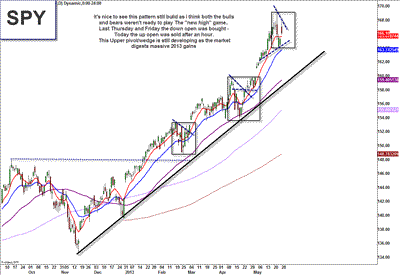

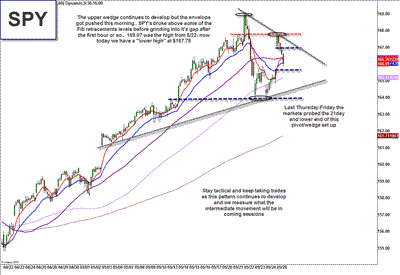

The upper pivot/wedge-type pattern continues to develop as the market digests massive 2013 gains. Last Thursday and Friday the down open was bought. Today the up open was sold after an hour. I don’t think either the bulls or bears were ready to play the “new highs” game again,

The last two times we got some type of pivot/wedge pattern in February and April, the market saw small corrections of 3% and 5%, respectively. This time we have gotten a 3.3% correction so far. While most sectors held their 21-day moving averages across the board, macro guys didn’t have much of a reason to make adjustments. For the intermediate-term and active traders, it’s been prudent to stay tactical and continue to take trades as this upper range continues to be in play. We will measure the intermediate-term composure in the coming sessions when there is more clarity.

Here is the daily chart:

Here is the 60-min chart:

Disclosure: Scott Redler is long SPY, BAC.