My annual electric bill here in sunny San Francisco comes to $4,800 a year. Since the California power authorities have set a goal of 33% alternative energy sources by 2020, PG&E (PGE) has the most aggressive green energy program in the country (click here for “The Solar Boom in California”. More expensive solar, wind, geothermal, and biodiesel power sources mean that my electric bill may rise by $300 a year to about $5,100.

Now let’s look at my gasoline bill. Driving 15,000 miles a year, my old Toyota Highlander Hybrid used 600 gallons a year, which at $4/gallon for gas cost me $2,400/year. So my annual combined electric power/gasoline bill was $7,500.

My new Tesla Model S-1 (TSLA) will cost me $180/year in battery charges to cover the same distance. By switching to the Tesla, my total energy cost plunges to $4,980 a year, down 34%. That’s a big saving. Now you know why alternative energy is so popular in the Golden State.

There is an additional sweetener, which I’m not even counting. I also spent $1,000/year on maintenance on my old car, including tune-ups and oil changes. The Tesla will cost me nothing, as there are no oil changes or tune ups, and my engine drops from using 1,000 overcooked parts to just eleven. We’re basically talking tire rotations only for the first 100,000 miles.

There is a further enormous pay off down the road. We are currently spending $100 billion a year in cash up front fighting our wars in the Middle East, or $273 million a day! Add to that another $200 billion in back end costs, including wear and tear on capital equipment, and lifetime medical care for 5 million veterans, some of whom are severely torn up.

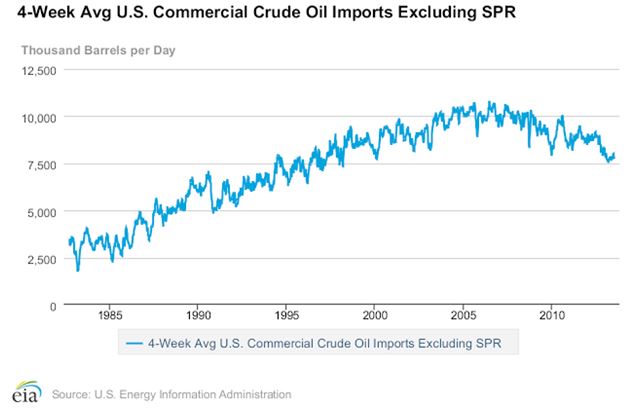

We import 7.5 million barrels of oil each day, or 2.7 billion barrels a year, worth $270 billion at $100/barrel (click here for the US Energy Information Agency stats). Some 2 million b/d, or 730 million barrels/year worth $60 billion comes from the Middle East. That means we are paying a de facto tax which amounts to $136/barrel, taking the true price for Saudi crude up to a staggering $219/barrel!

We are literally spending $100 billion a year so we can buy $60 billion worth of oil, and that’s not counting the lives lost. Even worse, 80% of total Persian Gulf exports now go to Asia, so we are now spending this money to assure China’s supplies, not ours. Only a government could come up with such an idiotic plan.

There is another factor to count in. Anyone in the oil industry will tell you that, of the current $100 price for crude, $30 is a risk premium driven by fears of instability in the Middle East. The Strategic Petroleum Reserve, every available tanker, and thousands of rail cars are all chocked full with unwanted oil. This is why prices remain high.

The International Energy Agency says the world is now using 90 million b/d, or 32 billion barrels a year worth $3.2 trillion. This means that the risk premium is costing global consumers $960 billion/year. If we abandon that oil source, the risk premium should fall substantially, or disappear completely. What instability there becomes China’s headache, not ours.

If enough of the country converts to alternatives and adopts major conservation measures, then we can quit importing oil from that violent part of the world. No more sending our president to bow and shake hands with King Abdullah. Oil prices would fall, our military budget would drop, the federal budget deficit would shrink, and our taxes would likely get cut.

One Tesla shrinks demand for 750 gallons of gasoline, or 1,500 gallons of oil per year. That means that we need 20.4 million electric vehicles on the road to eliminate the need for the 2 million b/d we are importing from the Middle East. The Department of Energy has provided a $1.6 billion loan to build a Nissan Leaf plant in Smyrna, Tennessee.

Add that to the million Chevy Volts, Tesla S-1’s, Mitsubishi iMiEV’s, and other electric cars hitting the market in the next few years. Also taking a bite out of our oil consumption are the 2 million hybrids now on the road to be joined by a third million in the next two years. That goal is not so far off.

Yes, these are simplistic, back of the envelope calculations that don’t take into account other national security considerations, or our presence on the global stage. But these numbers show that even a modest conversion to alternatives can have an outsized impact on the bigger picture.

By the way, please don’t tell Exxon Mobil (XOM) or BP (BP) I told you this. They get 80% of their earnings from importing oil to the US. I don’t want to get a knock on the door in the middle of the night.