First time unemployment claims essentially met expectations this week as ‘conomists had one of their rare correct guesses. But I should not be so hard on the ‘conomist crowd. The seasonal adjustment factor applied to the comparable week of the year over the prior 10 years has varied by +/-30,000 claims from year to year. So when the market gets upset or excited about a ‘conomists’ consensus miss of 10,000 or 20,000 or even 30,000, it’s really much ado about nothing. It’s statistical noise.

The Labor Department reported that in the week ending October 26, the advance figure for seasonally adjusted initial claims was 340,000, a decrease of 10,000 from the previous week’s unrevised figure of 350,000.

The consensus estimate of economists of 335,000 for the SA headline number was close to the mark (see footnote 1). Over the prior month economists were consistently unable to guess the impact of the government shout down, severely underestimating claims in those weeks. They apparently are not aware of the real-time hard data on Federal Withholding taxes, which I track weekly in the Treasury Update. That showed withholding tax collections dropping sharply over the period of the shout down.

The whole weekly ritual of reacting to these fictional, seasonally adjusted headline numbers is ridiculous. But the weekly data does have real value. Tracking only the actual, not seasonally finagled number exactly as the Feds collect the actual filings from the 50 states gives us a good picture of the trend of the economy nearly in real time, unlike most economic data which usually has a lag of at least a month. With no more government and related workers being furloughed since October 16, last week’s and this week’s actual, unadjusted numbers give us a good idea of the underlying trend.

The headline seasonally adjusted data is the only data the media reports but the Department of Labor (DOL) also reports the actual data, not seasonally adjusted (NSA). The DOL said in the current press release, “The advance number of actual initial claims under state programs, unadjusted, totaled 317,580 in the week ending October 26, an increase of 6,064 from the previous week. There were 339,917 initial claims in the comparable week in 2012.” [Added emphasis mine] See footnote 2.

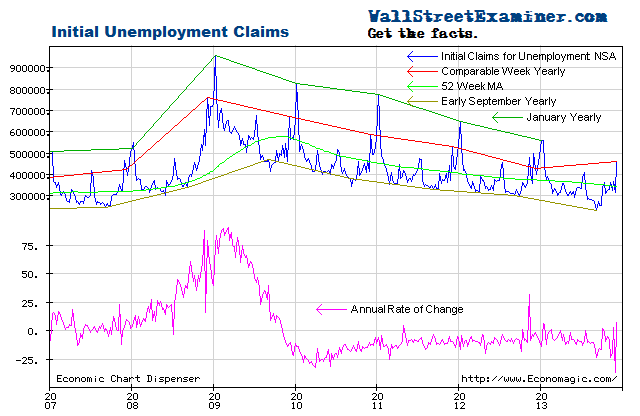

Claims were up year to year in the first week of the government shout down, then nearly even on a year to year basis in the second week. By the October 19 week claims began to return to their past trend of trending lower at about 8% per year. In the latest week actual filings were down 6.6% versus the corresponding week last year, slightly worse than the trend average of -7.9% per year over the past 104 weeks.

There’s significant volatility in this number, with a usual range of zero to -20%. In the second and third quarters, claims as a percentage of the total employed were at levels last seen at the end of the housing bubble, just before the market and economy collapsed. Since then they’re returned to a somewhat higher level, settling in at about 0.23% of total employed.

The fact that the numbers rebounded immediately after the ending of the government shout down suggests that there will be no lasting damage, contrary to the braying of the political and economic chattering classes, all of whom are pushing their own agendas.

The current weekly change in the NSA initial claims number is an increase of 6,000 (rounded and adjusted for the usual undercount) from the previous week. That compares with a decrease of 5,000 for the comparable week last year. The fourth week of October was an up week in 6 of the prior 10 years. The average change for the comparable week over the prior 10 years was an increase of 13,000. This week’s number, while worse than last year was in line with the prior 10 year average.

Federal withholding tax data slumped sharply in the first half of October. It then began a gradual recovery after mid month but is not back to trend yet. Since withholding is collected after the end of the pay period, the effects of Federal workers returning to work should be seen fully in that data within the next few days. I’ll report on that in the weekly Professional Edition Treasury update.

To signal a weakening economy, current weekly claims would need to be greater than the comparable week last year. With the exception of the October 5 week, which got a mulligan because of the government shout down, that has not happened. The trend had previously been one of accelerating improvement in spite of the fact that the comparisons are now much tougher than in the early years of the 2009-13 rebound. The data has returned to trend over the past two weeks, but again, with much tougher comparisons versus the prior year now, I would expect some slowing in the rate of improvement to be normal, and not an indication of a weakening economy.

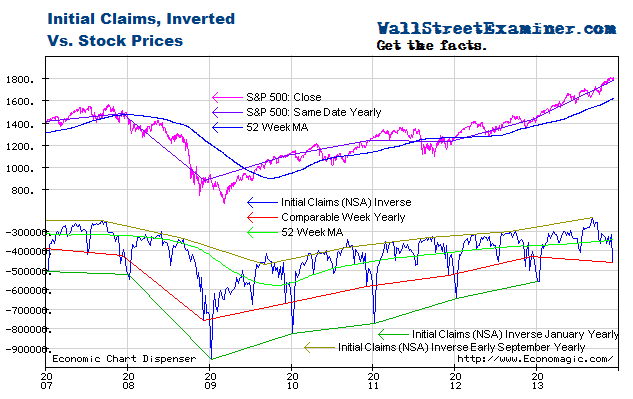

Relative to the trends indicated by unemployment claims, stocks have been extended and vulnerable since May. QE has pushed stock prices higher but has done nothing to stimulate jobs growth.

I plot the claims trend on an inverse scale on this chart with stock prices on a normal scale. The acceleration of stock prices in the first half of 2013 suggested that bubble dynamics were at work in the equities market, thanks to the Fed’s money printing. Those dynamics appeared to have ended in July but the zombie has kept coming back to life. I address the specific potential outcomes in my proprietary technical work.

More charts below.

Stay up to date with the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Professional Edition, Money Liquidity, and Real Estate Package. Try it risk free for 30 days. Get the research and analysis you need to understand these critical forces and stay ahead of the herd. Click this link and begin your risk free trial NOW!

Footnote 1: Economists adjust their forecasts based on the previous week’s number, leading to them frequently getting whipsawed. Reporters frame it as the economy missing or beating the estimates, but it’s really the economic forecasters who are missing. The economy is what it is.

The market’s focus on whether the forecasters have made a good guess or not is nuts. Aside from the fact that economic forecasting is a combination of idolatrous religion and prostitution, the seasonally adjusted number, being made-up, is virtually impossible to consistently guess (see endnote). Even the actual numbers can’t be guessed to the degree of accuracy that the headline writers would have you believe is possible.

Footnote 2: There is no way to know whether the SA number is misleading or a reasonably accurate representation of the trend unless we are also looking at charts of the actual data. And if we look at the actual data using the tools of technical analysis to view the trend, then there’s no reason to be looking at a bunch of made up crap, which is what the seasonally adjusted data is. Seasonal adjustment just confuses the issue.

Seasonally adjusted numbers are fictional and are not finalized until 5 years after the fact. There are annual revisions that attempt to accurately reflect what actually happened this week. The weekly numbers are essentially worthless for comparative analytical purposes because they are so noisy. Seasonally adjusted noise is still noise. It’s just smoother. So economists are fishing in the dark for a fictitious number that is all but impossible to guess. But when they are persistently wrong in one direction, it shows that their models have a bias. Since the third quarter of 2012, with a few exceptions it has appeared that a pessimism bias was built in to their estimates.

To avoid the confusion inherent in the fictitious SA data, I work with only the actual, not seasonally adjusted (NSA) data. It is a simple matter to extract the trend from the actual data and compare the latest week’s actual performance to the trend, to last year, and to the average performance for the week over the prior 10 years. It’s easy to see graphically whether the trend is accelerating, decelerating, or about the same.

The advance number for the most recent week is normally a little short of the final number the week after the advance report, because the advance number does not include all interstate claims. The revisions are minor and consistent however, so it is easy to adjust for them. Unlike the SA data, after the second week, they are never subsequently revised.

Cliff-Note: Neither stopping nor starting rounds of QE seems to have had an impact on claims. Nor did the fecal cliff secastration. The US economy is so big that it develops a momentum of its own that policy tweaks do not impact. Policy makers and traders like to think that policy matters to the economy. The evidence suggests otherwise.

Monetary policy measures may have little impact on the economy, but they do matter to financial market performance. In some respects they’re all that matters. We must separate economic performance from market performance. The economy does not drive markets. Liquidity drives markets, and central banks control the flow of liquidity most of the time. The issue is what drives central bankers.

Some economic series correlate with stock prices well. Others don’t. I give little weight to economic indicators when analyzing the trend of stock prices, but economic indicators can tell us something about market context, in particular, likely central banker behavior. The economic data helps us to guess whether the Fed will continue printing or not. The printing is what drives the madness. The economic data helps to predict the central banker Pavlovian Response which is, when the bell rings —> PRINT! Weaker economic data is the bell.

Please share your comments below this post.

The SA data trend this week is similar to the actual data. That’s not always the case. Sometimes the seasonal adjustment will skew the trend of that data off course, misleading economists and market watchers who only watch that number.

Four years into recovery, claims have leveled off at a level equal to the second year of the recovery from the 2002 recession. Four years into that recovery, claims were below 300,000 per week at this point in the year.

The Labor Department, using the usual statistical hocus pocus, applies a seasonal adjustment factor to the actual data to derive the seasonally adjusted estimate. That factor varies widely for this week from year to year. The factor applied this week was way above the historical range.

Stay up to date with the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, along with regular updates of the US housing market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Try it risk free for 30 days. Don’t miss another day. Get the research and analysis you need to understand these critical forces. Be prepared. Stay ahead of the herd. Click this link and begin your risk free trial NOW! [I cover the technical side of the market in the Professional Edition Daily Market Updates.]

See Rick Santelli use one of my proprietary charts on CNBC to explain how the Fed impacts the stock market directly through its trades with the Primary Dealers. This is just one example of the dozens of proprietary charts that I build that will help you to clearly see and understand the market’s trend, and when that trend is beginning to change.

Read

- When It Comes to Fed Day, Wall Street Mouthpieces May Not Always Tell The Truth, and Other Shocking Revelations

- Adler Launches A Tirade About Whether QE Causes Rising Stocks (Free Clip) – Radio Free Wall Street

- Housing Indicator Review – Pending Home Sales- No Hype, Just the Facts

- Is It Insane to Expect Change? Radio Free Wall Street – With Free Preview

- Claims Snap Back to Trend After Shout Down Ends

- The Great Deflector

Follow my comments on the markets and economy in real time @Lee_Adler on Twitter!