Friday’s monthly nonfarm payrolls data from the BLS should easily beat consensus expectations. Here’s why.

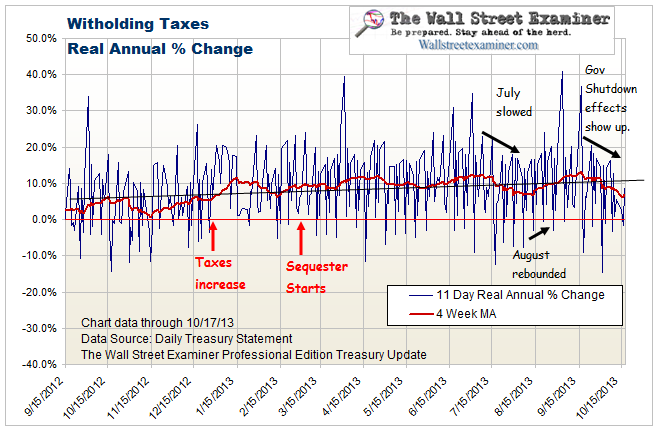

Withholding taxes, which constitute the bulk of the Federal government’s revenues, slowed in July to the point that they broke a year long uptrend, but August has seen a recovery back to trend. The drop in July suggested that the lagging releases of July economic data would disappoint, and that indeed happened. The pundits concluded that the economy is weakening and lowered their estimates for August. The problem is that they are looking in the rear view mirror rather than at current conditions. The economy perked up in August.

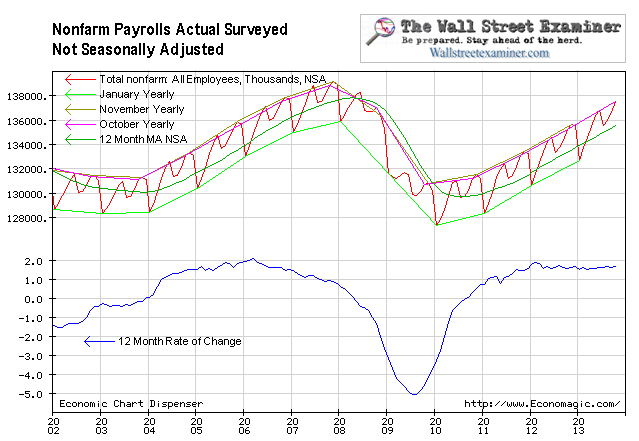

The current consensus estimate is for a gain of 177,000 in the seasonally adjusted headline number. That’s a month to month figure based on the BLS guesstimate of what the jobs data would be on an idealized basis assuming there were no seasonal variance.

The BLS will revise this number 7 times over the next 5 years as it recalculates the seasonal adjustment based on each new monthly data point as it comes it. The final seasonally adjusted figure is based on a 10 year average including the past 5 years and the next 5. Since the future data doesn’t exist yet the current seasonally adjusted estimate is little more than a swag in the first go round. The BLS says that the margin of sampling error is + or – 90,000.

The consensus view of +177,000 would represent a year to year gain of +1.7%. That’s exactly the trend of actual jobs growth over the past 21 months. The trend has been very stable. Apparently most economists are simply extrapolating that trend. The consensus guess of +177,000 is reasonable on that basis.

I take a guess at whether the headline number will beat or miss the consensus based on the real time data on withholding taxes collected daily by the Treasury. I report this data in two charts each week in the Professional Edition.

The BLS data is based on a survey of employers as of the 12th of the month. Since withholding taxes are collected and paid to the government a week or two following the employment period, the collections for the two weeks after the week of the 12th of the month would be the relevant period. That data for August showed a year to year gain of 14.5%.

That number includes the impact of the tax increase that went into effect at the beginning of the year, as well as any wage increases and increases in variable compensation such as commissions and bonuses. I’ve previously estimated the effect of the tax increase to be 7% based on a simple before and after analysis. Then I adjust for the recent BLS data on compensation inflation which has been near 2%.

That leaves a gain of 5% year over year, which is huge. Some of that is probably due to increased commission income and other variable income, but it’s still a mind boggling number which suggests a much greater year over year gain in payrolls than the implied consensus estimate of +1.7%. It means that the consensus guesstimate of a gain of 177,000 jobs in August is probably too low.

Given the fictitious nature of the seasonally adjusted number, guessing first release for any month is really a crapshoot. The consensus guesses are virtually always within the statistical margin of error, but traders seem to always be expecting a bullseye, which if it happens, would be a strictly random event.

So the market usually reacts one way or another to a non statistically significant miss well within the margin of error. It’s stupid, but the market doesn’t have a brain, contrary to what many pundits would have you believe. Market reactions to news today are mostly just a bunch of trading programs trying to steal nano-decimals from each other. Garbage.

July’s number will probably be revised down because the withholding data for July suggested a much weaker number for that month than the gain that was reported. What the first release for August holds is anybody’s guess, and the consensus guesstimate is as good as any. But based on the extremely strong withholding data for August, my money would have to be on a “beat.”

In terms of trading, a beat should be bearish. It would support the idea that the Fed will taper QE in September, which would reduce its support for stock prices. Also, economists would likely raise their estimates of economic growth. That, combined with the expectation of less QE would be really bearish for the Treasury market, where yields could break out above 3%.

Friday could be one of those days where good economic news is bad news for the markets.

Stay up to date with the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, along with regular updates of the US housing market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Try it risk free for 30 days. Don’t miss another day. Get the research and analysis you need to understand these critical forces. Be prepared. Stay ahead of the herd. Click this link and begin your risk free trial NOW! [I cover the technical side of the market in the Professional Edition Daily Market Updates.]

Read

Here’s The Evidence That It Wasn’t QE That Drove Down Long Term Rates – Video

Here’s Why First Time Claims Support Fed Tapering and A Hostile Environment For Stocks

The US Economy- Does Money Grow On Trees- Video – CNBC Africa

Pending Home Sales Up 8.6% Disprove The Idea That Higher Rates Are Slowing The Bubble

House Prices Are Rising Faster Than Case Shiller Says, Market Is Tight

Here’s How Real Durable Goods Orders Shows US Manufacturing Remains In A Slow Motion Collapse

Follow my comments on the markets and economy in real time @Lee_Adler on Twitter!