The Federal Reserve has become somewhat of a financial super hero. Sure, it’s not acting in everyone’s best interest (unless you’re a big bank), but it has the air of invincibility. But invincibility is a fickle thing and gold is showing Bernanke how fast it can be lost.

When looking at various markets, I often search for investment themes or trades that seem too obvious. Why? If it’s too obvious, it’s obviously wrong.

One of the obvious beliefs today is the power of the Fed to control markets. It has become a foregone conclusion that Fed stimulus lifts stocks. The only concern is when the Federal Reserve will start withdrawing the punchbowl.

Two recent events show that central banks are not the all-powerful and infallible entities they’re cracked up to be:

1) Despite Japan’s historic stimulus, the Nikkei dropped 23% in eleven days. That’s not what “Abenomics” was supposed to look like.

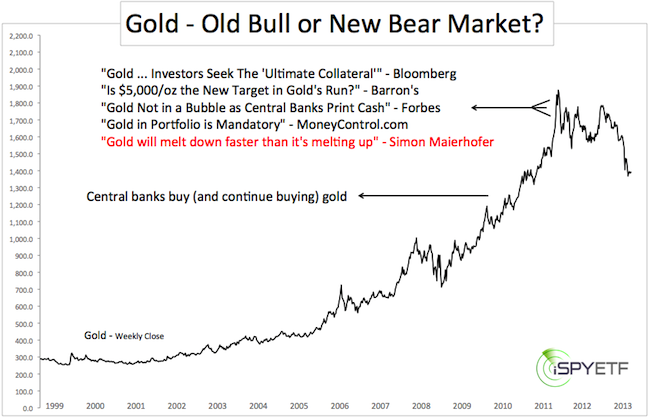

2) Gold prices plummeted over 30% (including the worst meltdown in decades) at a time when central banks were buying the yellow metal at record pace.

Not as an immediate forecast, but as a general investment lesson we should review the sentiment leading up to gold’s all-time high. I will use media headlines to chronicle the ‘great gold rush’ of 2011.

ABC News: Gold Rush also A Boon for the Refinery Biz – August 10

Bloomberg: Gold Exceeds $1,800 as Investors Seek to Hold the ‘Ultimate Collateral’ – August 10

Forbes: Jim Rogers Says Gold Going Higher – August 10

Forbes: Gold at $1,870 is Being Seen as a Haven – August 22

TheStreet.com: Wait to Buy Gold at a Pull Back – August 22

Beacon Equity Research: Gold Price Poised to go Parabolic – August 22

MoneyControl.com: Gold in Portfolio is Mandatory – August 22

Barron’s: Is $5,000/ounce the New Target in Gold’s Run? – August 22

Chicago Times: The Gold Rush is On Again – August 26

BusinessWeek: Gold Not in a Bubble as Central Banks Print Cash, Faber – September 6

Reuters: Hard Hit Gold Bulls Not Yet Out For The Count – September 26

On August 26, 2011, the SPDR Gold ETF (GLD) becomes largest ETF with $77.9 billion in assets.

The reasons for gold to rally and continue rallying were seemingly endless:

- Gold is a protection against inflation

- Somehow gold is also viewed as protection against deflation

- Gold is a safe haven during stock market meltdowns

- Somehow gold also rallies when stocks rally

- Central banks are buying gold, so should mom and pop

- Gold is the only real collateral in a QE world

Despite all the bullish rationale for higher gold prices, there were even more compelling reasons to avoid the hype. Throughout August and September 2011, I warned subscribers multiple times about the eventual pain ahead:

August 10, 2011: “Gold is extremely stretched and trading significantly above its upper Bollinger Band. Any break in the armor could lead to a scary and unexpected decline.”

August 21, 2011: “I don’t know how much higher gold will spike, but I’m pretty sure it will ‘melt down’ faster than its melting up. Resistance is at 1,915 – 1,975.”

August 24, 2011: “Even though gold is the logical fear trade, price action is also dictated by liquidity. At some point investors will have to sell holdings to pay off debt or answer margin calls. Commonly the most profitable asset is sold first. Gold has been the best performing asset for a decade and a liquidity crunch could produce sellers en masse.”

The moral of the story is that even deeply entrenched convictions are eventually overthrown by ‘unexpected’ events that should have been expected simply because they were so unexpected.

PS: Remember Apple.