Germans are conservative and central bankers are by nature careful about their choice of words. So we should take note when German Central Banks sound an alarm about a severe correction, right? Maybe not completely.

“Central Bank Sounds Alarm” said the front page of a German financial newspaper.

The article continues (translated from German into English): “Central bankers choose their words carefully. Central bankers avoid dramatizations or exaggerations. Danger is at hand when the good old German Central Bank (Bundesbank) warns of severe real estate losses caused by price corrections.”

According to calculations by the German Central Bank, home prices in some metropolitan areas (such as Munich, Duesseldorf, Hamburg and Berlin) are up to 20% overvalued.

“The rapid price increase is not justified,” says the German Central Bank. But, “despite of an overheated market, the Central Bank does not expect a real estate bubble like seen in the USA.”

According to the newspaper (Handelsblatt) only a small portion of German real estate is financed. Real estate loans grew only moderately since 2010, currently at euro 1.1 trillion.

Measured by size, Germany is a small country, but it’s been the engine that kept European markets (NYSEArca: VGK) going. Germany’s economy also has a notable effect on international markets represented by the iShares MSCI EAFE ETF (NYSEArca: EFA).

Not Like Las Vegas

Germany is not like Las Vegas, what happens in Germany doesn’t stay in Germany (NYSEArca: EWG).

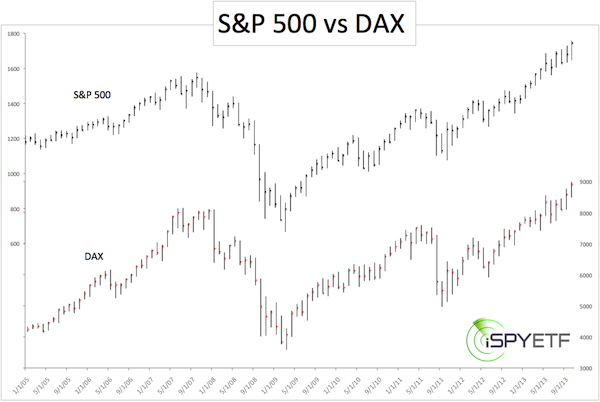

The chart below – which plots the German DAX against the S&P 500 (SNP: ^GSPC) – shows a close correlation between the DAX and S&P 500 (NYSEArca: SPY).

Germany isn’t an island, and if Germany gets into trouble, it will ‘export’ its problems along with Porsches and BMWs.

In fact, adding a few simple trend lines to the above DAX chart shows that the DAX has arrived at a crucial inflection point. Click here to see the chart with trend lines: Germany’s DAX Index Defined by Two Lines

Is Central Bank Alarm Bullish?

Perhaps the German Central Bank has ripped a page out of the Federal Reserve’s book.

It’s not common knowledge, but two recent Federal Reserve studies basically warned of a market crash and said it won’t be caused by QE. Click here for a quick and insightful summary of the bizarre studies: Federal Reserve Study

One thing is for sure, the persistent supply or ‘market crash alerts’ has provided the ‘wall of worry’ needed for stocks to climb higher. There is actual evidence for this.

To read why ‘false’ warnings and political chaos have provided the perfect environment for stocks, click here: Is the Mix of QE and Political Chaos the Perfect Environment for Stocks?

Simon Maierhofer is the publisher of the Profit Radar Report.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE Newsletter.