By Martin T., Macronomics

“Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.” – Winston Churchill

Figure 1 was extracted from Bank of America’s note “Banking on the Banks” from the 16th of May, clearly illustrates why the deleveraging has only just started in Europe.

“Meanwhile, Europe continues to lag the improvements seen in the US economy and markets. Quite simply, Europe’s economy struggles with too many banks, too much debt and too little growth. A long history of empire, trade, war and commerce means a long history of banking. The world’s first state-guaranteed bank was the Bank of Venice, founded in 1157, and the world’s oldest bank today is also Italian, Monte Paschi di Siena (founded 1472). In many European countries, bank assets dwarf the size of the local economy and are far in excess of other regions in the world.” – source Bank of America Merrill Lynch.

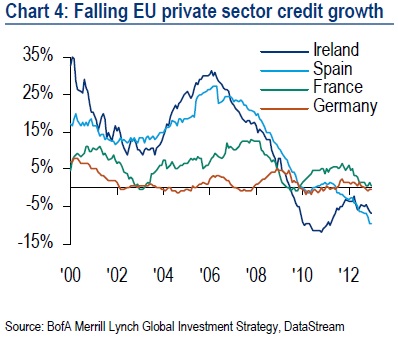

Why the credit crunch in European countries? Because this deleveraging was accelerated by the fateful decision taken by the European Banking Association of imposing European banks to reach a Core Tier 1 capital ratio of 9% by June 2012. It has not only broken the credit transmission mechanism to the real economy in Europe but caused a credit crunch as well (see figure 2).

(Figure 1 – bank assets as % of GDP)

(Figure 2 – EU private sector credit growth)