In keeping with the mood of Halloween, the monsters came out early this morning to scare the living Hades out of the gold & silver market. We had the typical FOMC precious metal smash-down today to balance out the bullish move in gold and silver yesterday instigated by the Fed’s policy of continued QE stimulation.

In a 24 hour period, silver traded more than 5% from highs to lows. Nothing like a dose of volatility to get investors ready for the cartel’s pagan festivities.

While the traders were focused on the “FED TRICK”, in the precious metal markets, few realized the “GOLD TREAT” as the U.S. Mint updated its Gold Eagle figures showing another 2,000 oz of the coins were sold since their update yesterday.

From The SRSRoccoReport:

This is an interesting development as the U.S. Mint normally dumps the sales for the last few days of the month on the following month. In that case, we would have not been able to realize that an additional 2,000 oz of Gold Eagles were sold within the past 24 hour period.

Furthermore, this goes to show that sales for the Gold Eagles are picking up substantially and at this daily rate we could see a much higher sales figure for November compared to the 48,500 oz sold in October.

Precious Metal Investors Better Wake Up

The precious metal sentiment is still at all time lows. This is partly due to the continued “Fed Taper” calls by Banks & Brokerage Houses. There is no way the Fed can taper its $85 billion a month of stimulus as the U.S. economy continues to weaken. However, this doesn’t stop the Banks & Brokerage Houses from doing their part in keeping the Fiat Monetary Regime alive as long as they can.

Investors must realize, when the Fiat Dollar Monetary Regime disintegrates, so do most of the assets that these Banks & Brokerages hold and represent. Basically, the continued treat of FED TAPER allows monetary authorities open season to smash the precious metals, while they prop up the broader stocks markets and bonds.

This tactic has worked wonders on those who are not invested in the precious metals, but were thinking about it. Ever since the metals tanked from their highs of $1,750 gold and $35 silver in the fall of 2012, the ignorant public now has lost faith in the precious metals as a store of value.

This is very unfortunate, because the opposite is the case. In addition, I’ve noticed that even some of the more diehard precious metal investors are starting to question the fundamentals of gold and silver. All I can say to those who are starting to throw in the towel on the precious metal investments…. the best is still yet to come.

Watch Out For Misleading Analysis on the Gold Miners

I read an article last week titled “GOLD – Mining Profits Fallacy”, written by Adam Hamilton of Zeal Intelligence. Hamilton states that investors are being misled by some “fool perma-bear’s self-serving falsehoods.”

According to Hamilton’s article:

Chief among them today is the widespread notion that gold miners can’t earn any profits. I get dozens of e-mails a week explaining to me why the gold stocks are doomed to fall much lower because they simply can’t earn sufficient money where gold is today. After having spent 14 years studying the markets full-time and trading gold stocks, the sheer popularity of this notion blows my mind. It is completely and utterly false!

Last year, the HUI gold miners that produce over a third of the world’s mined gold supply averaged $950 per ounce cash profit! Their gross margins have hovered in the 50% to 60% range continuously since 2006. There are very few industries in the world that have such high gross margins, the profitability of mining gold has been extraordinary. And this provides a fortress-like buffer to survive this year’s gold plunge.

In about half the feedback I get parroting these silly bearish rationalizations, the writers cite energy prices. They tell me gold mining isn’t profitable today because energy is so expensive, and gold mining is usually very energy-intensive.

——————–

I am only going to touch base on this today as I will be writing in more detail on this subject in the following weeks. Hamilton is making the case that the gold miners are still making huge profits due to their low cash costs. He provides a chart showing huge cash margins that were $950 an ounce in 2012.

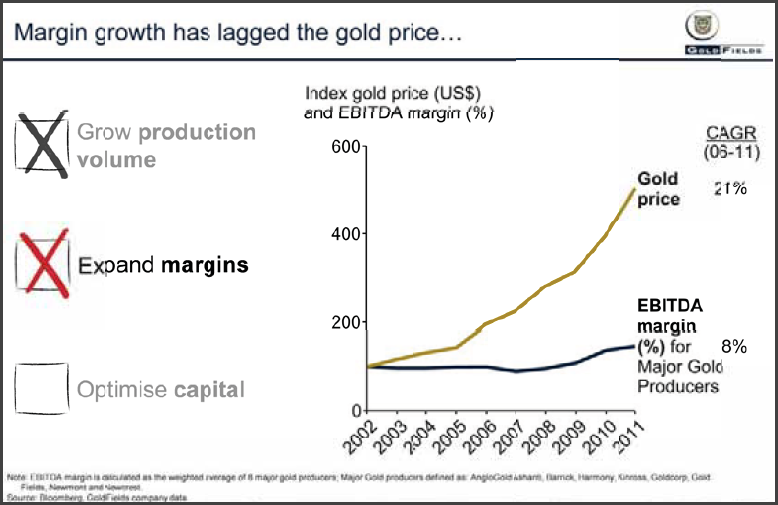

While I enjoy Hamilton’s articles, he surely misleads the investing public on this “Huge Gold Cash Profits Crusade.” Below is a chart I came across from one of those supposed Perma-Bearish gold analysts:

As you can see from the chart, as the index gold price has risen 21% CAGR – compounded annually, EBITDA margins – Earnings before Interest, Tax, Depreciation & Amortization have only increased 8%. The chart clearly shows that the top gold producers did not take advantage of the much higher gold price.

So, what Perma-Gold Bear put out this chart? It was Nick Holland, CEO of GoldFields. Nick spoke to a group at the Melbourne Mining Club back in July 2012 on why the top gold miners have under-performed the market and hurt shareholder value.

From the data that Holland is presenting in this chart, the gold miners profit margins have not been rising along with the gold price as Hamilton suggests.

Again, I will get into this in more detail in the coming weeks. While Hamilton puts out some excellent work on the precious metals and miners, he is clearly misleading investors that the gold miners are making significant profits at the current low price of gold.

I am not saying that the gold miners aren’t making profits… they just aren’t making huge profits — and actually some are indeed losing money.