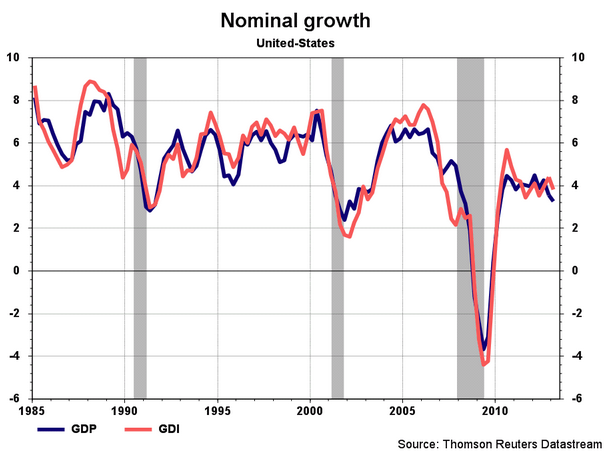

Studies show that GDI is a better measure of GDP than GDP itself. In most cases the gap between the two is relatively small. But over the past 6 months a huge gap has opened up. (It’s useful to look at 6 month figures as the 2013:1 data are hugely distorted by big 2012 year-end bonuses to beat the Obama–GOP tax increases.)

Over the past 6 months NGDP has grown at an annual rate of 2.19%, whereas NGDI (which measures exactly the same thing!) has grown at a rate of 5.06%. I suspect the truth is somewhere in between but closer to the 5.06%. Here’s why:

1. The labor market has been fairly strong over the last 6 months, with job creation accelerating from the middle of last year.

2. All sorts of asset markets (stocks, house prices, bonds, etc) suggest stronger US growth.

3. US consumer confidence has been strengthening.

4. I am not aware of any data confirming an ultra-low 2.19% NGDP growth rate. At that rate there shouldn’t have been any jobs created over the past 6 months.

BTW, if you look at growth by components (which is not a useful exercise) the huge negative over the last 6 months has been military spending. Yay!!

PS. Just to anticipate some comments: I am not suggesting we focus on NGDI instead of NGDP, NGDI is NGDP.

PPS. Yes, I know, the NGDI figures do provide a bit of support for Bernanke. But he still needs to do more.

PPPS. Thomas Raffinot sent me a graph showing that NGDP and NGDI do tend to track each other pretty well over the longer term. (Looks like 4 quarter MA)