What caused the recession of 1960?

Here is an answer given at timerime.com.

“The recession of 1960-1961 was mainly due to the high inflation, high unemployment rates, and a bad gross national product rating. This recession lasted for 10 months and resulted in the second longest economic expansion in U.S. history. During Kennedy’s 1960 presidential campaign he sought to accelerate economic growth by increasing government spending and cutting taxes, and increased funds for education. The GDP of the United States during this period fell 1.6%, and the unemployment rate hit its peak at 7.1%. Kennedy knew that the economy was in big trouble so he sent congress an economic growth and recovery package consisting of twelve measures. They were an increase in the minimum wage from .00 to .25 per hour, an extension of the minimum wage to a greater pool of workers, an increase in unemployment compensation with an increased aid to children of unemployed workers, an increase in social security benefits to a larger pool of people, emergency relief for feed grain farmers, area redevelopment, vocational training for displaced workers, and federal funding for home building and slum eradication. JFK ended the recession by stimulating the economy ten days after taking office.”

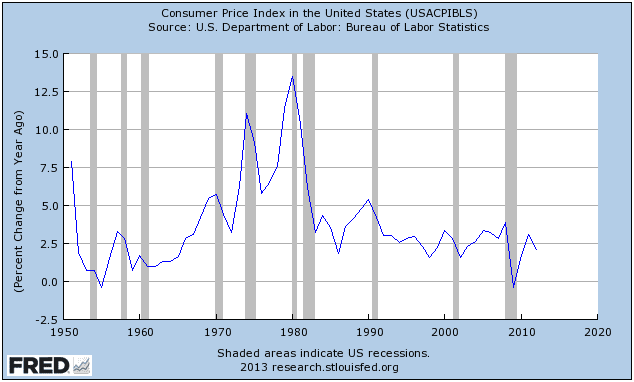

Did inflation cause the recession of 1960?

There does not appear to be much inflation around 1960.

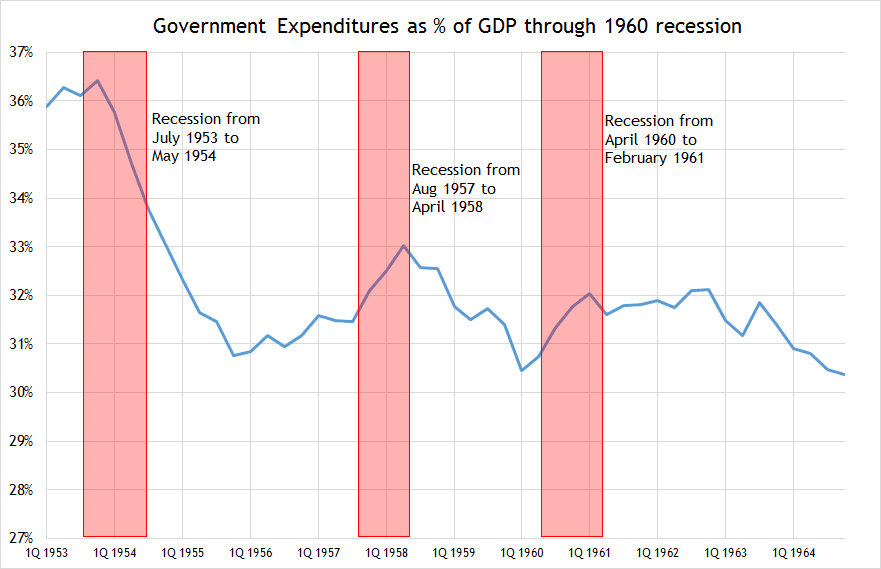

How about the stimulus package from Kennedy? Did it end the recession? How much did government expenditures change?

Link to graph #2. (source BEA NIPA tables)

It does not appear as though the economic growth and recovery package by Kennedy was a big change from previous government spending.

So what caused the 1960 recession?

Investopedia said…

“This recession was also known as the “rolling adjustment” for many major U.S. industries, including the automotive industry. Americans shifted to buying compact and often foreign-made cars and industry drew down inventories. Gross national product (GNP) and product demand declined.”

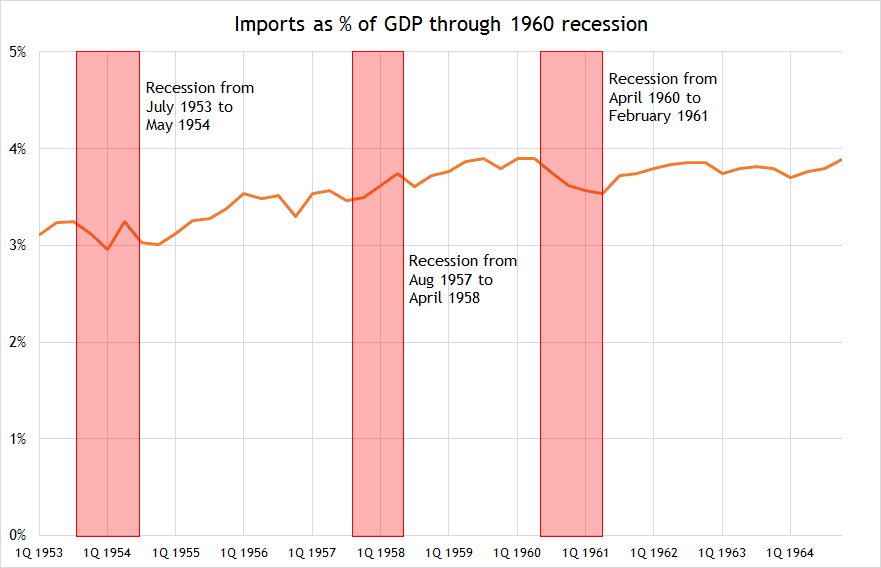

So did imports increase around 1960 as a % of GDP?

OK… Imports were rising some from 1955 to 1960 and then stabilized after the 1960 recession. Does the stabilization of imports contradict the economic fact that international trade makes everyone better off?

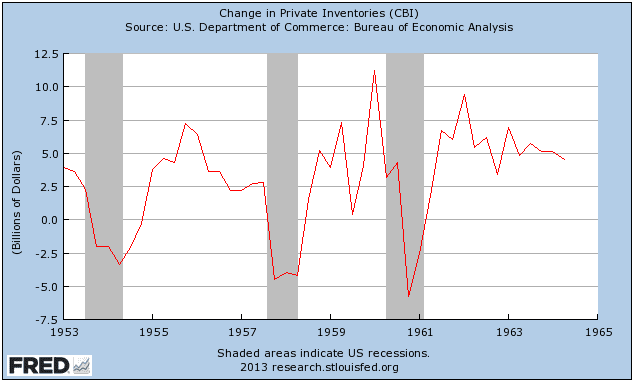

How about inventories?

Inventories were still increasing before the recession.

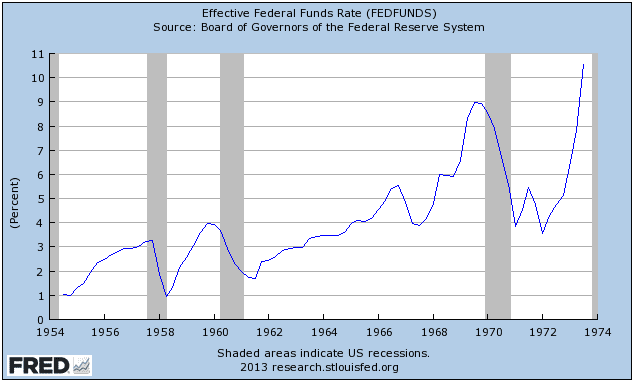

How about monetary policy? Did the Fed tighten before the 1960 recession?

OK… now we see something. The Fed tightened before the 1958 and 1960 recessions. Why did the Fed tighten before 1960? Well, Christina Romer and David Romer tell us in their 2002 paper, “A Rehabilitation of Monetary Policy in the 1950’s“.

“Finally, it is not easy to predict the consequences of a decline in the labor share, and the corresponding increase in the capital share, of a sector of the economy as opposed to the labor share of the overall economy. Nevertheless, a decline in the share from almost 60% to less than 30% is significant and may have important consequences. An increase in the share of profits probably leads to an increase in investment early on. Simultaneously, a decrease in the share of labor over an extended period of time induces a decline in consumption or prevents consumption from increasing, even if the economy is growing. Sooner or later there is a mismatch between supply and demand as the increase in capacity caused by the increase in investment will not be matched by an increase in consumption demand. This is a problem of lack of demand, an under-consumption crisis. Capacity utilization will have to decline and along with it will come a decline in production, employment, investment, and demand.”

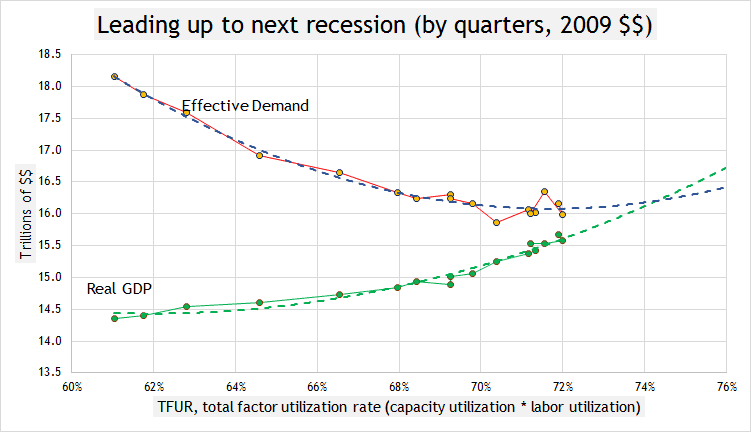

Economists do not think this describes the United States… yet. But it is this dynamic of low labor share that will bring about a limit on “production, employment, investment, and demand” before economists expect. And the Federal Reserve says not one word about labor share. They are going to be blind-sided on this one. Psychologically, economists don’t have a comprehensive contextual perception of the effect of low labor share, as Federal Reserve members did not have a comprehensive contextual perception of inflation back in the 1950′s.

Here is the updated graph of the effective demand limit with the new numbers for real GDP (2009 dollars). We are close…