Risk conscious gold investors and store of wealth buyers continue to focus on ‘return of capital’ rather than ‘return on capital’ and are therefore switching from the more high risk, in terms of counter party risk, ETFs to the safety of allocated bullion.

Today’s AM fix was USD 1,365.75, EUR 1,020.28 and GBP 871.29 per ounce.

Yesterday’s AM fix was USD 1,375.25, EUR 1,031.39 and GBP 878.47 per ounce.

Gold fell $6.40 or 0.47% yesterday, closing at $1,366.60/oz. Silver edged down $0.02 or nearly 0.09%, closing at $23.16. Platinum fell $14.52 or 1% to $1,504.49/oz, while palladium was down $10.75 or 1.4% to $749.75/oz.

Gold in USD, 30 Days – (Bloomberg)

Gold and silver both pulled back yesterday on profit taking and as stop loss limits triggered selling. There were jitters among some market participants as President Obama met the heads of the CFTC, SEC, CFPB, FHFA, NCUA, FDIC, the Comptroller of the Currency and the Federal Reserve.

U.S. Mint data showed a drop in sales of American Eagle gold bullion coins in August to 3,000 ounces as of yesterday. This is down from the record levels seen in recent months and below the monthly average of nearly 100,000 ounces for the 7 months of 2013.

Liquidated ETF gold holdings are being shipped from the U.K to Switzerland for refining into smaller one kilogramme gold bars, Australian bank Macquarie wrote in a note yesterday. These were then sent to Asia and bought by Asian investors. The note confirmed, what has been known anecdotally for some weeks.

This is contributing to the increased tightness in the physical market as large London Good Delivery bars (400 oz) are air freighted to Switzerland for refining into smaller kilo bars (32.15 ounces) for the voracious Asian market.

There is also an increasing preference for allocated storage in Switzerland by high net worths and family offices. Switzerland still has much of the world’s gold refining capacity and remains a favourite destination of investors and savers concerned about sovereign risk – including sovereign risk in the EU, U.K. and U.S.

Most of the gold ETFs holdings were held in London vaults, and U.K. gold ‘exports’ to Switzerland exploded from 92 tonnes in all of 2012 to a whopping 240 tonnes in May this year alone and a very large 797 tonnes in the first six months of 2013.

Gold Prices/ Fixes/ Rates / Volumes – (Bloomberg)

It is worth noting that the 797 tonnes, while a large number in tonnage terms, for the very small physical gold market, is only worth $37 billion in dollars terms which is less than half the $85 billion in quantitative easing or money creation and debt monetisation that the Federal Reserve does every single month.

The 797 tonnes of gold “exported” from the U.K. to Switzerland is nearly 30% of total annual gold mining supply.

Rather than “exported,” the flow of gold to Switzerland is more a form of capital flight as, the safest form of money in the world, gold, flows out of the U.K. and into strong, store of wealth, hands in Asia and storing bullion in Switzerland.

Throughout history, capital, assets, currencies and gold have flowed to the individuals, governments and countries that have treated it most kindly.

Gold ETP sales were 681.4 tonnes for all of this year so far through August 19, data compiled by Bloomberg show and these sales have been greatly surpassed by physical coin and bar demand in China and India alone.

Demand from India and China in Q2 alone was 310 tonnes and 276 tonnes or 586 tonnes combined. There is also the not insignificant and increasing coin and bar demand from the rest of Asia, the Middle East, South America, Europe, the U.K. and the U.S.

Investors appear to be switching from ETFs to allocated accounts, which are often held in Switzerland, Bloomberg noted. GoldCore have direct experience of this as we have seen flows from clients liquidating ETFs in the U.K., the U.S. and even Switzerland into the safety of allocated bullion accounts in Zurich and Hong Kong.

“Bail-ins” and the risk of being an unsecured creditor of investment and savings providers is one of the reasons for the flight to allocated gold.

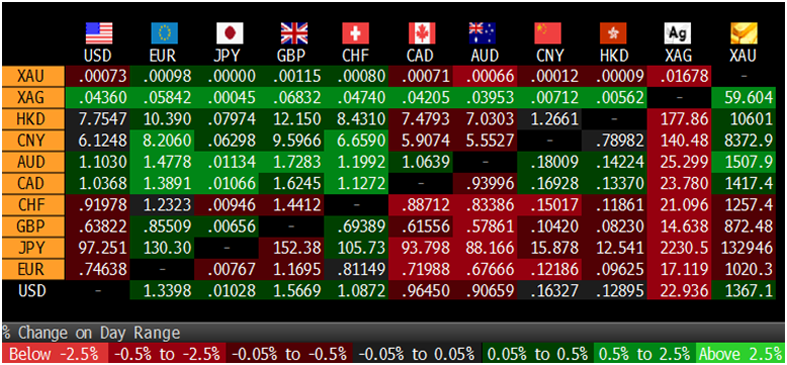

Cross Currency Table, 1200 GMT – (Bloomberg)

Prudent and risk conscious gold investors and store of wealth buyers continue to focus on ‘return of capital’ rather than ‘return on capital’ and are therefore switching from the more high risk, in terms of counter party risk, ETFs to the safety of allocated bullion.

Store of wealth bullion buyers will use weakness to accumulate physical again due to the strong fundamentals.