misguidedly taught us about the primacy of price, incentives and rational behavior.

I certainly make no claim to a deep understanding of those portfolio effects. (If I had such an understanding, I’d be far richer than I am.) But I do have some thoughts I’d like to share.

• When the Fed issues reserves and retires bonds, it’s 1. reducing the net flow of newly-issued (treasury and GSE-mortgage) bonds into the market, or even causing a net reduction. And if the latter is true, it’s 2. reducing the total stock of bonds available for trading in the market.

Since the flow of new bonds is obviously much smaller than the outstanding stock, you would expect flow effects of Fed actions to have much greater immediate influence on bond markets than stock effects.But it’s unclear what their long-term effects might be. A steady flow reduction, on the other hand, will eventually have cumulative effects on the total stock — again with uncertain future effects.

Jake Tepper, quoted in this post by Cullen Roche (read the comments too), gives us this:

…The fed is going to purchase $85 billion of treasuries and mortgages a month. So over 500 billion in six months…. the net issuance [by Treasury] versus refunding is a little over 100. That means we have 400 billion, 400 billion that has to be made up.

Whatever “made up” means. But Tepper’s also ignoring the Fed’s other big buys: mortgage-backed securities issued by government-sponsored enterprises (Fannie, Freddie). I would like to see as long a time series as possible of the following:

Net MBS issuance by GSEs (issuance – retirement)

Plus:

Net Treasury issuance (new issues – retirement)

Minus:

Net Fed ”retirement”

Also have to include Fed repos, I think? But maybe trivial over the long term.

In other words: net Net NET consolidated flow of new bond issuance to the private sector by Treasury, Fed, and the GSE gods.

Then: that measure as a percent of GDP? Of total Treasury/GSE bonds outstanding? Total Credit Market Debt Outstanding (TCMDO)? Other measures to compare it to?

• Contrary to what you often hear, even today when reserves and bonds are paying nearly equivalent interest rates, they are not equivalent assets. Because: bonds have expiration dates, and variable market prices/interest rates. So bonds carry market/interest-rate risk and reward for their holders — the potential for cap gains and losses. Reserves don’t.

As you can read in this must-read 2009 paper from the Bank of International Settlements, reserves are the Final Settlement Medium. They’re what it comes down to every night when all the day’s bank transactions are consolidated, netted out, transferred, and resolved. A dollar of reserves is always worth a dollar. There’s no possibility of capital gains or losses on reserve holdings. Reserves are inexorably nominal. (Even more so than $100 bills, which are worth less relative to reserves if they’re sitting in a Columbian drug-dealer’s suitcase.)

So when the Fed gives the banks reserves and retires bonds, it’s taking on market risk/reward, replacing it with absolutely nonvolatile, risk/reward-free assets (at least in nominal terms). It’s removing leverage and volatility from the banking system. (MMTers might well ask why our government system requires the injection of that volatility in the first place, when the Treasury could simply be issuing “dollar bills” with no expiration dates or interest payments, instead of treasury bills. [Or consols.] But that’s an aside.)

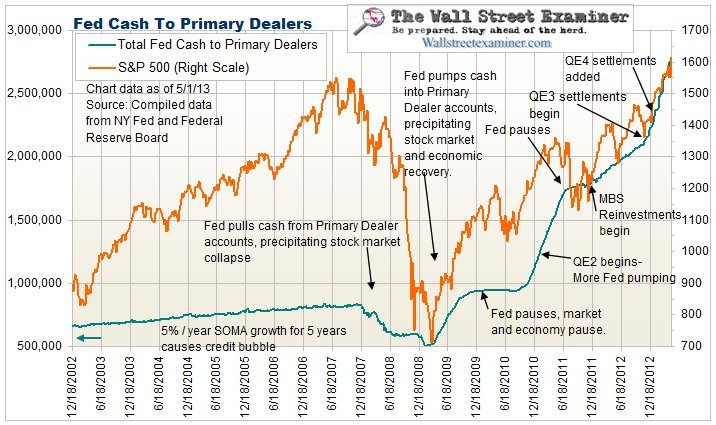

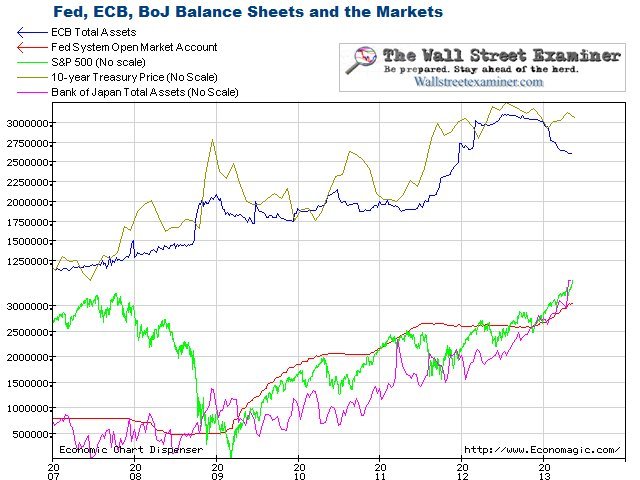

• I have to address notions like this one from Lee Adler, in a comment on Dow’s post:

The correlation between Fed and other central bank money printing with market behavior is clear and direct.

Yeah: while the Fed is on a bond-buying spree, it buoys bond prices and depresses yields. Especially when bond yields are historically low, market players shift their portfolio preferences from bonds to equities in a “reach for yield,” so equities go up too. (This presumably yields a wealth effect of [rich] people spending more — perhaps the only transmission mechanism to the real economy for Fed balance-sheet changes.)

This says exactly nothing about those balance-sheet moves as an impact on the stock of “money,” or inflation. It just says that while Fed asset purchases/sales are ongoing (and expected to continue), they will raise or lower the value of financial assets. It’s either orthagonal to Dow’s assertions, or in fact demonstrates exactly what he’s saying about psychological effects.

• It doesn’t make sense to say that the Fed is “monetizing” the debt (because reserves aren’t money). If you think in terms of consolidated Treasury/Fed net issuance/retirement of government bonds, it’s retiring debt — removing bonds from the market and absorbing them into the Treasury/Fed complex. The bonds still exist, of course, and the Treasury still pays interest — to the Fed, which kicks it right back to Treasury. But as far as the markets are concerned, those bonds are essentially dead and gone (at least for now).

It seems that the Fed could simply burn a whole pile of those bonds, no? It would have no effect on flows, aside from the rather pointless interest flows back and forth between Treasury and Fed. And it would only affect the stock of “dead” bonds — ones that have been retired into the Fed. (The notion’s been discussed by people as diverse as Ron Paul and Mervyn King – Paul with the misconception that this would be “declaring bankrupcy,” and King with the misapprehension that it would be “monetizing the debt.”)

• It’s not at all clear what the flow effect would once the had Fed stopped net-buying bonds, while Treasury and the GSEs continued issuing new bonds in excess of retirements. Financial asset prices might stay at their then current levels. Who knows.

• The question, of course, is whether the Fed will ever sell all those bonds back to the market (thereby reducing reserve holdings). The average maturity of the Fed’s bond holdings is >10 years, so they’ll naturally expire and disappear, but only slowly. We’ve entered a brave new monetary world, in which central banks exert themselves not just through reserve management/interbank lending rates, but through balance-sheet expansion and contraction. (See the two “schemes” in the BIS paper linked above.) I don’t know if anyone knows what to expect in that regard. The Fed’s certainly talking about reducing its bond purchases in the future, which will affect net bond flows into/from the market, but it’s not at all clear whether it will ever shrink its balance sheet to pre-crisis levels (in absolute terms or relative to other measures), thereby reducing banks’ reserve holdings to those earlier levels.

• The $10-trillion question: If the Fed did sell off all its bond holdings in an effort to get back those halcyon days when banks didn’t hold any excess reserves — so the Fed could control the interbank rate with small open-market operations — what in the hell would happen? Whether slowly or quickly, bond prices would fall as the sales continued, yields would rise (compared to a counterfactual in which the Fed wasn’t selling off their holdings). Markets would shift their portfolio preferences from stocks to bonds, so equity prices would fall along with bond prices. Disastre?

Again, I don’t think anybody knows.

Cross-posted at Asymptosis.