This is part two in a series that focuses on where U.S. investors should seek growth in global markets, what kinds of income possibilities are available, and what protection is offered in today’s capital markets. Click here to read Part 1: Reluctantly Look to Overseas Opportunities

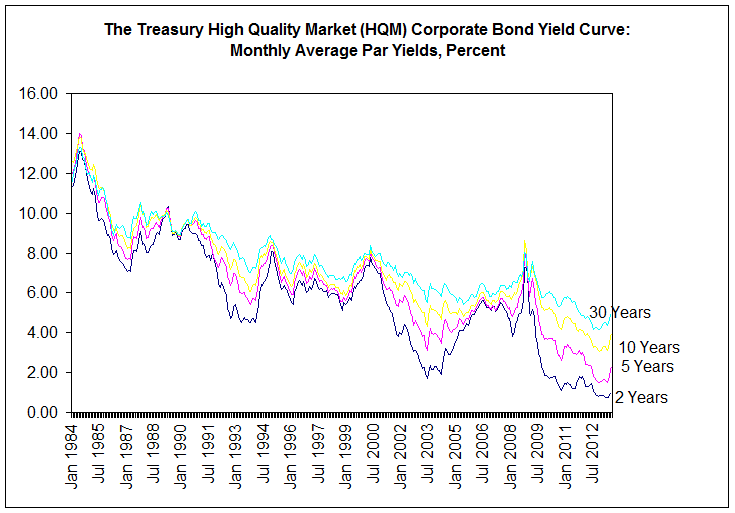

Favorable borrowing costs are a large contributor to the lofty valuations of today’s U.S. stock market. Unfortunately, that comes at the expense of corporate bond income seekers who have suffered decades of rapidly declining yields. While actual bond values have risen for holders, those investors just jumping into the bond market at random points have found it increasingly hard to capture attractive income.

Of course, an ‘attractive yield’ is a relative term, and too many retail investors peg their yield desires on the mid 1980s when corporate bonds paid 12% to 13% annually. Interestingly, we never seem to pine for those same days when a fixed mortgage was 14%, or when the average car loan interest rate was more than 16%…

Despite yields that are in some cases just 1/3rd of what they were in the 80s, corporate bonds are still a legitimate income source, and are more widely owned than you might think. As of March 2013, individual investors held about 28% of the total outstanding principal value of all corporate bonds.

Looking beyond corporates to municipal bonds, you’ll find similarly low rates, but even greater percentage interest from individual investors. In fact, individuals are the largest holders of securities in the muni-bond world – $2.7 trillion of the entire $3.7 trillion market. They hold about 50% of these muni bonds directly, and another 25% through muni-bond mutual funds, exchange-traded funds (ETFs), and closed-end funds.

It begs the question: Why are individuals so enamored (and so highly invested) in these debt offerings when there are alternatives that we’ll discuss that offer yield and better performance?

The Tapering of Central Bank Intervention

As has been widely reported, Fed Chairman Ben Bernanke has been pretty clear that the Federal Reserve program to suppress interest rates through massive purchases of treasuries bonds will be reduced, allowing interest rate to gradually rise. The Fed is not shutting off the faucet completely; rather it will gradually reduce its bond buying while at the same time keeping a watchful eye on what happens to the economy. The sense is that Fed ‘tapering’ will be performed in real time; buying will be decreased if the economy is improving rapidly or increased if it isn’t. The market is betting that U.S. economic indicators are good enough for the Fed to justify putting its proverbial wallet back into its pocket very shortly.

For potential corporate and muni buyers, look for rate improvement in 4Q13 and 1Q14 as the Fed appears to be itching for excuses to taper.

An Alternate Source of Income in the Taper World

As taper talk began last May, major bond indexes have been plummeting. The Bloomberg U.S. Treasury Bond Index is down 4.09% for the year, and its U.S. Corporate Bond Index down also 4.28% for the year. Even the S&P National AMT-Free Municipal Bond Index is down 4.95% YTD.

While not a bond index per se, the S&P U.S. Preferred Stock Index is down 5.48% year to date.

But preferred shares are worthy of consideration, though…

ETFs like the iShares S&P U.S. Preferred Stock Index (PFF) are down less than the bond or preferred indexes, and they are providing healthy yields. The PFF is down year-to-date only 1.61% (through 8/31), and is providing a yield of 5.79%. PowerShares Preferred (PGX) is down 2.24% year-to-date (8/31) while providing 6.72% in annual yield.

These and other preferred ETFs that have weathered the announcement of Fed tapering while offering strong yields deserve considerable attention by income seekers. In fact, there are several additional income alternatives that we will discuss in future articles.

InvestingChannel