From the BLS:

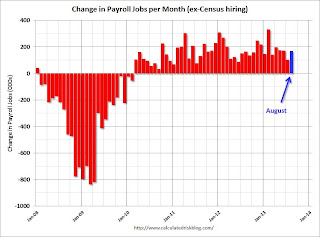

Total nonfarm payroll employment increased by 169,000 in August, and the unemployment rate was little changed at 7.3 percent, the U.S. Bureau of Labor Statistics reported today. …

…

The change in total nonfarm payroll employment for June was revised from +188,000 to +172,000, and the change for July was revised from +162,000 to +104,000. With these revisions, employment gains in June

and July combined were 74,000 less than previously reported.

The headline number was slightly below expectations of 175,000 payroll jobs added. However employment for June and July were also revised lower.

Click on graph for larger image.

Click on graph for larger image.

NOTE: This graph is ex-Census meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes.

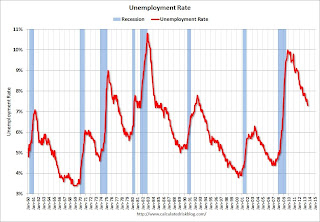

The second graph shows the unemployment rate.

The unemployment rate declined in August to 7.3% from 7.4% in July.

This is the lowest level for the unemployment rate since November 2008.

This is the lowest level for the unemployment rate since November 2008.

The unemployment rate is from the household report and the sharp decline in the participation rate helped lower the unemployment rate.

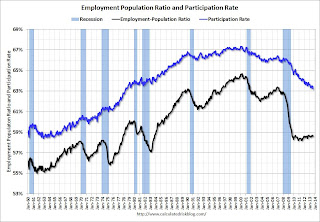

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate decreased to 63.2% in August (blue line) from 63.4% in July. This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.

The Employment-Population ratio declined in August at 58.6% from 58.7% in July (black line).

I’ll post the 25 to 54 age group employment-population ratio graph later.

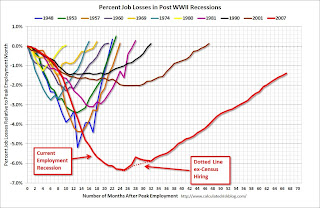

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

This shows the depth of the recent employment recession – worse than any other post-war recession – and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

With the revisions, this report was well below expectations. I’ll have much more later …