RC, i’ll try to keep it brief for now. I want to refine my screening and further identify some of the types of picks you seek. so, how do you screen for and find trades such as KIOR mentioned earlier, as well as the many others?

You post a lot of these during the day(s) via the runner screen. Are there any other screens/screening techniques you use on a regular basis?

I noticed KIOR this week from my “Small Bombs Screens”. I also noticed the ticker popping up on my daily runner screen, a screen found inside The PPT that looks for momentum short squeezes. Normally, when I start to see a ticker populate a few times on this screen, and the chart has a setup worth playing (which is key), then it’s time to start paying attention to said name.

Once I find a stock with a favorable pattern, like KIOR, it immediately goes into a three tier watchlist system, a system former iBC blogger John Lee helped my develop.

The 3 tier watchlist system, goes as follows:

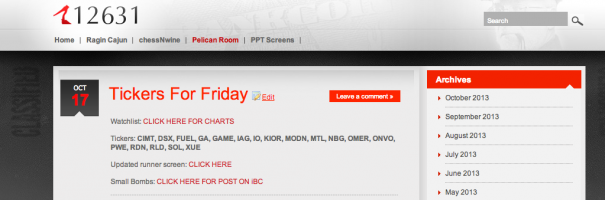

1.) High Priority – These are the setups that will likely see an immediate breakout, think ONVO from last Friday. KIOR was also on this watchlist Friday. This high priority list is posted nightly inside 12631, here is a screenshot:

2. Second tier setups – these are setups that are not quite ready, but are close. These are setups that need more time in order to consolidate to offer a high probability trade.

3. Recycle bin – These are stocks that may not be ready, but names I don’t want to lose track of. Sometimes a stock will breakdown, only to come roaring back, consolidate, and offer another opportunity to get in. When I see this happen, I will normally shuffle the name back up to “Second Their setups” or even my “High Priority List”

________

Once I have my three watchlist system setup, my job then becomes to manage my watchlist effectively. I am constantly shuffling through the “Second tier list” and “high probability list” throughout the day, moving tickers into their appropriate category. This helps me focus on the top setups of the day.

I am constantly running screens throughout the day to find tickers to add to this never ending watchlist cycle. Prophet charts from thinkorswim does a great job in helping me keep a well organized list.

How do you screen for and find trades such as KIOR mentioned earlier, as well as the many others

My favorite screens are located in The PPT and here are the ones I run daily:

- Momentum screen: aka runner screen (PPT members click here to save screen)

- High volume/hybrid screen (PPT members click here to save screen)

- Small Bombs Screen, (PPT members click here to save screen)

- Top hybrid gainers, which i post daily on the blog

- The “Notable stocks” screen that I post at the bottom of the daily scorecard is also monitored on a daily basis.

I run the screens, view the charts, and use my trained eye to add tickers to my watchlist. As you begin to recognize patterns, it will become easier to select names from scans. This comes with experience. Here is a good link for beginners on chart patterns.

Stay tuned for Part II: analyzing the trade in multiple timeframes.