With share prices up by 20% this year, many commentators are warning of a top, a bubble, an Armageddon to come. But I think that we are just getting started.

Share prices have the rocket fuel for the Dow average to make it to 15,000 by the end of 2015, and possibly 100,000 by 2025. To understand why, you have to focus on major long-term structural changes occurring in the global economy which at this point only a handful of strategists can see.

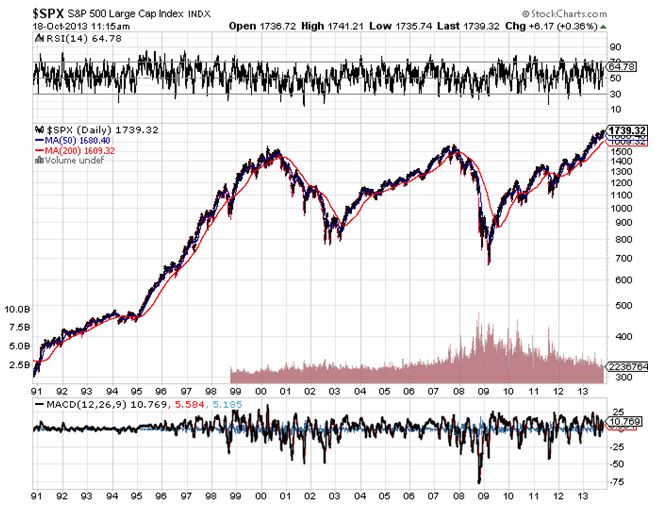

The evidence couldn’t be more undeniable. The major stock indexes have repeatedly broken out to new all time highs in 2013. The more volatile and economically sensitive Russell 2000 small cap index has left it in the big caps dust. Inflows to equity mutual funds have been the most prolific since 2008. It all paints a picture of a run up to and (SPX) of 1,780 by year-end, which by the way, has been my own forecast all year. Perma bears be damned!

The financial press would have you believe this is all happening because Ben Bernanke changed his mind on “tapering” postponing the death sentence for his quantitative easing program until well into 2014, as if that was ever in doubt. My own theory about the extended life of ultra lax monetary easing has held up once again.

Betting on Ben’s fears of a replay of 1937, when premature tightening tipped the US economy into the second leg of the Great Depression, has been a huge winner for me for years now. It means that he is willing to err on the side of over stimulation, by a lot. With wage growth stagnant for decades, and many commodity prices and precious metals down 30% or more year-to-date, he certainly has a free pass on the inflation front to do so.

Corporate earnings are also helping, consistently surprising to the upside. None other than Morgan Stanley (MS) and Goldman Sachs (GS) have led the pack with further profit upgrades. Again, this was no surprise to me.

However, I think the market is trying to tell us infinitely more than what appeared in yesterday’s headlines. There is something deeper going on here beyond the noise of the daily data releases. Asset prices are acting like there is a major structural change underway in the world economy, which so far has remained invisible to all except the market.

Yes, there are a few professionals out there who can see imminent momentous change within their own narrow industries. But no one has yet aggregated all these changes together, so I’ll take a whack at it. Here are ten theories for you to contemplate.

1) There is more Peace Dividend to Pay– Is it possible that the markets have not yet fully discounted America’s victory in the cold war? That the payout was interrupted by the dotcom and housing crashes, and that it is now resuming?

Yes, we priced in a chunk with the run up in the Dow average from 2,500 to 11,000 during the 1990’s. But could there be more to go? After all, 21 years since the fall of the Soviet Union and the US still faces no industrial strength enemy, and there are none on the horizon either. At the very least, this reality should be enough to chop our current defense spending by half, and eliminate most of our budget deficit. Much of the defense establishment agrees with me.

2) Obama Care Works – With the House of Representatives voting to repeal the president’s health care plan for the 40th time, and closing down the government for 16 days in protest, conservative antipathy towards Obamacare couldn’t be more clear. But what if, instead of doubling health care costs as the right has claimed, it drops them by half? What if the plan does add 0.5% to annual GDP and creates 2 million jobs?

This, after all, was the original plan. Health care is expensive in the US because of the lack of competition, and Obamacare delivers that in spades for the first time. Of course there were going to be teething problems. After all, the government is trying to create 50 Amazons overnight at once. It took 20 years for my former Morgan Stanley colleague, Jeff Bezos, to create just one.

The early evidence shows that the competitive health insurance exchanges the plans set up are delivering price reductions of 30% to 50% in New York and California. I walked into Costco the other day and was offered a plan for $235 a month with an $8,000 deductible, just so I could avoid the penalties for the uninsured. The best offer I previously received from Blue Cross of California was $3,500 a month.

If this, in turn, solves the health care and Social Security crisis it will do a lot to wipe out that “uncertainty” you hear so much about. The predictions of the eventual insolvency of the United States also go down the drain.

3) Another Technology Revolution – Are we on the verge of another great technology breakthrough like the one we saw during the dotcom boom, when PC’s, the Internet, and the World Wide Web simultaneously came together to supercharge corporate earnings for a decade? What if the cost of treating cancer drops from $100,000 to $200, as my friend, Dr. Michio Kaku, believes. What if new Apples and Googles (GOOG) continue to appear out of nowhere?

If you lived in San Francisco and were barraged by venture capital pitches on a daily basis, as I am, you would think this new Golden Age is going to start any minute. There are a thousand things percolating out there. The only question is whether the lead industry will be communications, health care, energy, or all three. Ride your bike south of Market Street someday and see how much research capacity is being built now, the size of a small city. It is awe-inspiring.

4) The Real Cost of Energy Collapses – We all know about the new 100-year supply of natural gas discovered under our feet that will turn us into Saudi America. But there are 100 additional ways that energy supply is improving and demand is falling.

Conservation will be huge, as will grid and utility modernization. What if Tesla’s (TSLA) Elon Musk is able to deliver a $40,000 electric car with a 300-mile range in five years, as he has promised? This will be a game changer. His track record so far is pretty good. This is the man so brimming with confidence that he just bought James Bond’s submarine car for $1 million (see the cool modified Lotus in The Spy Who Loved Me). Falling energy costs mean that the profitability of virtually every listed company goes through the roof.

It is likely that if Iran ever does make good on its threat to close the Straights of Hormuz that no one will care. Some 80% of that oil, and soon to be 100%, goes to China, and that will be their problem, not ours.

5) Productivity Accelerates – By relentlessly introducing new technologies and cutting costs, corporate profitability has soared for the past 30 years. Pessimists now say things can’t get any better. But what if they do?

As I tell guests at my strategy luncheons, this is not a mean reverting data series. Having invested in the machine that took your labor force from 1,000 to 100, what if the next one brings it to 10? Guess which country is about to lose millions of jobs from offshoring and new technology? China. Just talk to any European CEO about their new “American Strategy.”

6) Interest Rates Stay Low for Another Decade – If wages stay in check, oil prices fall, and commodity places stay low, then the Fed has absolutely no reason to raise interest rates for another ten years, no matter what the economy does. The next demographic push that creates a worker shortage and higher wages doesn’t start until the early 2020’s.

Sure, the Fed will probably normalize overnight rates back to 2% by next year, as the safety net for the economy is no longer needed. But rates could remain historically very low for quite a long time. This savings immediately drops to the bottom line of any borrower, be they individual, corporate, or government. In fact, looking at the main causes of the recessions for the last 50 years—a spike in interest rates or a sudden cut off in oil supplies, and absolutely none are visible on the horizon, for now.

7) Shinzo Abe Saves Japan – The conventional wisdom is that the new government in Japan is resorting to a last desperate act to save their economy that will fail, and that a complete collapse of their over leveraged financial system will result. But what if Abe gets his necessary reforms through and the country regains its powerhouse status. If Japan’s $6 trillion economy, the world’s third largest, bounces back from a 1% to a 4% GDP growth rate, there will be positive implications for all of us.

8) Europe Gets Its Act Together – It seems that all we ever hear about from the continent is debt crisis and stagnation and a political system so fragmented that no one can do anything about it. But what if new leadership emerges and takes the initiative to coalesce and solidify Europe?

That would involve creating a single Ministry of Finance, issuing pan Euro bonds, and a European Central Bank with teeth and courage. Their economic problems would disappear and growth would double. As part of my consulting arrangements with governments there, I have been recommending these measures for years, and everyone agrees. All that is missing is the political will to carry them out.

9) The Dollar Stays Strong – With America’s debt to GDP now over 100% and rising, many analysts believe it is just a matter of time before we see a major crash in the dollar. This is only the continuation of a 220-year-old trend.

What if it goes up instead? Energy independence means we will no longer ship $400 billion a year to the Middle East to pay for oil imports. CEO’s in Europe and Asia are stumbling over each other to find ways to get capital into the US to take advantage of a stronger economy. Higher growth rates mean the feared American deficits start shrinking on their own, with no action from congress whatsoever. This is all long-term dollar positive.

10) Multiples Keep Expanding – Most strategists believe that the S&P 500 is fairly valued at 1,740 with a price earnings multiple of 15 times, dead in the middle of its historic 9-22 range. But if any of my theories above unfold, then higher multiples are justified. If they all unfold, then investors wouldn’t hesitate to pay a 25 multiple for American stocks, as their future outlook is so unremittingly positive.

You may say this sounds crazy, and you’d be right. But remember, twice in the last 25 years we have seen market multiples skyrocket to 100. Japanese share valuations reached that nosebleed summit in 1989, and American Dotcom stocks did so in 2000. And they reached those numbers with fundamentals far less substantial than we are facing now. Just take multiples on today’s market up from 15X to 20X, and the Dow should be worth 20,000.

Sure, all of the above represents a pie in the sky best-case scenario. Some, or none of them may actually play out in the real world. But the ones that do occur will have a super-leveraged effect on each other. The net impact will be US GDP growth easily leaps back from today’s feeble 2% to the virile 4% or more that we grew comfortable with during the fifties, sixties, and eighties. That growth rate will solve America’s Social Security, Medicare, and deficit problems in fairly short order, without any action by the government.

Needless to say, all of the above is hugely positive for the stock market. It brings forecasts for a Dow 20,000 by 2015 and 100,000 by 2025 out of the realm of fantasy. It kind of makes today’s stock prices look dirt-cheap. Maybe that’s what the market is trying to tell us, if we only had the patience and the foresight to listen.

This doesn’t mean that you need to rush out and buy more stocks today. Some of these trends will take a decade or more to play out. Better entry points will no doubt present themselves this year. But the writing is on the wall for higher equity prices, not just in the US, but globally.

I can tell you from the vast expanse of my own 45 years in the prediction business, I have learned one thing. All that is forecast never happens, and all that happens was never forecast. I’m still waiting for my flying car, although the Tesla S-1 comes close.