Commercial investors, the ‘big boys of investing’ are considered the smart money on Wall Street. It generally pays to follow their lead. Right now commercial traders are short the Nasdaq-100 to an historic extreme.

For a moment picture a boat, the kind of boat you’d take on a fishing trip or island excursion.

Now imagine your favorite football team on the boat. Everything is fine as long as all 53 players are evenly spread out over the boat.

All of a sudden a gray whale shows up and all players are moving starboard. Now the captain screams to avoid capsizing the boat and swimming with the whale.

Right now, almost all investors are on the same side of the trade. To be exact, investors love stocks, the S&P 500, Dow Jones and particularly the Nasdaq.

Since mid-October the tech-heavy Nasdaq-100 has been on quite a streak, gaining almost 10% in less than a month.

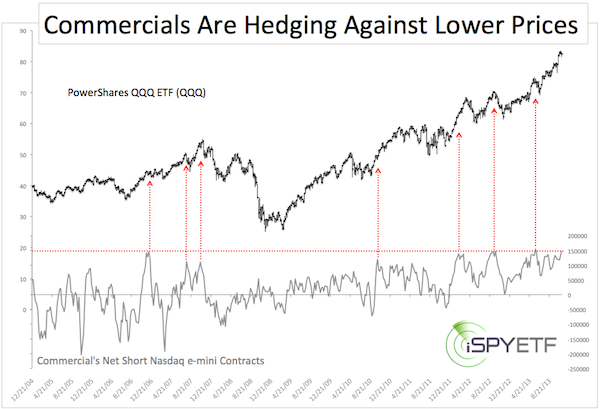

The Nasdaq chart below plots the PowerShares QQQ (Nasdaq: QQQ), the Nasdaq-100 tracking ETF – against commercial traders net short positions in the Nasdaq e-mini futures.

Commercial Nasdaq money is now short to a rare extreme.

Commercial traders are considered the ‘smart money.’ They are not a contrarian indicator.

As the red lines bring out, the Nasdaq QQQ ETF hits a ‘rough spot’ more often than not after similar extremes (especially in the last two years).

The above Commitment of Traders (COT) data in itself should not act as a sell signal.

But the COT is confirmed by other sentiment extremes.

In fact one of them as a flawless track record of predicting S&P 500 corrections. Click here for more details on this accurate S&P 500 Correction Indicator