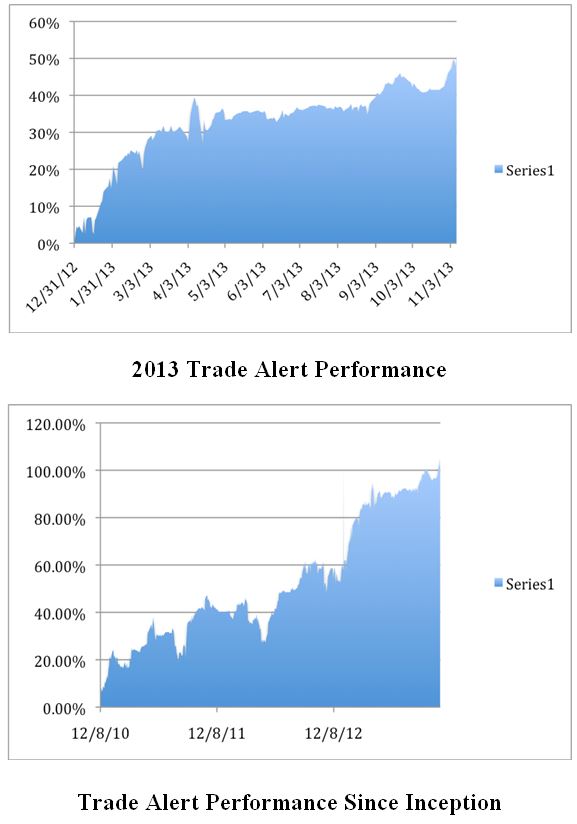

The Trade Alert service of the Mad Hedge Fund Trader has posted yet another new all time high in performance, taking in 51.13%. The November month to date record is now an enviable 6.67%.

The three-year return is an eye popping 106.18%, compared to a far more modest increase for the Dow Average during the same period of only 20.3%.

That brings my averaged annualized return up to 36.4%.

This has been the highest profit since my groundbreaking trade mentoring service was launched 35 months ago. These numbers place me at the absolute pinnacle of all hedge fund managers, where the year to date gains have been a far more pedestrian 3%. I predict the arrival of a lot more job seekers on Craig’s List in January.

These numbers come off the back of another blistering week in the market where I added 5.13% in value to my model-trading portfolio.

I took profits on all of my extensive shorts in the Treasury bond market, taking advantage of the sudden back up in ten-year yields from 2.47% to 2.77%, the sharpest move of the year.

I then bet that the stock market would continue another tedious sideways correction going into the Thanksgiving holidays. I bought an in the money put spread on the S&P 500, and then bracketed the index through buying an in the money call spread.

When the market took a swan dive on Thursday, my short position then protected my P&L from undo volatility. I accomplished the same with a second short position in the Russell 2000 (IWM). I then took advantage of the weakness to add another long in the Industrials ETF (XLI), a rifle short at one of the best performing sectors of the market.

This is how the pros do it, and you can too, if you wish.

Carving out the 2013 trades alone, 61 out of 72 have made money, a success rate of 85%. It is a track record that most big hedge funds would kill for.

My esteemed colleague, Mad Day Trader Jim Parker, has also been coining it. He caught a spike up in the volatility index (VIX) by both lapels. He also was a major player on the short side in bonds, to the delight of his many followers. By the way, Jim will be following up with another educational webinar on How to Trade this coming Wednesday, and you should receive email invitations for this shortly.

The coming winter promises to deliver a harvest of new trading opportunities. The big driver will be a global synchronized recovery that promises to drive markets into the stratosphere in 2014. The Trade Alerts should be coming hot and heavy. Please join me on the gravy train.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011 and 14.87% in 2012. The service includes my Trade Alert Service and my daily newsletter, the Diary of a Mad Hedge Fund Trader. You also get a real-time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars. Upgrade to Global Trading Dispatch PRO and you will also receive Jim Parker’s Mad Day Trader service.

To subscribe, please go to my website at www.madhedgefundtrader.com, find the “Global Trading Dispatch” box on the right, and click on the lime green “SUBSCRIBE NOW” button.