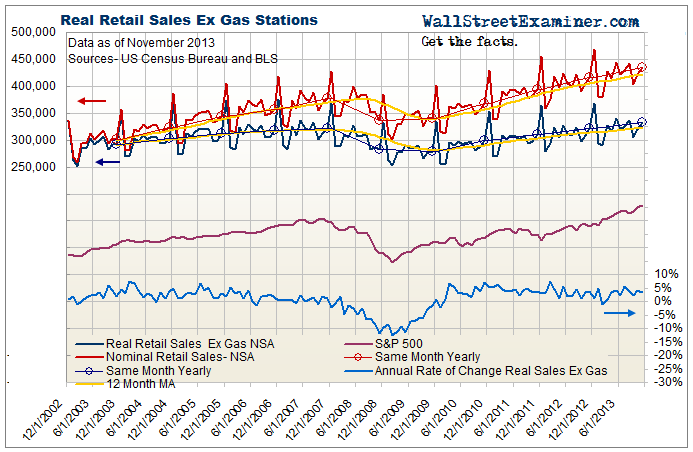

Retail sales were sharply higher in July, contrary to media reports featuring the headline seasonally adjusted data. That data was misleading, due to the vagaries of seasonal adjustment methodology. We’ve had the discussion of the problems with seasonally adjusted data many times. The focus of this post is on the actual data, adjusted for CPI inflation, or in other words the actual unit volume of retail sales (see Note at end). On the basis of actual sales volume, this July was much stronger than July 2012, and was the strongest July gain since 2004.

According to the Commerce Department’s Advance Retail Sales Report , “advance estimates of U.S. retail and food services sales for July, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $424.5 billion, an increase of 0.2 percent (±0.5%)* from the previous month, and 5.4 percent (±0.7%) above July 2012. Total sales for the May through July 2013 period were up 5.2 percent (±0.5%) from the same period a year ago. The May to June 2013 percent change was revised from +0.4 percent (±0.5%)* to +0.6 percent (±0.2%).”

The seasonal adjustment factor played havoc with the year to year comparison. On an actual, not seasonally adjusted basis, the year to year gain was 6.76%. The seasonally adjusted data understated the actual gain by 1.4%. In June, the seasonally adjusted data overstated the year to year gain by 2.0%. These mistakes momentarily mislead the market as it reacts to inaccurate data.

The median forecast of economists in mainstream media surveys was for sales to be up 0.2% month to month on a seasonally adjusted basis. For a change, the economists’ consensus was a good guess this month. More importantly however, while they guessed what the headline number would be, the annualized gain of 2.5% grossly understated the actual year to year gain giving the market the misimpression that sales were somewhat soft when they were actually very strong.

The year to year change in real retail sales, ex gasoline sales and adjusted for inflation in July was a gain of 5.8% which was much stronger than the 2.8% in June. I was expecting July to be a little soft based on the weakening of Federal Withholding Tax collections in July. I have no explanation for the strength, so I’ll make like an economist and credit the weather.

On a month to month basis, historically July is a mixed month, sometimes up, sometimes down. This year, there was a gain of 1.3% from the June reading. The average change for the 10 year period from 2003 to 2012 was near zero, and last year saw a drop of 1.6%. This year was the best July since 2004. Perhaps August will be payback time.

Rising gas prices are a de facto tax on consumers that can cause reduced consumption of other goods and services. A rise in gas prices cuts consumers’ ability to spend more on other things. Conversely, a fall in gas prices is like a tax cut that puts a little cash back in consumers’ pockets. Gasoline prices rose about 13 cents a gallon through July according to the US Energy Information Administration. Theoretically this factor should have been a drag on retail sales ex gas, but it apparently had no impact. Perhaps consumers cut back on their gasoline consumption instead of other purchases.

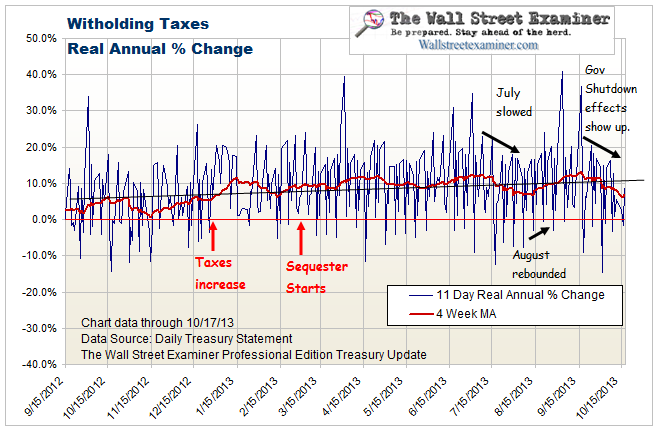

Real Federal Withholding Taxes

Consumers were hit with increased Federal payroll and income taxes in January. Sequestration cuts have taken effect gradually since March. Those factors were supposed to depress retail sales, but this clearly has not shown up in this data (or anywhere else). Gains in withholding tax collections greater than the increase in tax rates suggested that the increase in the number of jobs had helped to sustain slow growth in retail spending. But tax collections slowed in July, making this retail sales gain somewhat mysterious. I looked at credit card and auto loan debt in July and they were little changed for the month.

The Fed and BoJ’s QE campaigns continue to risk stimulating rising gasoline prices. We’ve seen some lift in crude over the past couple of months, and the metals have also perked up in recent weeks.

Till now, the central banks have been skillful at jawboning speculators away from commodities purchases. The Fed has been threatening an end to QE since January. Lately they’ve been raising the verbal pressure. But maybe their luck is running out. Even after the initial taper there will still be plenty of excess liquidity around, with the Fed and BoJ still pumping billions into the market each month. The bulls’ sanguinity about conventional CPI inflation could be a hint that their best case scenario has reached its end.

US population is growing at slightly less than 1%. A retail sales real growth rate of several times that is remarkable. The wealthy and tourists are apparently helping to boost sales. The growth rate had trended down even as the Fed has engaged in more money printing. That downtrend was broken in July signaling that the US economy may be heating up. That will encourage the Fed to taper QE.

Does any of this matter for stock prices? Not directly, no. In the 2003-07 bull market stocks only turned down when the Fed stopped growing its balance sheet in mid 2007. This was after retail sales growth has been slowing for several years. The real driver of the market is cash flow from the Fed to the dealers who run the games, and the Fed only pulled the punchbowl in the past when it saw reason to be worried about conventional inflation.

Current data isn’t sufficient to get them to do that, but the Fed has seen that QE is ineffective in boosting jobs, while very effective in fomenting asset bubbles in stocks and housing. If the Fed has learned nothing else, it has learned that bubbles lead to crashes. That is what is probably driving the taper talk. Tapering QE would not trigger a bear market, but it should slow the uptrend, and possibly add to its choppiness.

Note: When analyzing retail sales, I’m interested in the actual volume of sales, not the inflation skewed dollar total. To get to the kernel of the matter, I look at the real, not seasonally finagled retail sales, adjusted for top line CPI inflation (not core which normally understates the actual). Then I back out gasoline sales, which are a substantial portion of total retail sales. Gasoline sales distort total retail sales higher when gas prices are rising, when they actually act like a tax on disposable income and reduce non-gasoline sales. On the other hand, when gas prices fall, the top line total retail sales figure will understate any gains in the volume of sales. Gasoline sales typically account for around 12% of total retail sales. By subtracting gas sales and adjusting for inflation, the resulting number represents the actual volume of retail sales.

This analysis uses not seasonally adjusted (NSA) data due to the inaccuracy and potentially misleading nature of seasonally adjusted data .

Track the data that does matter to the market and stay up to date with the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Wall Street Examiner Professional Edition. Try it risk free for 30 days. Don’t miss another day. Get the research and analysis you need to understand these critical forces. Be prepared. Stay ahead of the herd. Click this link and begin your risk free trial NOW!

Read:

Claims Data Rings No Bell to Trigger Central Banker Pavlovian Response

As Wages and Hours Stagnate and Lag Inflation, Fed Declares Victory and Goes Home

48% of Americans Hold Full Time Jobs, Same As In 1982 Recession

In Last 12 Months Fed SOMA Up 27%, Housing Prices Up 13.5%, Stock Market Up 22%, Jobs Up 1.7%,

Rick Santelli Features My Cash to Primary Dealer Chart on CNBC – Video

Claims Data Strengthens Suggesting Economy On Same Old Track With Same Implications For Stocks

Follow my comments on the markets and economy in real time @Lee_Adler on Twitter!