The economy is nearing the natural level of real GDP and economists are saying that the natural rate of interest is negative. Now the natural rate of interest is the equilibrium interest rate when real GDP reaches its natural level. It is absolutely crazy to think that the natural rate would be negative… absolutely crazy.

The best source to understand the natural interest rate is this paper by John Williams, President of the Federal Reserve Bank of San Francisco.

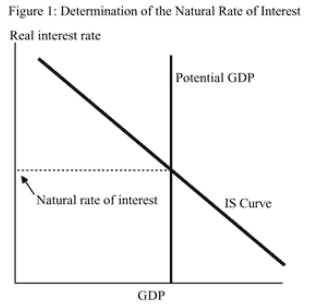

“In this Letter, the natural rate is defined to be the real fed funds rate consistent with real GDP equaling its potential level (potential GDP) in the absence of transitory shocks to demand. Potential GDP, in turn, is defined to be the level of output consistent with stable price inflation, absent transitory shocks to supply. Thus, the natural rate of interest is the real fed funds rate consistent with stable inflation absent shocks to demand and supply.

“At the intersection of the IS curve and the potential GDP line, real GDP equals potential, and the real interest rate is the natural rate of interest.”

John Williams gives this diagram…

Potential GDP is the natural level of real GDP at the LRAS curve. At the LRAS curve, production slows down to its natural level. Increases in demand will not show up as increased production, but as increased prices. So there is a natural rate to keep the increased demand in line production, so that inflation does not rise.

A negative natural rate would imply the need for a negative rate to “make” people consume more in order to be able to produce at the natural level of real GDP. (I guess raising wages isn’t an option.) Anyway, a negative natural rate makes people consume and makes them push the inflation rate to a stable level at what might be considered an “unsustainable” level of output.

This is just crazy…

If the natural rate were negative at the natural level, and the Fed rate was stuck at the zero lower bound (ZLB), you would have an economy in decline. That is not the US economy. There is still some inflation and there is still economic growth even with the ZLB. We are heading toward the natural level of real GDP.

When real GDP reaches its natural level, the Fed funds rate should be prepared to be at least 2% in my opinion… in line with the inflation target. If the Fed rate is at the ZLB and stuck in the mud of QE, it will have an incredibly hard time playing catch up if the economy starts to show signs of price inflation in assets or household items.

This is how I see the minimum monetary policy…

The violet and yellow lines cross at the natural level of real GDP.. and they should cross equal to or more than the inflation target of 2%. I have them crossing just a bit above 2% here. The red dot shows that we are currently quite close to the natural level. The red dot is rising up a line of balance toward the minimum natural rate. If the Fed rate rises along this line, the economy can make balanced adjustments along the way. The red dot would imply a Fed rate of at least 1.5% now.

Yet, the blue dot shows that the Fed rate is still at the ZLB. If the Fed rate has to respond to price inflation at the natural level of real GDP (LRAS curve), it will have to respond drastically by moving vertically fast. This is not a balanced response. Better to have moved steadily upward over time.

The natural rate of real GDP (LRAS curve) is going to sneak up on the economy. We are going to see inflation rise within the year… not in household goods… but in asset prices. The stock market is already hitting new highs and climbing. Just wait a few months when the natural level of real GDP kicks in more. Loose money which is frustrated by constrained production will find its way into asset prices. We will need a tighter monetary policy to control the instabilities from too much liquidity among owners of capital.

Paul Krugman wants wages to rise before monetary policy is tightened.

“So it makes no sense at all to tighten until we see wage inflation rise, not just from its current level, but several points higher.”

The problem with his view is that wages will not rise, even at the natural level of real GDP. The excess liquidity will go into asset prices, not wages. Unemployment is too high for labor to bargain for higher wages, or firms to offer higher wages to desired workers. He has his site set on the wrong target.

Household goods will not rise in price because there isn’t liquidity among its purchasers. Labor share of output is down. Labor has relatively weaker purchasing power for household items. Yet, the purchasers of assets have liquidity directly from the low interest rates and low labor share. A negative natural real interest rate would imply an economy pledged to feeding asset bubbles as its modus operandi… an economy pledged to low wages and high corporate profits.

If an economist makes a case for a negative natural rate, they make a mistake with the vertical line of potential GDP in the graph above. They have to realize that the potential GDP curve has shifted to the left… due to low labor share. If they see the vertical line pushed far to the right, then they will see a negative natural rate. But the vertical line is actually farther to the left indicating a positive natural rate.

Here is a recent graph of mine to show that the utilization of labor and capital is going to be constrained at a lower level due to the lower labor share.

The blue line which represents utilization of labor and capital is going to be constrained at a lower level. Economists are thinking that unemployment will decline to 5% with a capacity utilization of 80%. The resulting value of 76% would be above its constraint of labor share relative liquidity (orange line). I am showing that the vertical line of the natural level of real GDP is actually more to the left than economists think. Even Dean Baker and Jared Bernstein think the unemployment rate will go down to 4%. They are definitely seeing the vertical LRAS curve way too far to the right.

The truth is that the economy has a positive natural interest rate, but thinking that it is negative will cause lots of financial instability, because loose monetary policy at the vertical LRAS curve creates inflation where the liquidity is building up over supply… namely asset prices.

Economics is in a mess… mostly due to not understanding the constraint of labor share and effective demand. Keynes told us about effective demand, but it was never understood well. The key is to see labor share as the constraint upon the utilization of labor and capital.