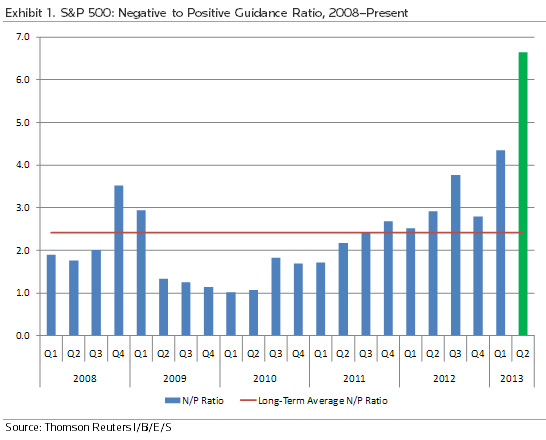

Second quarter earnings season officially starts in a few weeks and things are all set to get off to the usual “under promise” and “over deliver” environment that sets the mainstream media in a frenzy over the high level of earnings beats. This earnings season will be particularly easy to “beat” given that earnings guidance is coming in extremely weak. According to Thomson Reuters this is the weakest quarterly guidance since Q1 2001:

Second-quarter earnings guidance looks extremely weak, with 93 of the 116 preannoucements negative. The healthcare sector has the most negative N/P ratio, and the consumer discretionary sector is also very negative.

With the first-quarter earnings season mostly complete, investors are anticipating second-quarter earnings results. First-quarter earnings growth is currently at 5.0%, up from the 1.5% that analysts were predicting at the beginning of earnings season. Second-quarter earnings expectations are similarly low, with 2.8% growth currently forecast. This is down from the 6.1% estimate from the beginning of April. While some of the decline is likely due to the normal seasonal estimate revision pattern, company-issued guidance has not helped.

Of the 116 second-quarter earnings preannouncements given by S&P 500 companies, 93 of them have been negative, while only 14 have been positive. The resulting 6.6 negative to positive guidance ratio is the most negative since the first quarter of 2001. As seen below in Exhibit 1, the recent trend has been toward more negative preannouncements as earnings growth has slowed. While there is still more guidance to come as the second-quarter earnings season approaches, the N/P ratio as it stands is significantly more negative at 6.6 than for the first quarter, which itself was the most negative since Q3 2001, at 4.3. Over the long term, there have been 2.4 negative preannouncements for each positive one.