Dogs that bark don’t bite. Like a barking dog, the Hindenburg Omen’s market crash signals have been notoriously off. However, there is one statistical signal that may restore the bruised signal’s reputation and credibility of the latest signal.

The Hindenburg Omen had its glory days (2007), but more recently it’s become famous for notorious misfires.

Despite many hyped up Omen sightings in recent years, the Dow Jones (DJI: ^DJI) and S&P 500 (SNP: ^GSPC) are trading near all-time highs while the VIX is hovering near historic lows.

But (and this could turn out to be a big but), I stumbled upon a statistical nuance that may restore the bruised indicator’s image.

Hindenburg Omen Crash Course

Here’s a quick nutshell definition in case you’re not familiar with the Hindenburg Omen (HO).

The HO is a combination of technical factors that attempt to measure the health of stocks traded on the New York Stock Exchange (NYSE: ^NYA). The Omen triggers if a particular number of NYSE-traded issues hit new highs and new lows.

The Omen’s ‘claim to fame’ is its ability to signal a stock market crash (or at least the increased probability of a crash). Over the decades there’ve been some amazing hits and misses.

Hindenburg Omen is Back

The latest rally leg has brought a whole cluster of Omens in its wake. Omen clusters (not just scattered signals) appear to be the key to the signal’s reliability (or lack thereof).

An Omen here or there may get the media’s attention, but it doesn’t consistently phase stocks. However – this observation may restore the Omen’s credibility – a cluster of a dozen or so Omens in a 50-day period, tends to be bearish for stocks.

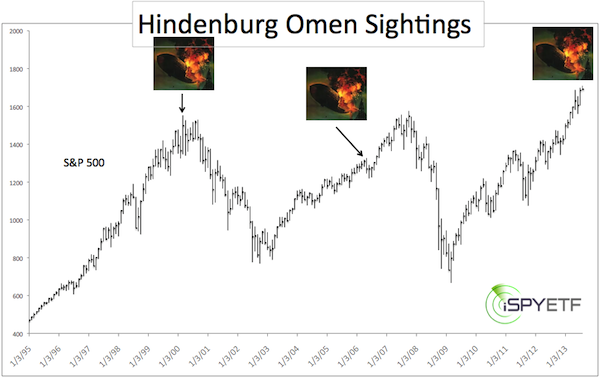

We are seeing such an Omen cluster right now. The chart below plots the S&P 500 (NYSEArca: SPY) against the most recent ‘Dozen-Omen-Cluster’ sightings. They occurred in January/February 2000, March/April 2006 and July/August 2013.

The chart looks somewhat ominous, but does this mean that stocks will crash and burn tomorrow?

No, even when correct, the effect of the Omen doesn’t have to be instantaneous.

Nevertheless, the Omen is yet another indicator that cautions of a looming market top.

With stocks near all-time highs and momentum slowing, now is certainly the time to keep our eyes peeled for unwanted bearish surprises. In fact, a drop below key support will likely trigger a wave of selling and lower prices.

Where is key support? Must hold support is shown in this article: The S&P 500 is Revealing Must Hold Support.