The Federal Reserve has ‘manufactured’ a relentless bull market for stocks while kicking the economy’s ‘bread and butter’ sector – manufacturing – into recession territory. Manufacturing activity is at a 42-month low, stocks at an all-time high. What gives?

On the first business day of each month the Institute for Supply Management (ISM) releases the Manufacturing ISM Report on Business, also known as ISM Manufacturing Index.

The forecast for May called for a reading of 53, but 49 is what we got. This is the worst ISM headline print since June 2009.

We hear the headline print report every month, but what does it (49 this month) mean anyway?

The Manufacturing ISM Report on Business is based on the responses of member purchasing and supply executives from around the country.

Survey responses reflect the monthly change, for each of the following indicators: New orders, backlog of orders, new export orders, imports, production, supplier deliveries, inventories, customers’ inventories, employment and prices.

The resulting single diffusion index number reflects the percentage of positive response from the segments that qualify for seasonal adjustments (new orders, production, employment, supplier deliveries). For May that number was 49. Any print below 50 indicates that the manufacturing economy is generally declining.

Stocks and Manufacturing Out of Sync

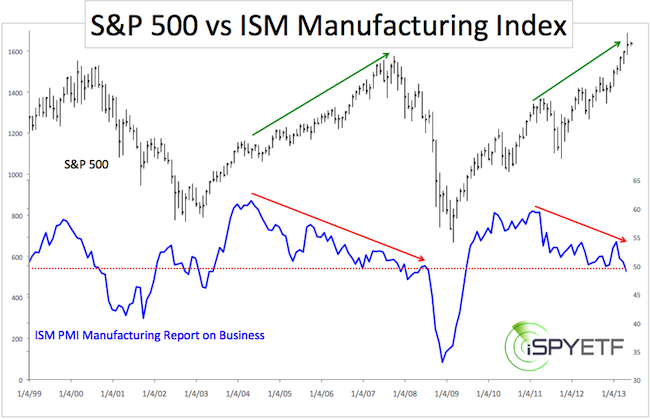

A declining manufacturing economy doesn’t automatically translate into lower stock prices. As the chart illustrates, a contracting manufacturing economy from 2004 – 2007 didn’t deter the S&P 500 from soaring to the 2007 high.

The same thing happened from 2011 – 2013. The S&P 500 (corresponding ETF: SPDR S&P 500 ETF – SPY) and all major market indexes (with exception of the Nasdaq) are now trading near all-time highs, the ISM manufacturing index at a 42-month low.

There’s one major difference between the 2004 – 2007 and 2011 – 2013 period:

Prior to 2007 the Federal Reserve didn’t spend trillions of dollars to prop up the economy.

I don’t use the ISM Manufacturing Index as a leading indicator for stocks. Based on Monday’s strong rally despite a weak ISM reading, the stock market cares as much (or little) about the manufacturing data as I do.

A Price to Pay … Eventually

A strong manufacturing sector is as vital to a healthy economy as a strong heart for the body. If the heart is weak, the body suffers … eventually.

If the manufacturing sector is weak, the economy suffers … eventually. When the economy suffers, the stock market declines … eventually.

The divergence between stocks and the ISM Manufacturing Sector was dissolved in 2007/08 when the S&P lost about half of its value.

The key question with all things QE is this: When will the Fed ‘manufactured’ bull market backfire? Answer: Eventually? Question: When is eventually?

It’s the mission of the Profit Radar Report to identify major turning points for the stock market and to quantify what exactly ‘eventually’ means.