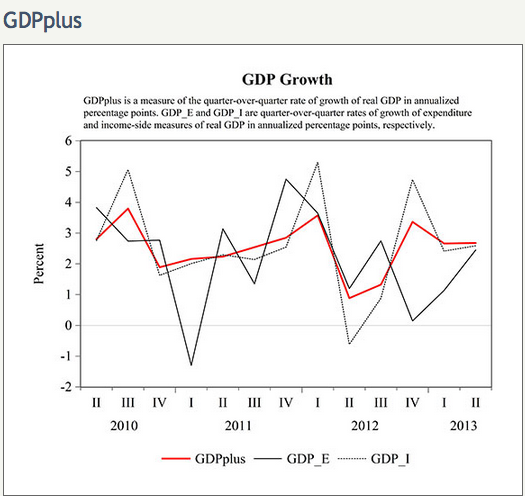

I’ve often complained about incompetence at the BEA. The quarterly GDP numbers don’t seem very accurate. For instance, they don’t seem to correlate with the jobs numbers, which seems really strange to me. The don’t correlate with GDI. Now the Philly Fed has done something about the problem. They have used the RGDI and RGDP estimates, as well as some fancy statistical analysis, to come up with optimal estimates of RGDP growth:

That’s what I thought all along!

Notice the RGDI numbers (dotted line) are better than the RGDP estimates (solid black line) in 11 out of 13 cases. Also notice that growth has been pretty stable, except a slowdown in mid-2012, which led the Fed to adopt QE3 and forward guidance. Those numbers correlate with the monthly jobs figures, which show fairly steady growth, apart from a slowdown in mid-2012. And a zero fiscal multiplier in 2013.

Now we need NGDPplus estimates.

Many thanks to the Philly Fed, and can we all now use their figures?

Or at least until they produce estimates that don’t match my market monetarist priors? 🙂