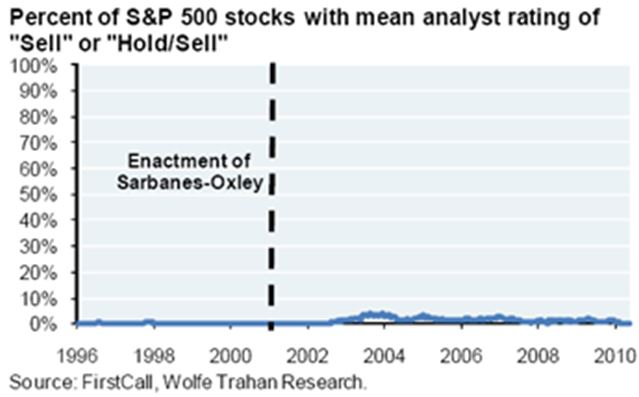

If there was ever an argument that you should rely on independent newsletters for guidance about financial markets, such as The Diary of a Mad Hedge Fund Trader, and not traditional brokerage houses, take a look at the chart below from JP Morgan.

It shows that despite all of the reforms passed after the dotcom crash, less than 3% of broker reports come with “sell” or “hold/sell” ratings. If an investment bank’s analyst dislikes a stock, they will simply drop coverage or lose the file behind the radiator, rather than lose potentially lucrative business or risk potential law suits.

If individual investors are going to have a prayer of keeping their heads above water in the “new normal,” it will only be through studying truly unbiased sources and drawing their own conclusions. Despite many pretenders, there are no real “gurus” out there, no matter how hard you look.

If this reality is too hard to face, get used to the 0.01% you are earning in your money market fund, or the 0.5% you get with six month Treasury bills. These ultra-low short rates are going to be around for a while.